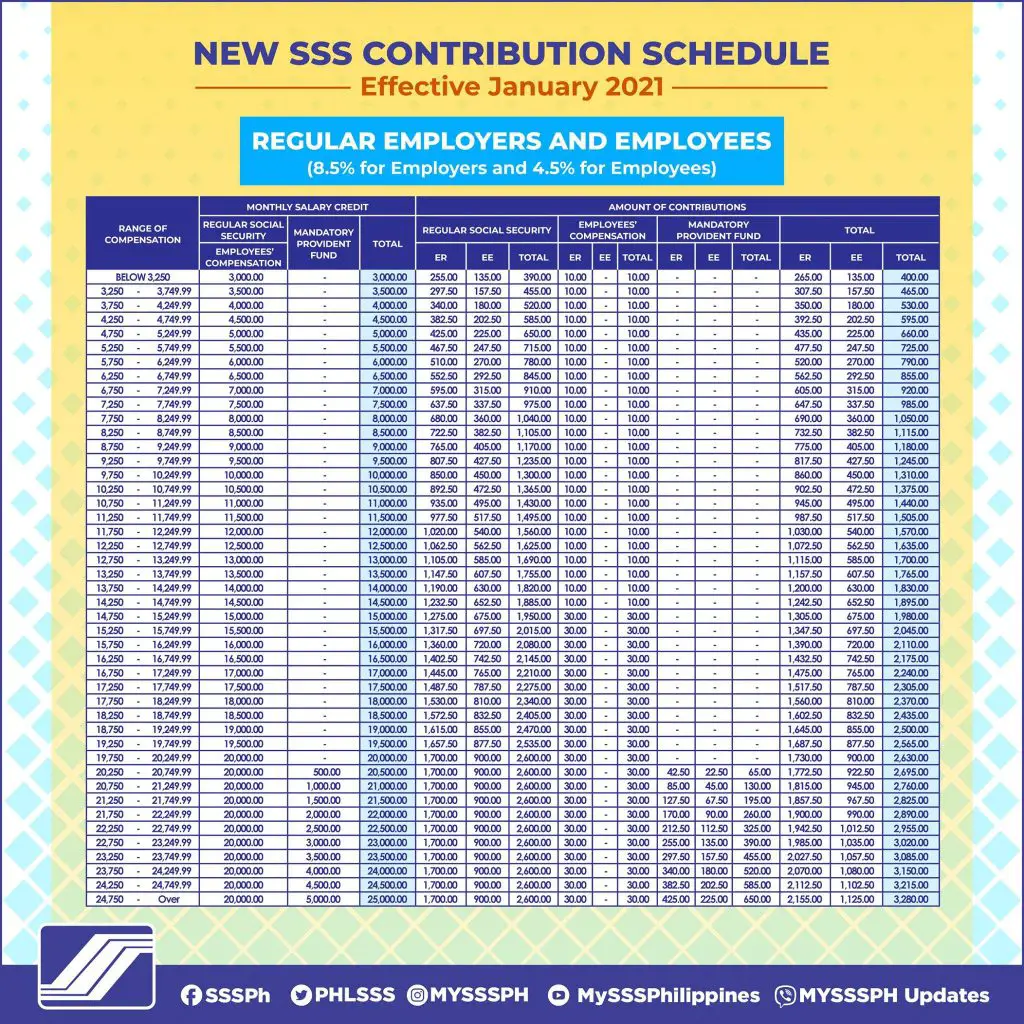

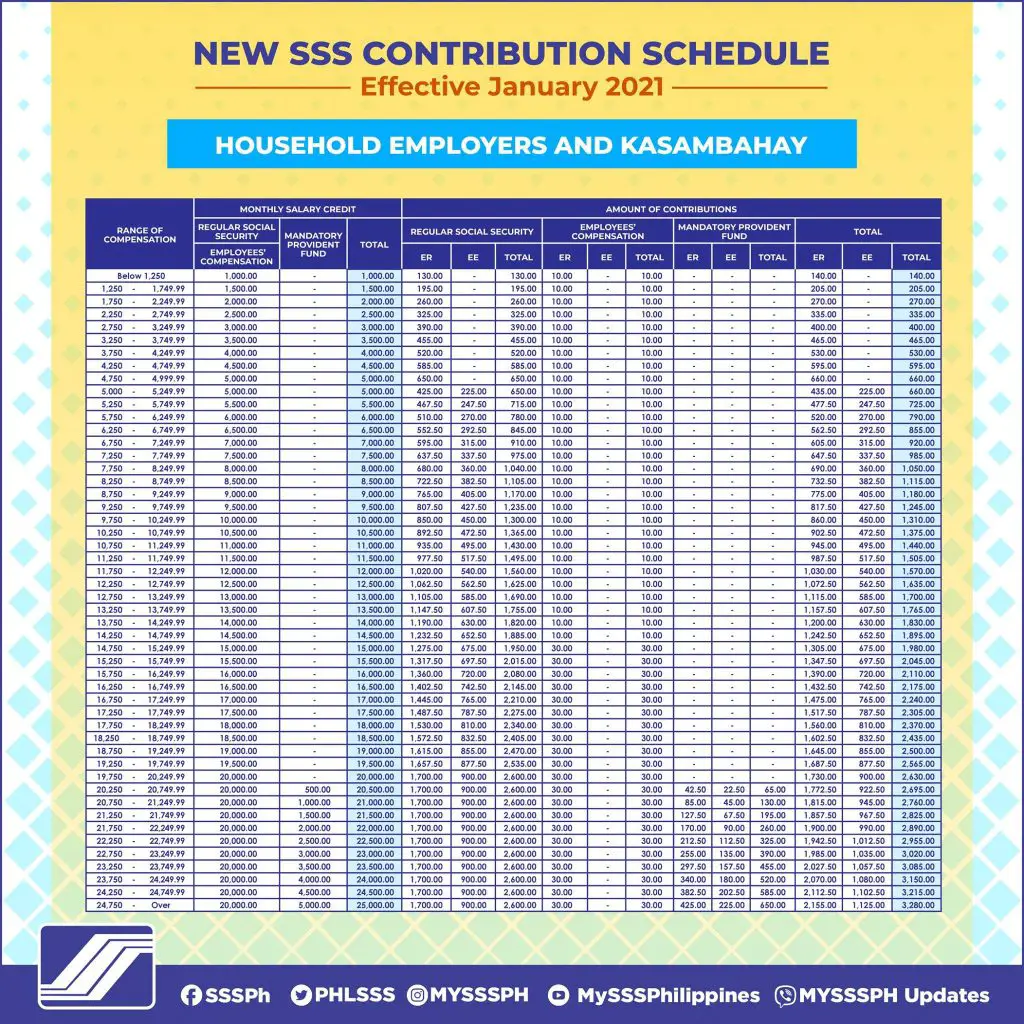

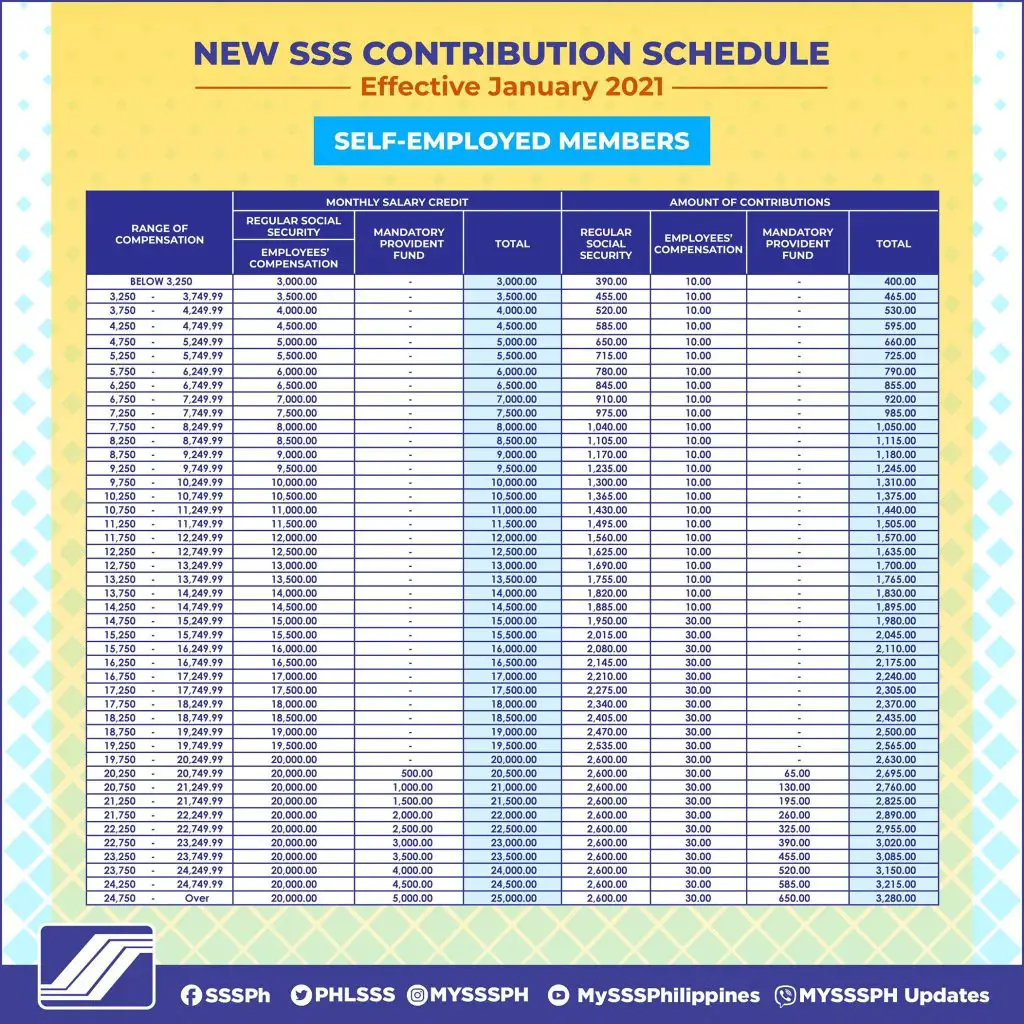

Starting January 1, 2021, the SSS shall implement the New Schedule of Regular Social Security, Employee’s Compensation (EC) and Mandatory Provident Fund Contributions for Regular Employers