If you are an SSS Voluntary Paying Member like Self Employed, Voluntary, Non Working Spouse and OFW, and aiming to Qualify for SSS Materntiy Benefit, this is for you!

Many female SSS members has shared in the SSS Maternity Benefit Helping Group that though they have paid their Contribution for their Qualifying months for Maternity Benefit, they still did not qualified or have received a lower SSS Maternity Benefit compared to their original computation. Here in this article, we will explain why and when is an SSS Contributions considered late payment for SSS Maternity Benefit Qualification and Computation.

How to Know if I am Eligible for SSS Maternity Benefit?

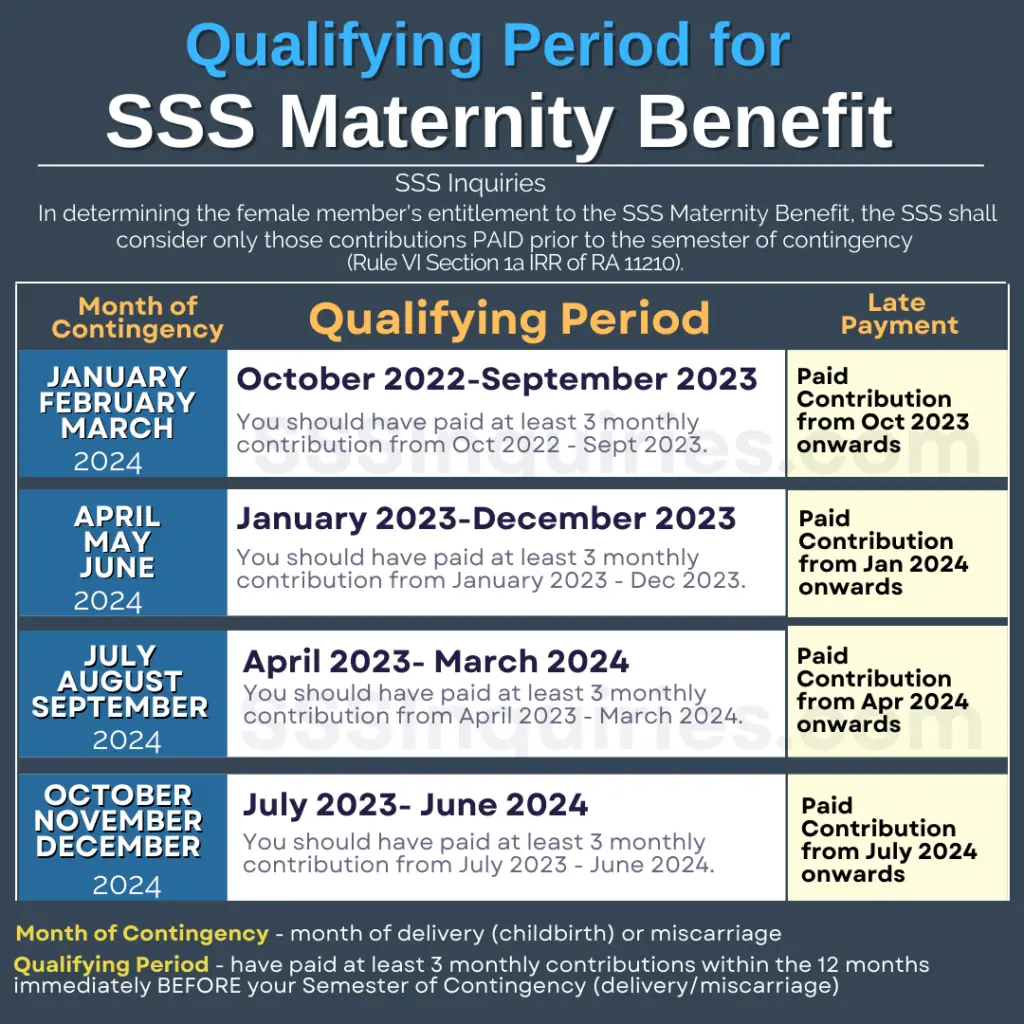

You are Eligible for the SSS Maternity Benefit if you have paid at least 3 monthly contributions within the 12 months immediately BEFORE your Semester of Delivery/Contingency (childbirth or miscarriage).

