In light with the enhanced community quarantine implemented as a precautionary measures against the COVID-19 pandemic, SSS has extended Contributions Payment deadline for the first Quarter of 2020.

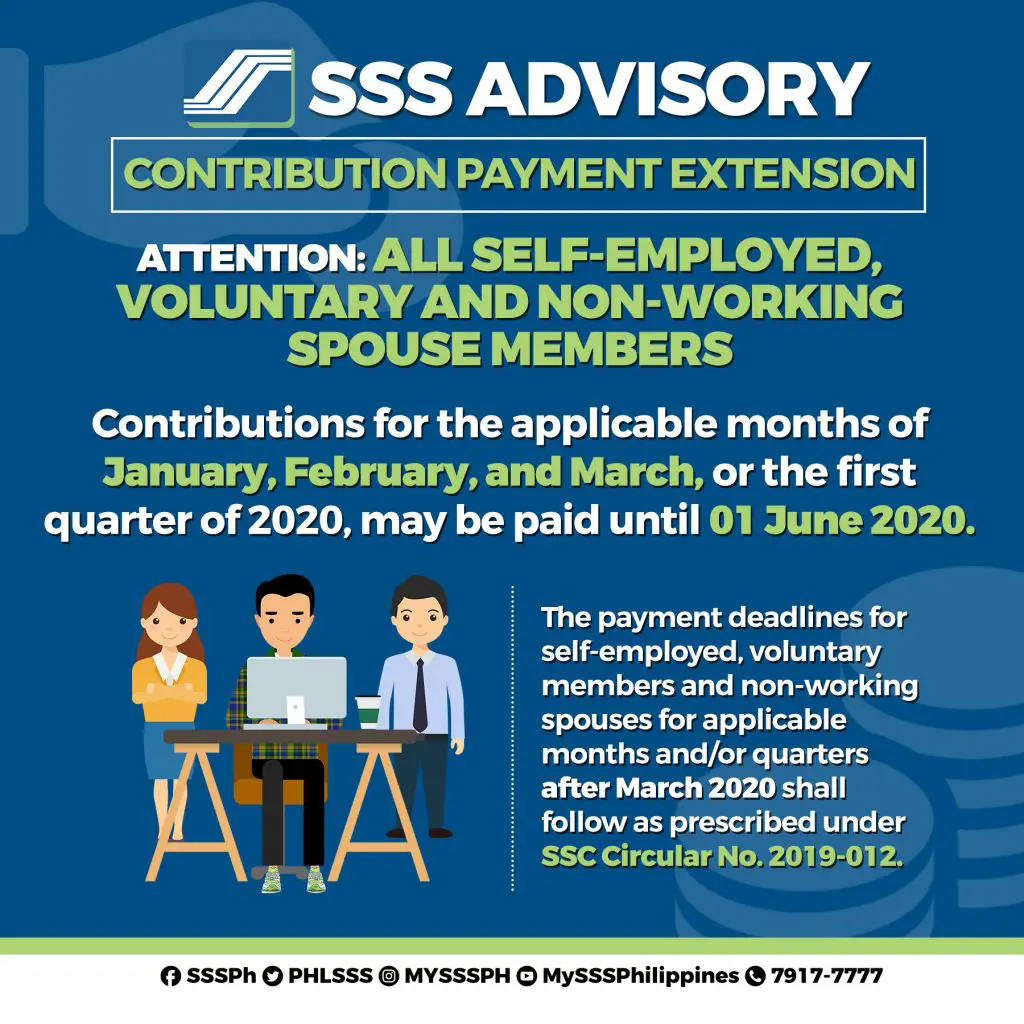

For Self-Employed, Voluntary and Non-Working Spouse

For Self-Employed, Voluntary and Non Working Spouse Members, Contributions for the applicable months of January, February, March (or the first quarter of 2020), may be paid until June 1, 2020.

However, the payment deadline for self-employed, voluntary and non-working spouses for applicable months and/or quarters after March 2020 shall observe the original payment deadline.