and Employees, Self Employed, Voluntary and Non Working Spouse and Household Employers and Kasambahay.

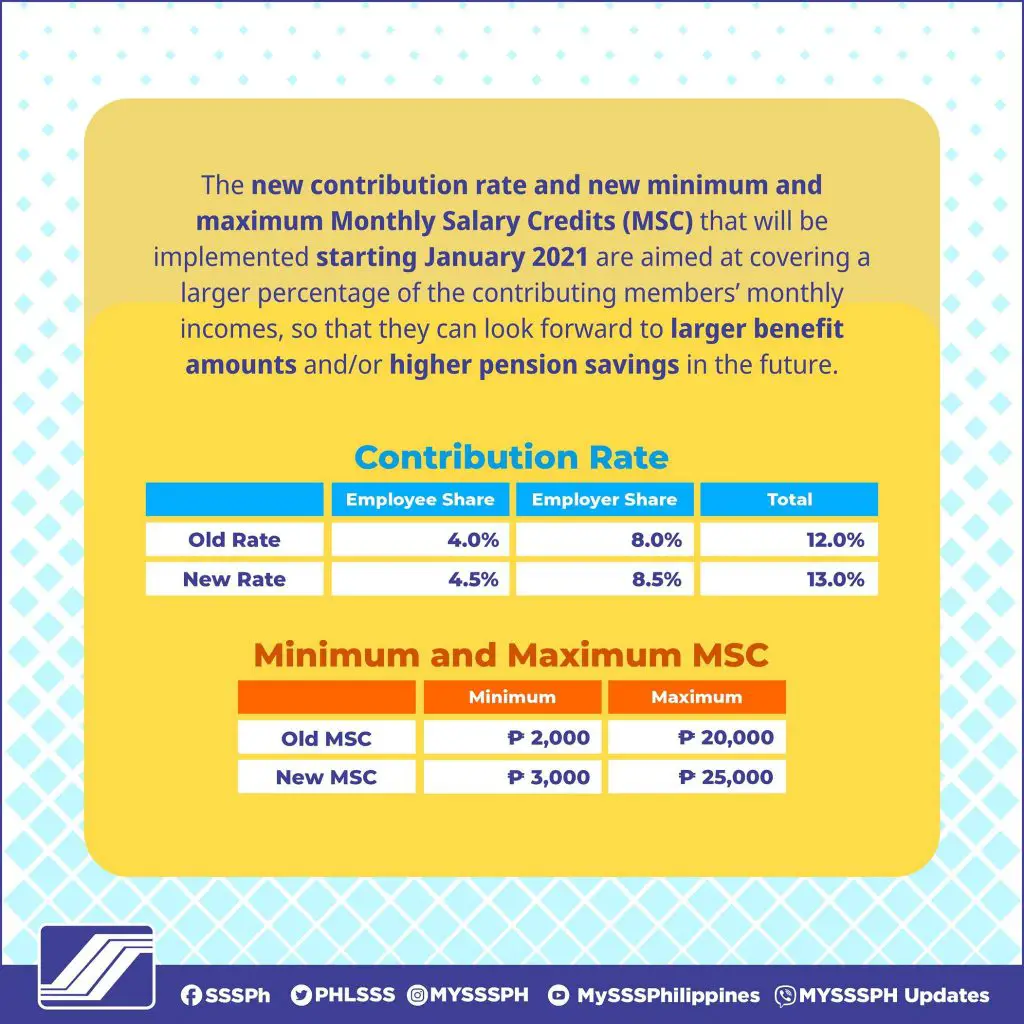

In line with the enactment of Republic Act No 11199 known as the Social Security Act of 2018 which includes a provision that increases the Social Security (SS) Contribution rate to 13%, the minimum Monthly Salary Credit (MSC) to Php 3,000 and the maximum MSC to P25,000. This SSS Contributions increase aimed at covering a larger percentage of the contributing member’s monthly incomes, so that they can look forward to larger benefit amounts and/or higher pension savings in the future.

