Short of cash or an emergency came up? Here is a way a Comprehensive Guide to know if you are Qualified to avail SSS Salary Loan and How to Apply Online!

Who are Qualified to avail SSS Salary Loan?

- You must be a currently employed, self-employed or voluntary member.

- You must have posted at least 36 monthly contributions to avail of a one-month loan, or at least 72 monthly contributions for a two-month loan. Six (6) of these contributions must have been posted in the last 12 months prior to the filing of application.

- Your employer, if any, must be updated in the payment of contributions.

- You must not be more than 65 years old at the time of application.

- You must have not been granted final benefits, such as death, retirement or total permanent disability.

- You must have not been disqualified because of fraud committed against SSS.

How to Apply SSS Salary Loan Online?

Before, you have to go to the SSS Branch to apply for SSS Salary Loan. But since November 2019, SSS has implemented that all Salary Loan must be submitted online. You only need to login to your SSS Online Account and you no longer need to submit any document in SSS Branch.

Related Articles:

- How to Apply SSS Number Online?

- How to Create an SSS Account Online?

- What to do if I forgot my SSS Account?

- How to know my SSS Loanable Amount?

- What to do when my Employer does not remit my SSS Contributions, Loans

- SSS Contributions Table 2020

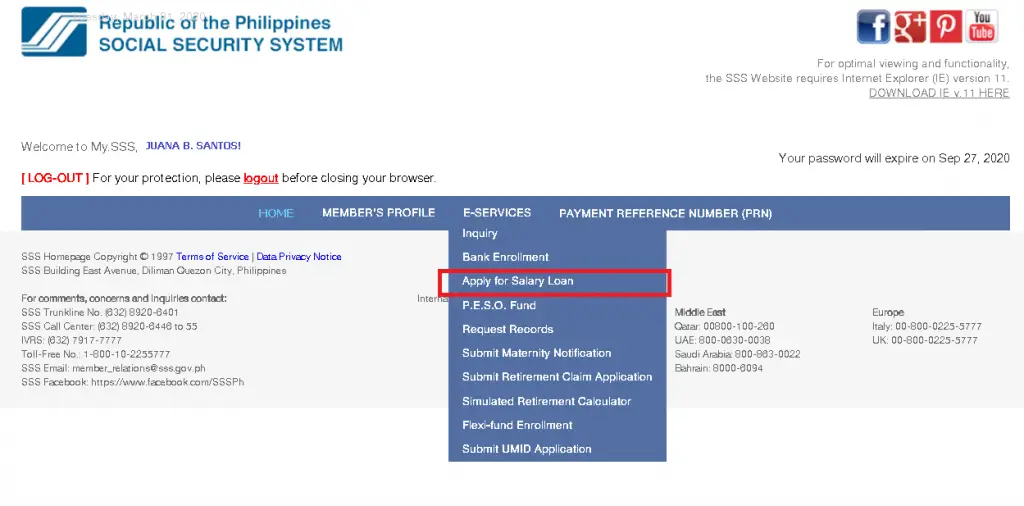

Step 1: Log in to Your My.SSS Account

Log in to your My.SSS account at the SSS website. Click E-SERVICES and then “Apply for Salary Loan” as shown in the screenshot below.

