SSS has implemented the Real Time Posting of Contributions last January 2018 that aims to post accurately and immediately your paid SSS Contributions. With the implementation of this program, SSS Voluntary Paying members like Self Employed, Voluntary, OFW, Non Working Housewife shall first get their SSS Payment Reference Number (PRN) for the payment period that they will be paying then pay in Accredited SSS Payment Partners and Banks instead of just filling up your info and SSS Number which used to be the process before.

Payment Centers and Banks that accepts the SSS PRN became limited because as bank tellers has told us, SSS has required its payment partners to also upgrade their systems to accept the SSS PRN in their teller machines.

Disclaimer: The SSS Inquiries and its administrators is not in anyway related to the Philippine Social Security System. This site is organized and maintain by ordinary SSS Members who are passionate to help and share their knowledge regarding SSS Membership and Benefits. This articles does not aim in any way promote the Coins.ph app in behalf of SSS. We aim to lay down options to SSS Members on how to pay their SS Contributions.

In this article, we will discuss a step by step process on How to Pay your SSS PRN using Coins.ph. If you would like to know the SSS Accredited Banks and Payment Partners for the SSS PRN, you may check this article:

How to Pay your SSS PRN using Coins.ph?

If you do not have your SSS PRN for the month that you are paying, you can either go to the SSS Website to get your PRN, go to the SSS Branch or call the SSS Payment Center.

This articles in getting the SSS PRN may also help you:

- Seven Ways to get your SSS PRN for Voluntary Paying Members

- How to generate your SSS PRN as Employers?

- How did I obtained and paid my SSS PRN using the Moneygment App?

- How to update my SSS Contact Information?

- Where to pay your SSS Contributions?

One of our SSS Inquiries admin has documented how he paid his mother’s SSS Contribution for July to September 2018 using the coins.ph app.

Coins.ph was once famous to Filipinos when Bitcoin value has increased dramatically last quarter of 2017, and Coins.ph was one of the platforms in the Philippines where you can buy and sell a portion of Bitcoin. But aside from being a cryptocurrency platform, it can serve as your loading and payment station, and a good platform for peer to peer money transfer. Coins.ph have been here for a while and a Financial Technology platform accredited by Banko Sentral ng Pilipinas – so we can at least have a peace of mind that it is not a fly by night platform.

If you do not have a coins.ph installed, you may download it in the Google Playstore or Apple app store.

You may use this link to download, and you will get P50 free after your ID verification has been approved.

Disclaimer: The link has an affiliate link where the SSS Inquiries site will be rewarded by the platform. You will not be charged nor your coins.ph funds will be deducted.

Step by Step Process on How to Pay your SSS PRN using Coins.ph

Note: In order to pay your SSS Contribution, you must first obtain your SSS PRN for the Applicable Month that you are paying.

-

Install your Coins.ph app then Sign Up.

-

If you already have Coins.ph account, login to your app using your Registered Mobile Number or Email, and your password.