Change in the SSS Contribution rate is from 12.0 percent to 13 percent. Where in the old rate, Employee share is 4.0% percent and Employer Share is 8.0 percent while the new 2021 Contributions rate, Employee Share is 4.5 percent and Employer share is 8.5 percent.

From the old 2020 rate, minimum Monthly Salary Credit is 2,000 while the maximum is 20,000. In the new 2021 Monthly Salary Credit, minimum MSC is 3,000 and maximum MSC is 25,000.

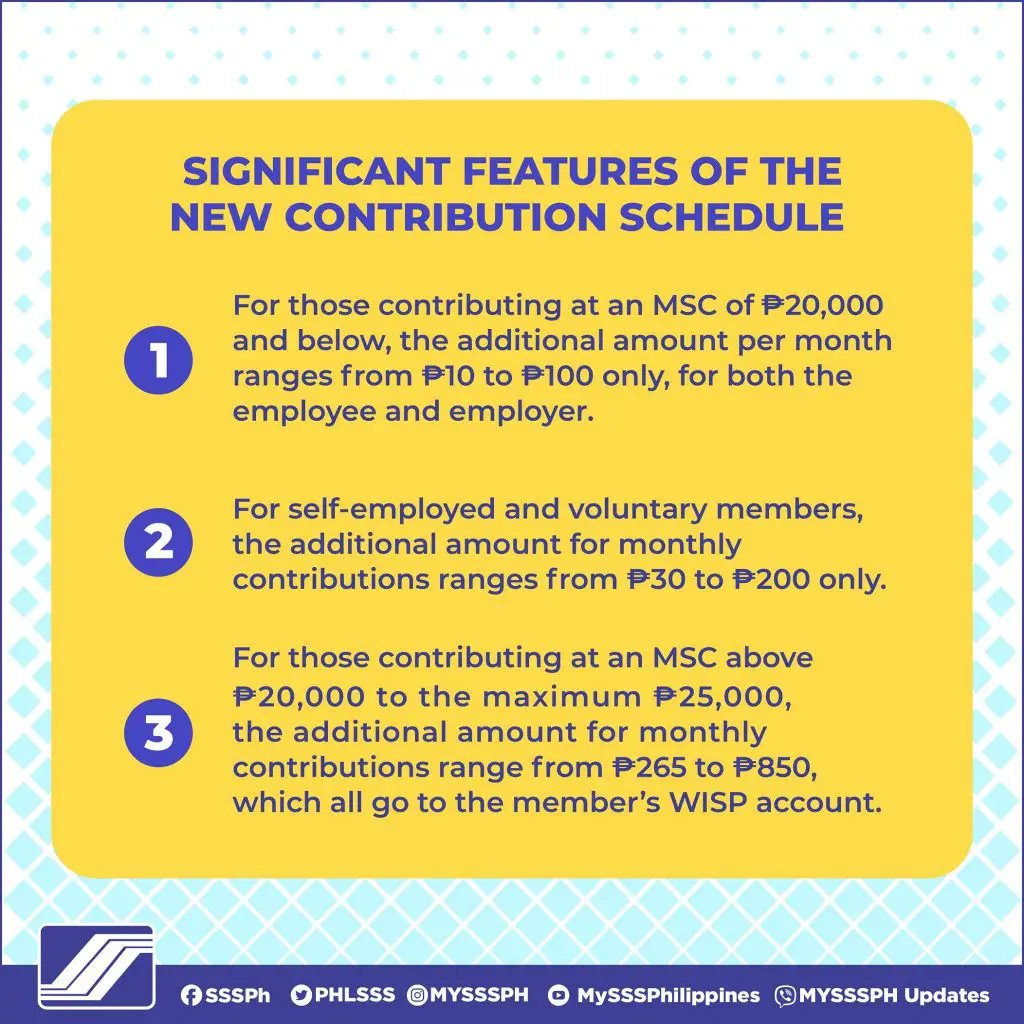

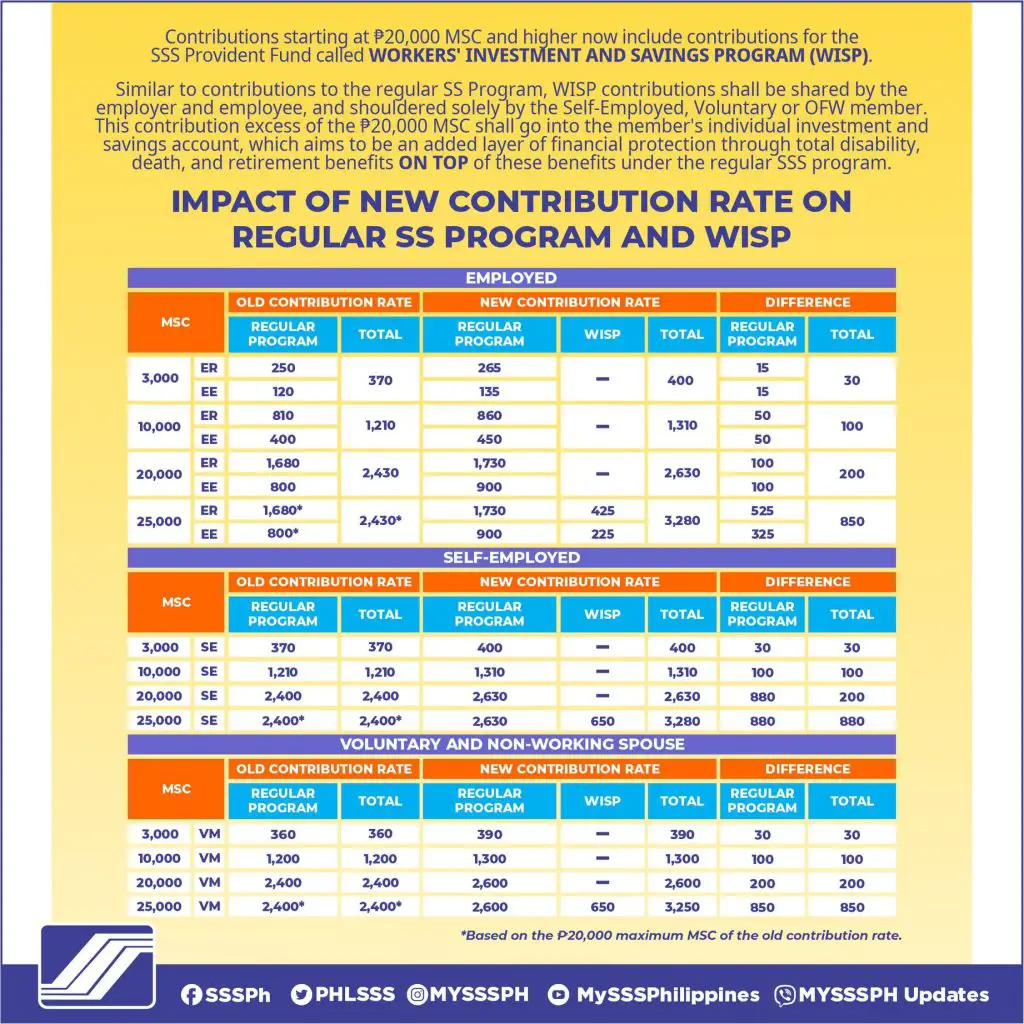

What is Worker’s Investment and Savings Program (WISP)?

The Worker’s Investmnent and Savings Program (WISP) is similar to contributions to the Regular SS Program. WISP Contribution shall be shared by the employer and employee, and shouldered solely by the Self-Employed, Voluntary or OFW member. This contribution excell of the 20,000 shall go into the member’s individual investment and savings account, which aims to be an added layer of financial protection through total disability, death, and retirement benefit ON TOP of the benefits under the regular SSS Program.