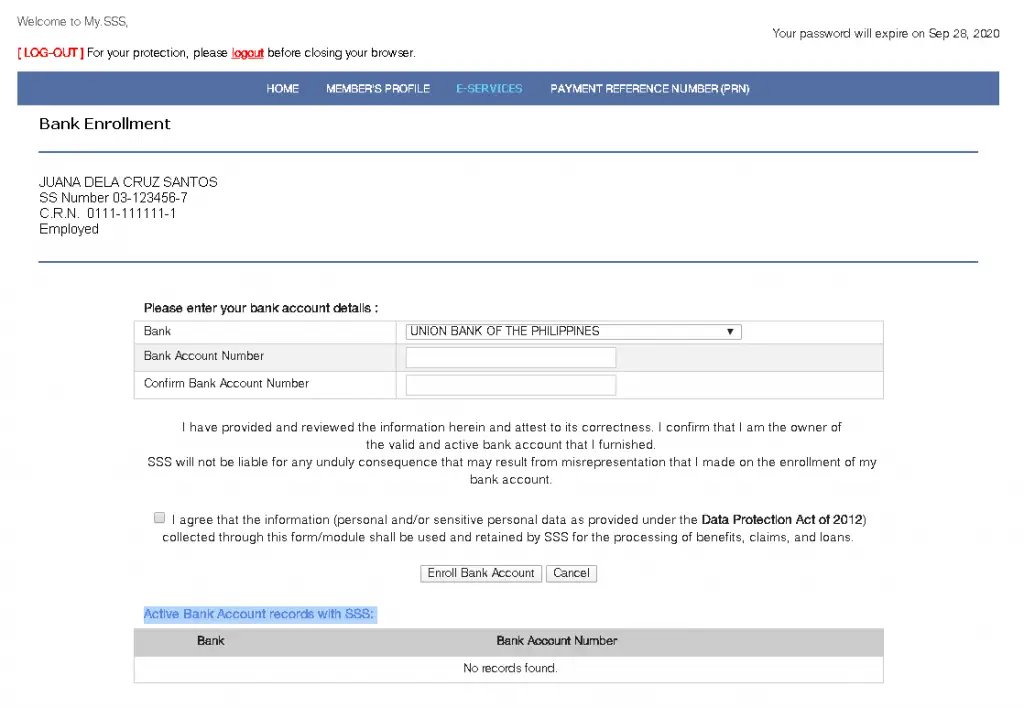

Step 2: Enroll Your Bank Account

Your SSS Salary Loan proceeds may be directly deposited to your Bank Account. As of time of writing, accredited Bank for SSS Salary Loan is for UNION BANK OF THE PHILIPPINES only or to any Bank Account registered with the UMID-ATM.

For bank enrollment, select UNION BANK OF THE PHILIPPINES from the dropdown list. Enter your Unionbank account number twice.

Check the box before “I agree that the information…” and click “Enroll Savings Account.” Click “OK” when a pop-up message appears.

Step 3: Update Your Local Mailing Address

To update your local mailing address, you may have to use the new SSS member portal. Log in to the SSS member portal using the same user ID and password as your old My.SSS account.

Click “My Information” and then the “Update Information” button at the bottom of the page.