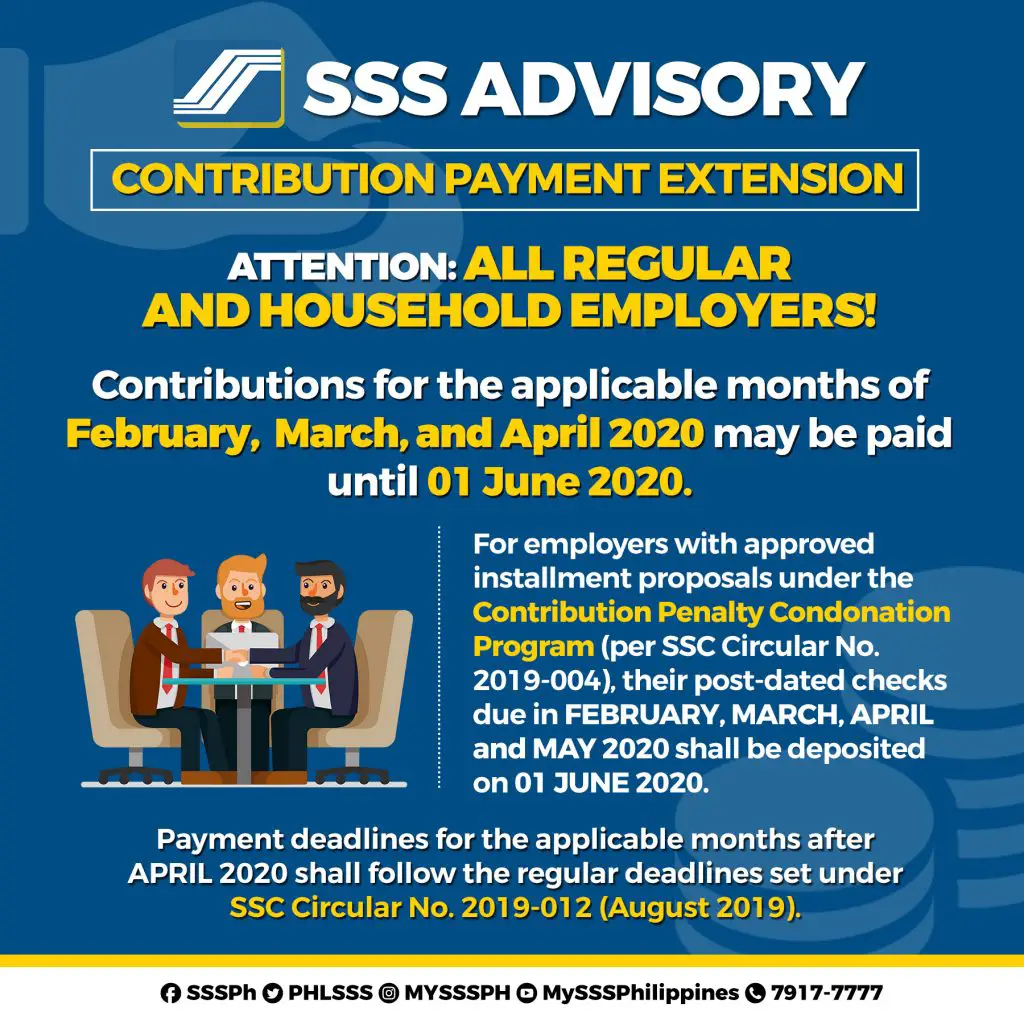

For Regular and Household Employers

For Regular and Household Employers, contributions for the applicable months of February, March and April 2020 may be paid until June 1, 2020.

For employers with approved installment proposals under the Contribution Penalty Condonation Program, their post-dated checks due in February, March. April and May 2020 shall be deposited on June 1, 2020.

Payment deadline for the applicable months after April 2020 shall observe the original payment deadline.

Be the first to comment on "SSS Contributions Payment Deadline extended in light of COVID-19"