SSS Contributions Schedule 2021

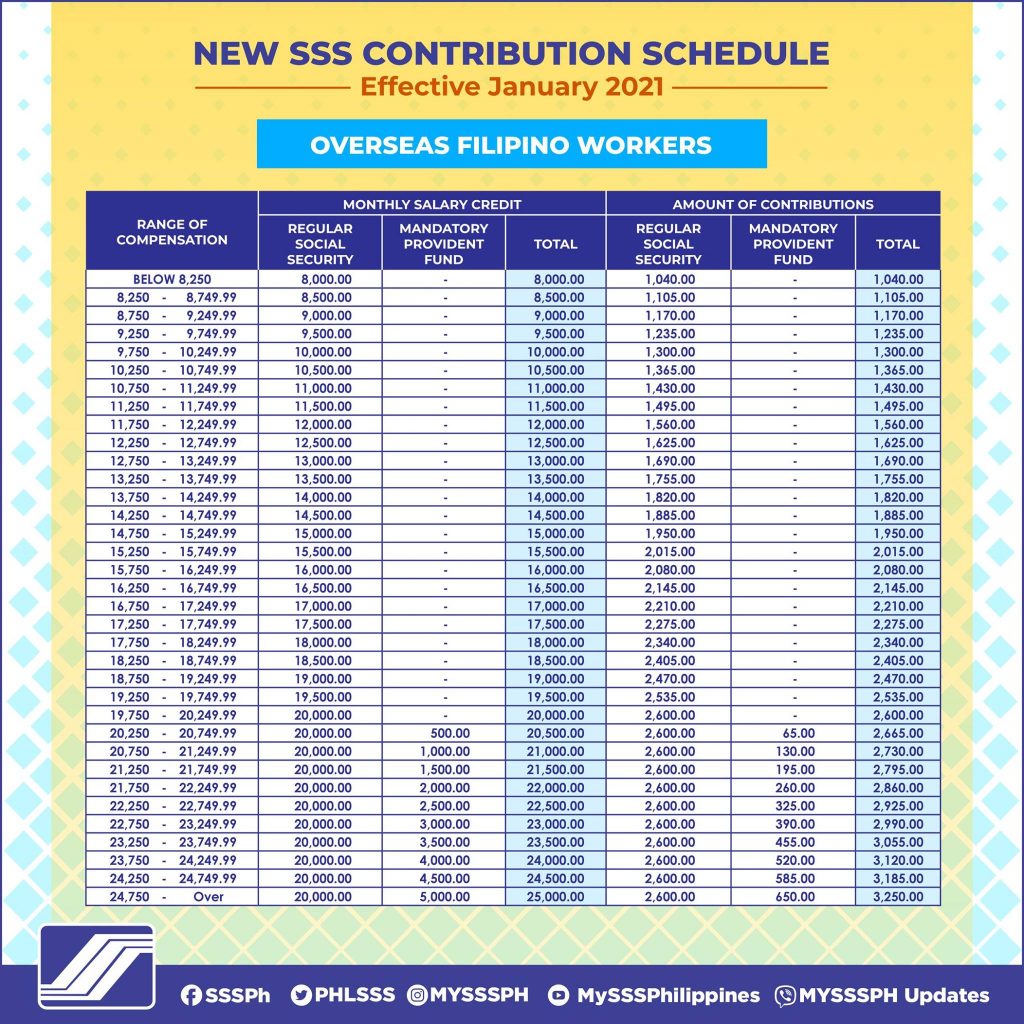

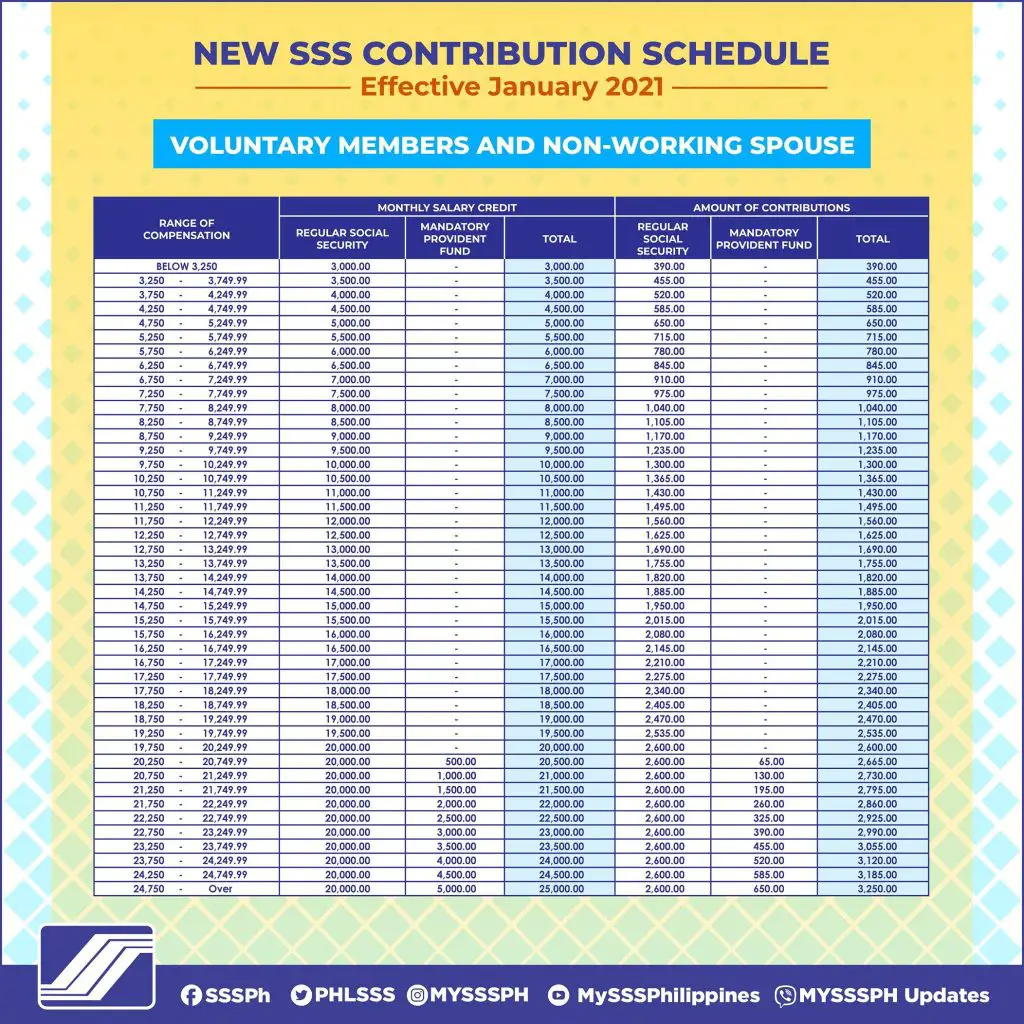

Kindly browse the Contributions Schedule below and see the corresponding Schedule depending on your category (e.g Employed, Self Employed, OFW, etc).