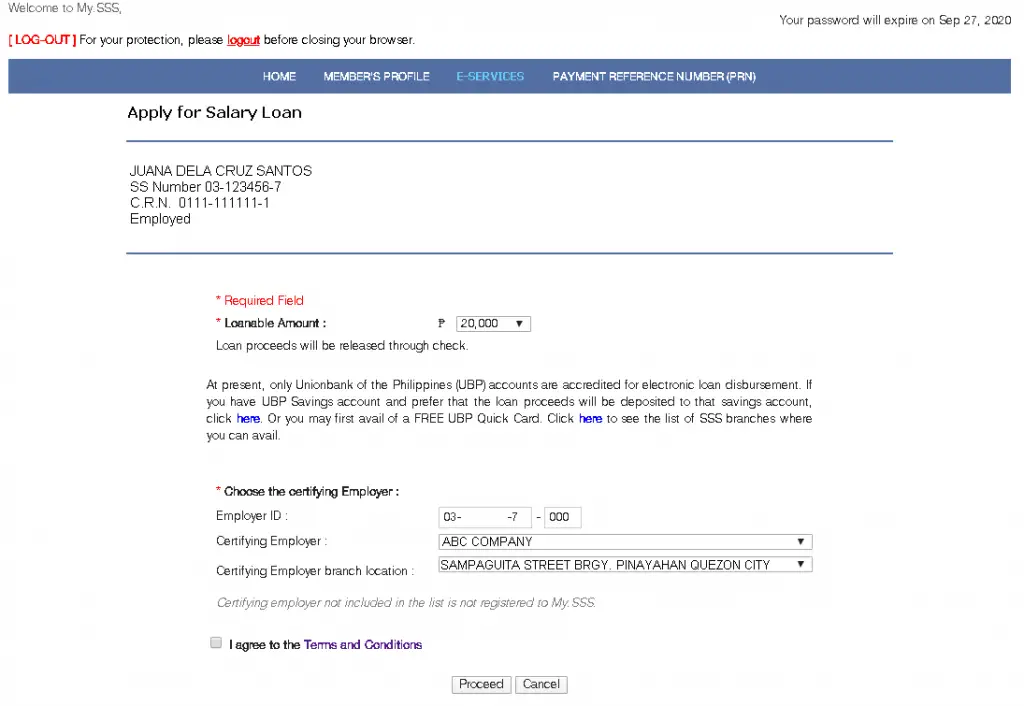

Step 4: Fill Out the Application Form

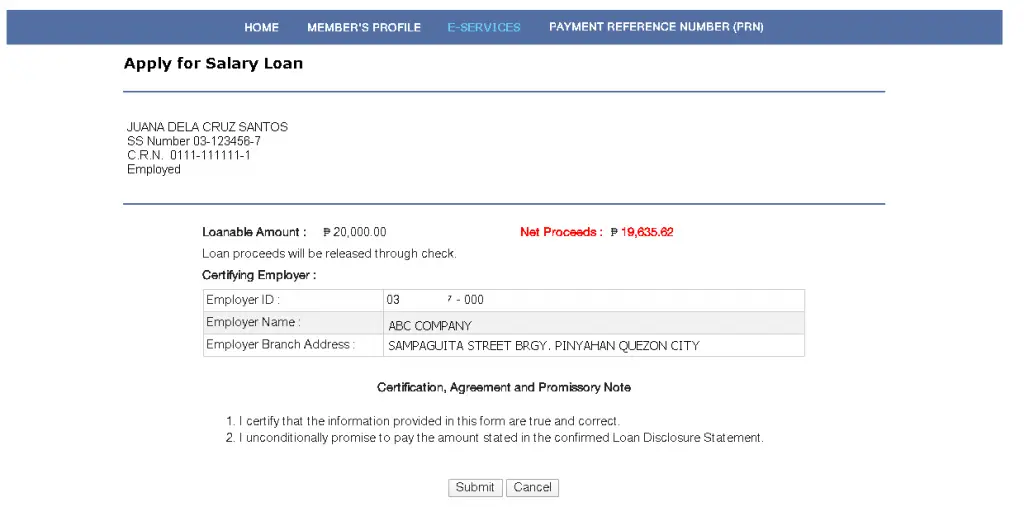

Now go back to your My.SSS account and go to E-SERVICES > Apply for Salary Loan.

Choose the Loanable Amount from the dropdown box. Default amount is the maximum amount that you can loan, but you can choose a lower bracket.

Your current Employer is default selected as your Certifying Employer.

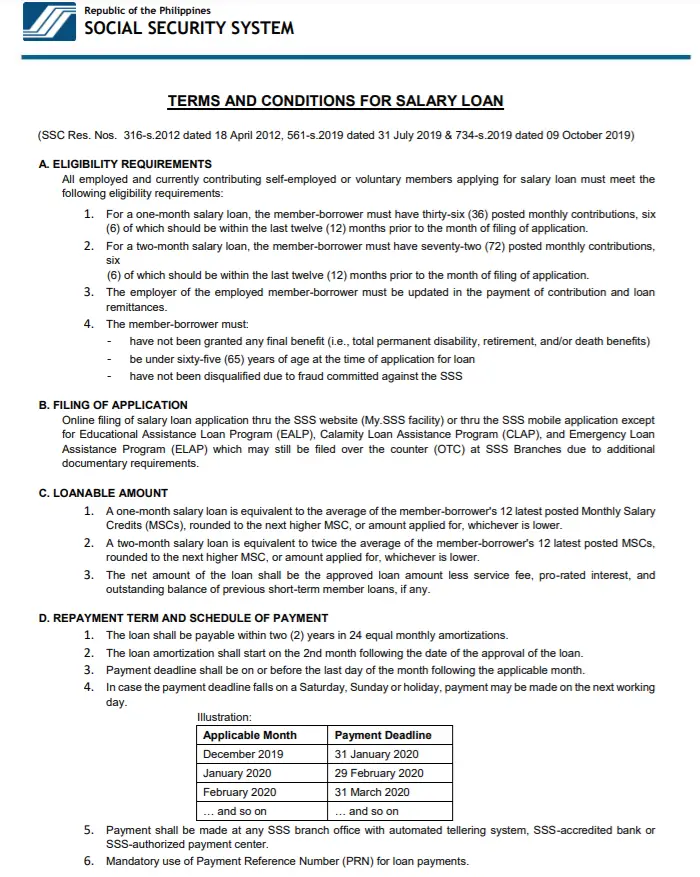

Check the box next to “I agree to the Terms and Conditions.” A new window will pop up containing the terms and conditions. Read it carefully.

