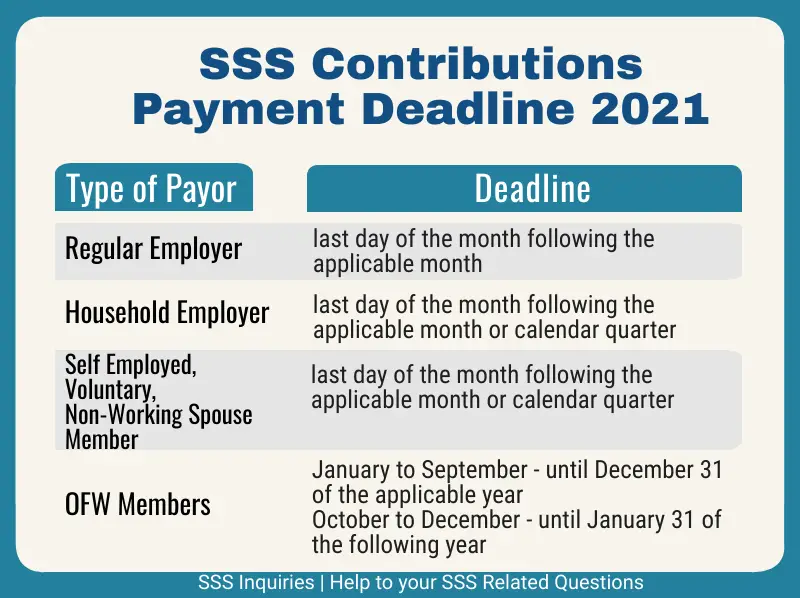

Starting this January 2021, the Philippine Social Security System has implemented a new SSS Contributions Payment Deadline. In the previous years, SSS Contributions deadline is based on the ending digit of the SSS Employer or member but now, payment deadline is on the last day of the following month or the calendar quarter depending on the member’s type.

SSS has implemented a new SSS Contributions Schedule this January 2021. If you haven’t check it, you may read it here.

| Type of Payor | Deadline |

| Regular Employers | last day of the month following the applicable month |

| Household Employers | last day of the month following the applicable month or calendar quarter |

| Self Employed, Voluntary, Non-working spouse members | last day of the month following the applicable month or calendar quarter |

| OFW members | January to September – until December 31 of the applicable year October to December – until January 31 of the following year |

Related Articles:

- How to get Payment Reference Number(PRN) for Voluntary Paying SSS Members?

- How to get my SSS PRN thru Text?

- Where to pay my SSS Payment Reference Number?

- How to Pay SSS PRN thru GCash?

- How to Pay SSS PRN thru Monegment?

Reference: SSS Official Facebook Page