SSS Contributions Schedule 2021 for Regular Employers and Employees

SSS Contributions Schedule 2021 for Household Employers and Kasambahay

SSS Contributions Schedule 2021 for Self Employed Members

SSS Contributions Schedule 2021 for Self Employed Members

SSS Contributions Schedule 2021 for Voluntary members and Non Working Spouse

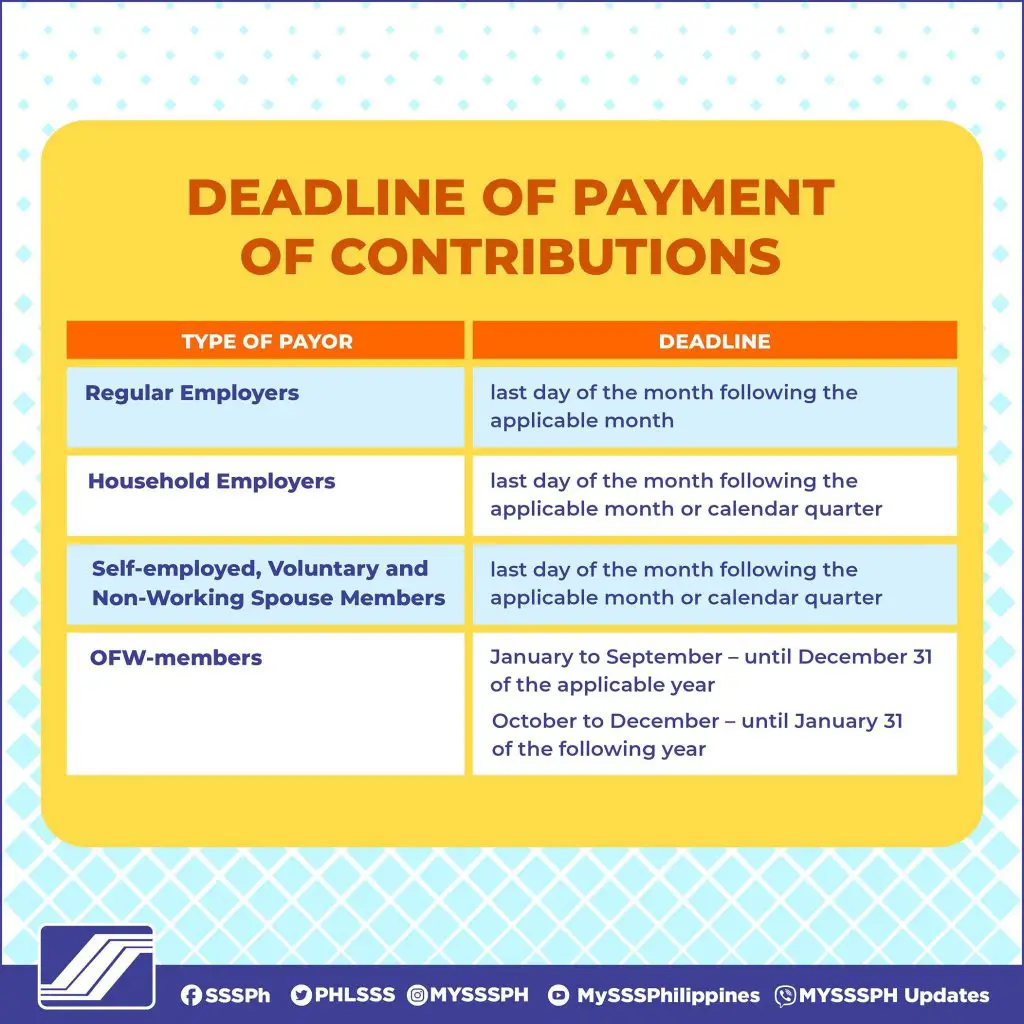