Common Misconceptions on the Eligibility on SSS Maternity Benefit

- Many were confused that they only need to have at least 3 months of contribution before they give birth to qualify for the SSS Benefit, but that is wrong.

- Having an SSS Contribution from prior years does not guarantee you that you will be entitled to an SSS Maternity Benefit

The qualification on the paid SSS monthly contribution is tricky, especially for those that are paying voluntarily. So allow us to explain how to be qualified for an SSS Maternity benefit.

To know if I am Qualified for SSS Maternity Benefit:

- Identify your Delivery Month. Consult your doctor to know your expected delivery month. Or you may estimate by adding 9 months from the date of your conception. Let us assume that your Expected Delivery Month is December 2022, we will use this on our example.

- Identify the Quarter of your Delivery Month. Then based on your expected delivery month, identify the quarter where it will fall. If you are still confused on how to identify which quarter your month of delivery falls, here is a table of Quartering being observed by the SSS.

| Quarter | Covered months |

| Quarter 1 | January – March |

| Quarter 2 | April – June |

| Quarter 5 | July – September |

| Quarter 4 | October – December |

On our example, if your expected month of delivery is December 2022, then it falls on the 4th quarter of the year.

3. Identify the Semester of Contingency. After knowing the Quarter of your Delivery month, now let us identify the Semester where your delivery month falls. A semester refers to a two consecutive Quarters. To identify the semester of your Delivery Month, add one quarter prior to the quarter of your delivery month.

| Semester | Quarters Covered |

| Semester A | Quarter 1 and 2 |

| Semester B | Quarter 2 and 3 |

| Semester C | Quarter 3 and 4 |

| Semester D | Quarter 4 and 1 |

So in our example, December 2022 falls on the 4th quarter of the year. The Quarter before that is the third Quarter (July 2022). The 3rd and 4th quarter or the July-December 2022 is your Semester of Contingency.

Let’s take another example. Your Expected Delivery Month is July 2022 and it falls under the third quarter (July-September) of the year. The quarter before that is the second quarter (April-June). The second and third quarter of 2022 or the April – September is your Semester of Contingency.

4. Check your Contributions posted if you have at least 3 months within 12 months prior to your Semester of Contingency. Now that you know your Semester of Contingency, you should have at least 3 months contribution within the 12 month period BEFORE your Semester of Contingency.

For our Example No 1.

Expected Month of Delivery is December 2022.

Semester of Contingency is July-December 2022.

12 Month Period prior to Semester of Contingency: July 2021-June 2022.

From July 2021-June 2022, the SSS member should have at least 3 months contribution posted to qualify for the SSS Maternity Benefit.

For our Example No 2.

Expected Month of Delivery is July 2022.

Semester of Contingency is April-September 2022.

12 Month Period prior to Semester of Contingency: April 2021– March 2022.

From April 2021– March 2022, the SSS Member should have at least 3 months contribution to qualify for the SSS Maternity Benefit.

Now that you already know the contribution eligibility to be qualified for the SSS Maternity Benefit, you may check your posted contributions online. If can still cope up for your Contributions by paying quarterly payment (as a Voluntary Member) or paying for the whole year contribution (if you are an OFW member), then do so. You may check the SSS Contributions Schedule and Deadline of payment thru this link. If you are Employed and you found out that your Contributions are not completely posted, go directly to the Payroll officer of your company to know the status of your contribution remittance.

Then when is an SSS Contributions Considered LATE Payment for SSS Maternity Benefit Computation?

This case usually happens for SSS Self Employed, Voluntary, OFW, Non Working Spouse members. Kindly read slowly and take note as this the explanation below is the most important part.