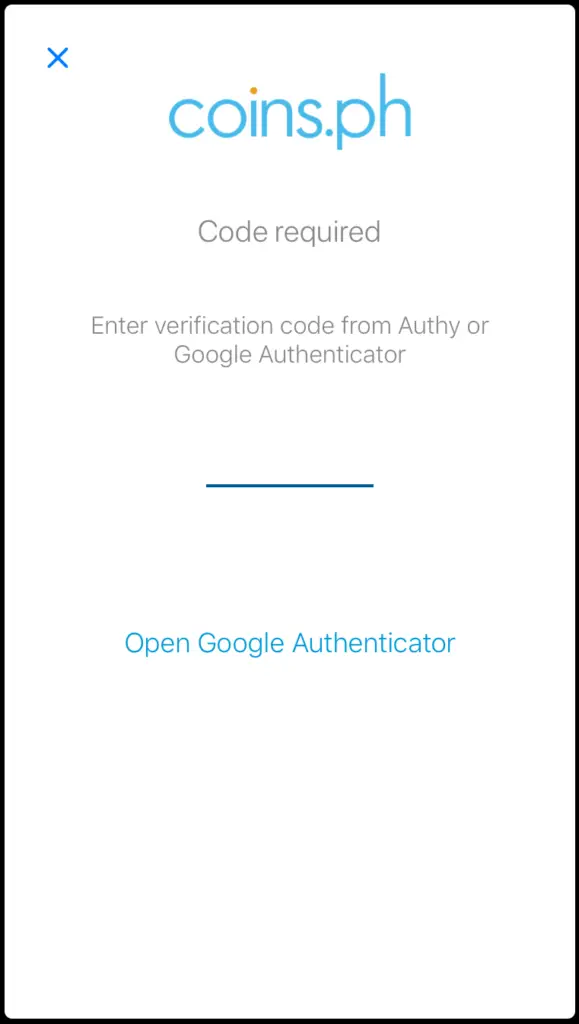

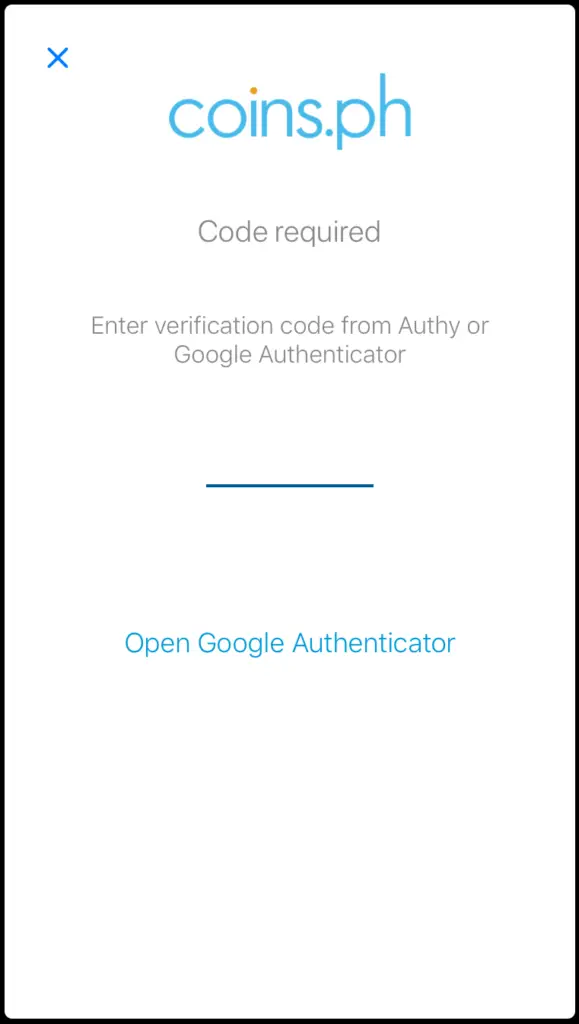

If you have set up to use a Two Factor Authentication, you must first enter the special code on your designated Authenticator.

-

After successful login, Coins.ph home screen will display.

-

Click the Pay Bills button then Browse thru the SSS Contributions

-

Select from SSS Contributions your SSS Membership Status (e.g OFW, Voluntary, Self Employed, etc)