SSS Contributions Deadline of Payment 2021

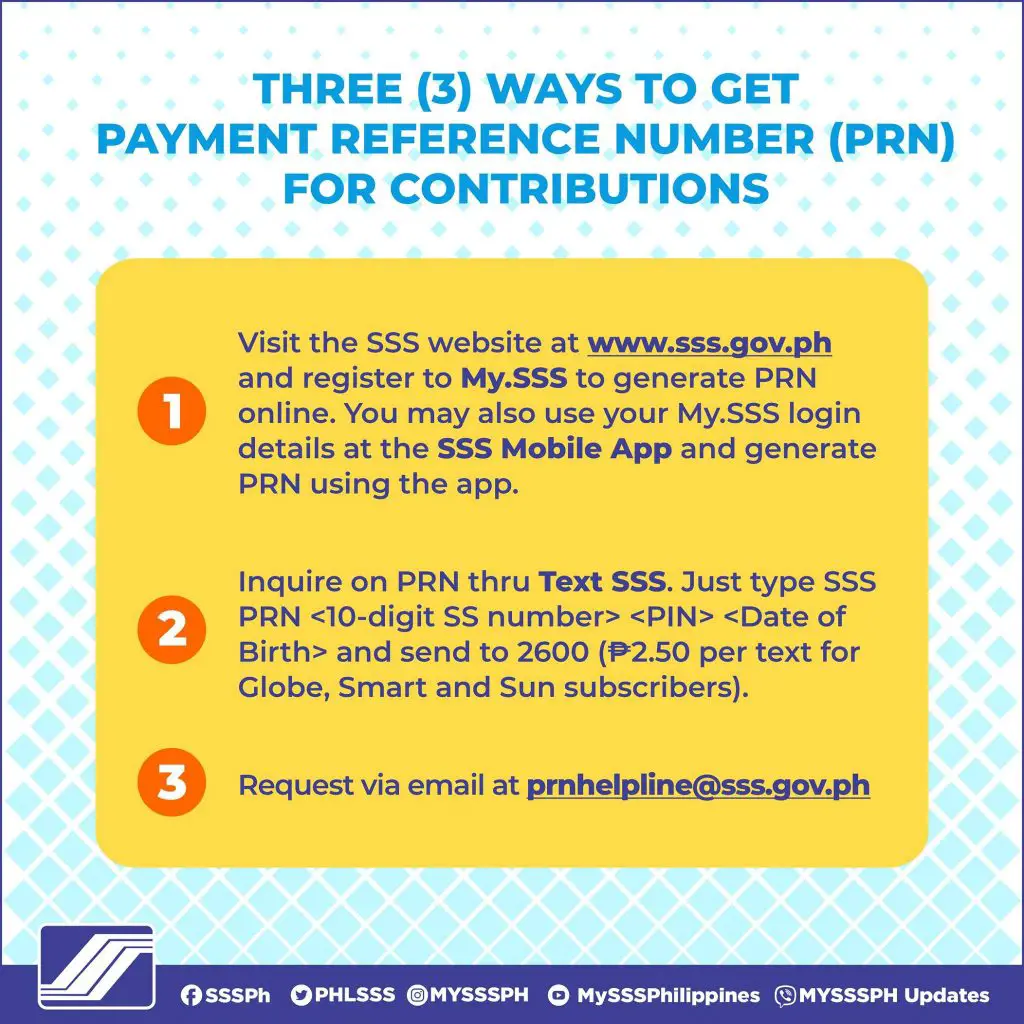

Three Ways to get your SSS Payment Reference number for Contributions

You may also check our full list on how to get your SSS Payment Reference Number for Voluntary members.

Here is also a Tutorial on how to Get SSS Payment Reference number for Employers

Source: SSS Official Facebook Page