Let’s go back to our example.

For our Example No 1.

Expected Month of Delivery is December 2022.

Semester of Contingency is July-December 2022.

12 Month Period prior to Semester of Contingency: July 2021-June 2022.

From July 2021-June 2022, the SSS member should have at least 3 months contribution posted to qualify for the SSS Maternity Benefit.

If the Voluntary paying member is paying quarterly, for example, for April – June 2022 (2nd Quarter Contribution), it can still be paid until July 31. But since July 31, 2022 falls on weekend, it is extended to next working day – August 1, 2022. If the member paid her SSS Contribution from April – June 2022 on August 1, 2022, technically it is paid on time and within the Contributions Payment Deadline.

But in the Expanded SSS Maternity Benefit Act – Rule VI Section 1a IRR of RA11210, it states that “In determining the female member’s entitlement to the SSS Maternity Benefit, the SSS shall consider only those contributions PAID PRIOR to the semester of contingency. “

Going back to our example 1.

Expected Month of Delivery is December 2022.

Semester of Contingency is July-December 2022.

Qualifying Period: July 2021-June 2022. (12 months prior to the semester of contingency)

From July 2021-June 2022, the SSS member should have at least 3 months contribution posted to qualify for the SSS Maternity Benefit.

If member paid her SSS Contribution for April – June 30 on August 2, 2022, it is considered LATE PAYMENT since her payment date is within her semester of contingency ( July 2022 – December 2022).

Member should have paid on or before June 30, 2022 for her April – June 2022 contribution for it to be considered on her SSS Maternity Benefit Qualification and Computation.

For our Example No 2.

Expected Month of Delivery is July 2022.

Semester of Contingency is April 2022-September 2022.

Qualifying Period: April 2021– March 2022 (12 Month Period prior to Semester of Contingency)

From April 2021– March 2022, the SSS Member should have at least 3 months contribution to qualify for the SSS Maternity Benefit.

Late Payment: Paid Contributions from April 2022 onwards.

Related Articles:

- How to Apply and Qualify for SSS Maternity Benefit

- Frequently Asked Question about SSS Maternity Benefit

- How to Know How Much is your SSS Maternity Benefit

- Common reasons why your SSS Maternity Benefit is denied

- Affidavit of Undertaking Template

- How to Comply with Disbursement Account Enrollment Module?

- How to Submit SSS Maternity Application (MAT2) in SSS Website for Self Employed, Voluntary, OFW, Non Working Spouse and Separated from Employers?

- How to File for SSS Maternity Reimbursement for Regular and Household Employer?

Sharing is Caring

Naguguluhan lang po Ako, na miscarriage po ako nitong at June 2022 at gusto ko po itong ifile sa sss binayaran ko po Ang April-june 2022 ko,Kasi po 2 years nakong di nkakapaghulog sa sss kc nawalan na po aq ng work,Hindi po ba Ako qualified sa maternity benefits

question ko lang po expected delivery date ko po Dec.21,2022 nkpagbayad ako ng April,May,June 2022 qualified po kaya ako?and maghuhulog ako this week for July,August,Sept.2022, nagsend na ko ng notification thru sss online

Pwede pba kya ako humabol mg bayad ng contributions ko after 19 years na di nhulugan isa pa po if nkapag hulog po ba pwede b ako mgfile ng maternity reimbursement ?

Hello poh,EDC- ko poh March 2,2023 nghulog ako nung july-september 2022..ngfile ako ng Mat1 bakit wala parin accepted ung MAT1 koh..sana mtulungan niyo koh..salamat

Hi ask ko lang po, edd ko po is March 2023 nghulog po ako ng contri ko ng july to sept. Paid on oct 2022 and ng hulog po ulit ako ng oct. To dec. Paid last jan 2023 eligible po ba ako makakuha ng maternity benefit po? Sana mapansin at masagot po.. thanks in advance po..