-

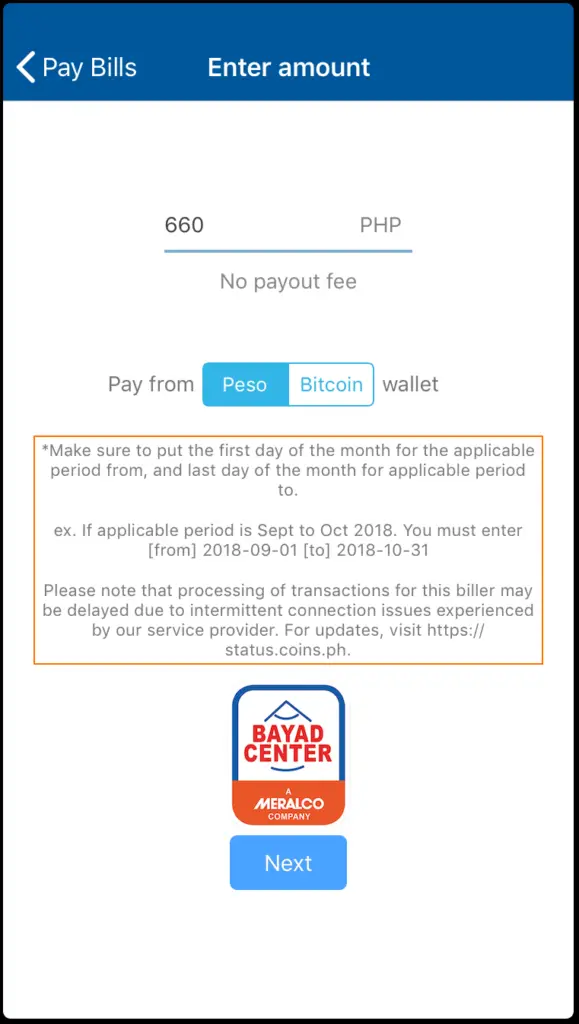

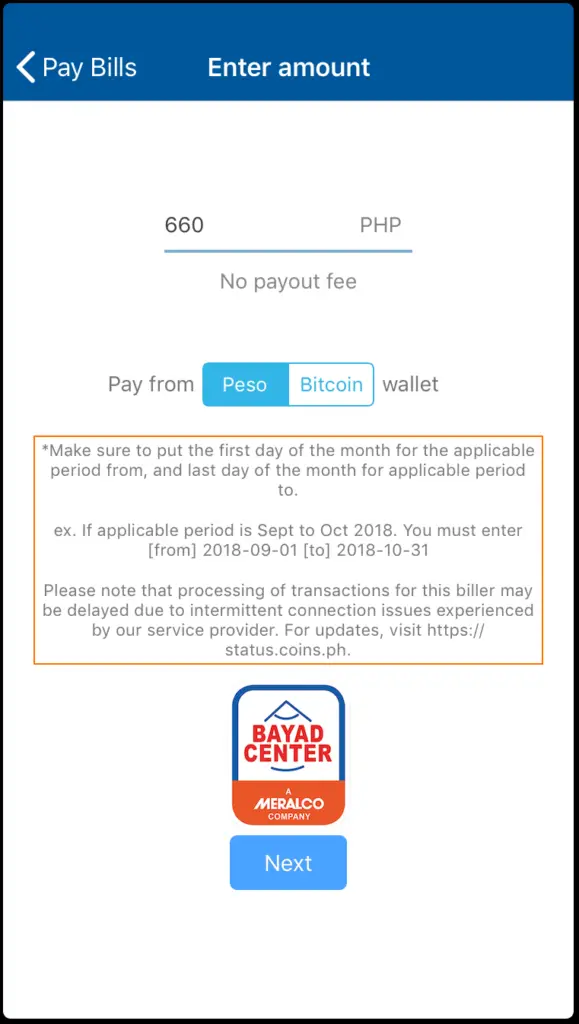

Put the SSS Contribution amount you are paying. If you are about to pay for one quarter, multiple the monthly SSS Contribution into three.

In our example, we will pay P220 as SSS Monthly Contribution so we put P660 as the total contribution.

-

Put the SSS PRN, Full Name and the Applicable Month that you are paying

If you are paying for one quarter (e.g July – September 2018), put the beginning day of the month beginning the quarter and the end of the month of the third month of the quarter. On our example, we are paying for July-September 2018, so we put 2018-07-01 in the Applicable Month From and 2018-09-30 in the Applicable Month To.

Coins.ph don’t add a transaction fee on top of your SSS Contributions.

If you will only pay for one month, then put the beginning day and the end day of the month in the Applicable Month From and To respectively. For example, if you will be paying for November 2018 contribution only, put 2018-11-01 in the Applicable Month From field and 2018-11-31 in the Applicable Month To Field.

If you are paying as an OFW and you will want to contribute for your Flexi Fund, add a Flexi Fund amount not less than P200.00.

Double or triple check your entry before you submit your transaction. Swipe the button to Confirm your transaction.

-

You will get a confirmation on your Email by Coins.ph if your transaction has been successfully processed.

Since we used the PRN, we assumed that the payment of our SSS Contribution has been tagged in the SSS System real time.

We got an email confirmation from coins.ph that the transaction has been successfully processed in the merchant.

We paid the PRN at around 8pm and by morning, the next day, we got a text confirmation from SSS that SSS Contribution payment from July – September- the month of the SSS PRN I paid is already posted in the SSS.

Unlike the Moneygment App which we have previously reviewed in the SSS Inquiries, the coins.ph is posted real time. One thing good in the Moneygment App is that you can create your PRN inside the app.

Coins.ph doesn’t charge additional fee on top of the SSS PRN you paid. I actually got a rebate of P5 as part of their promo. You will get P5 for every unique bill paid, and you will get an additional P100 if you paid 5 unique bill within the week.

You may download it in the Google Play store or Apple app store.

You may use this link to download, and you will get P50 free after your ID verification has been approved.