Click “Proceed” to continue to the next step.

Step 5: Read the Disclosure Statement

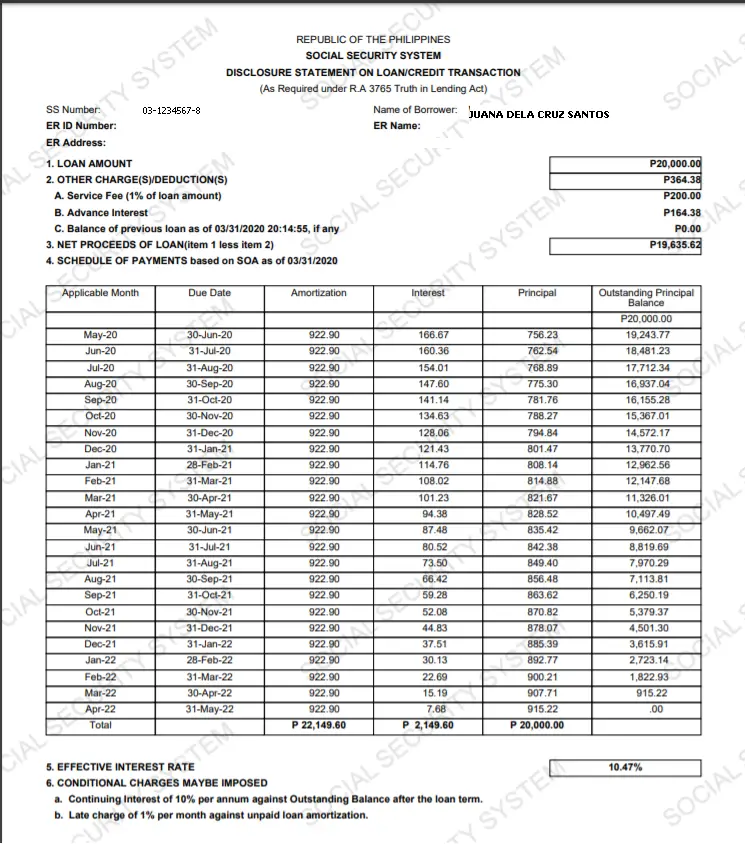

Read the system-generated Disclosure Statement, which contains financial information about your SSS salary loan including amortization, interest rates, schedule of payments, and other charges and deductions. You can download or print it for your reference and record keeping.

If you agree with the terms of the loan, click “Proceed.”

Step 6: Submit Your Application

This is final step before you submit your application. Read the certification, agreement and promissory note on the page, and if you think that there are mistakes in your application, then click the “Cancel” button to back to the previous step. Otherwise, click “Submit” to submit your SSS salary loan application.

Step 7: Wait for Approval

Congratulations! You have successfully submitted your SSS salary loan application. Save or record your transaction number in case you need it. You will also receive a confirmation email from the SSS containing the transaction number.

Step 8: Check the Status of Your Loan

You can learn about the status of your SSS loan by going to E-SERVICES, clicking Inquiry, and then going to Loans > Loan Status/Loan Info.

=It will take about 2-3 weeks for your SSS loan application to be approved. Be sure to check your loan status in your My.SSS account from time to time. In my case, my loan was approved in just two days.

After your loan is approved, you can log in to your account to view information about your loan and to generate a statement of account. Just enter the date of computation to generate a statement of account, which lists your past and current dues, your outstanding principal balance, and the total amount of payments made.

Schedule of Payments

The SSS salary loan is payable within two years in 24 monthly installments. A complete breakdown of your payables can be found in the Disclosure Statement.

The loan amortization starts in the second month after the date of the loan approval. For example, if your loan was approved on June 10, 2020, then your loan amortization starts on July 2020.

The payment due date or deadline will be on the last day of the month following the applicable month. If the payment deadline is a Saturday, Sunday or holiday, you can pay on the next working day. For example, the payment deadline for June 2020 is July 31, 2020.

You can pay your amortizations at any SSS office, SSS-accredited bank, authorized payment center, or online payment service like GCash. Member-borrowers must use their payment reference numbers (PRN) when paying.

Related Article: SSS Payment Centers and Partner Banks

Interest, Fees and Penalties

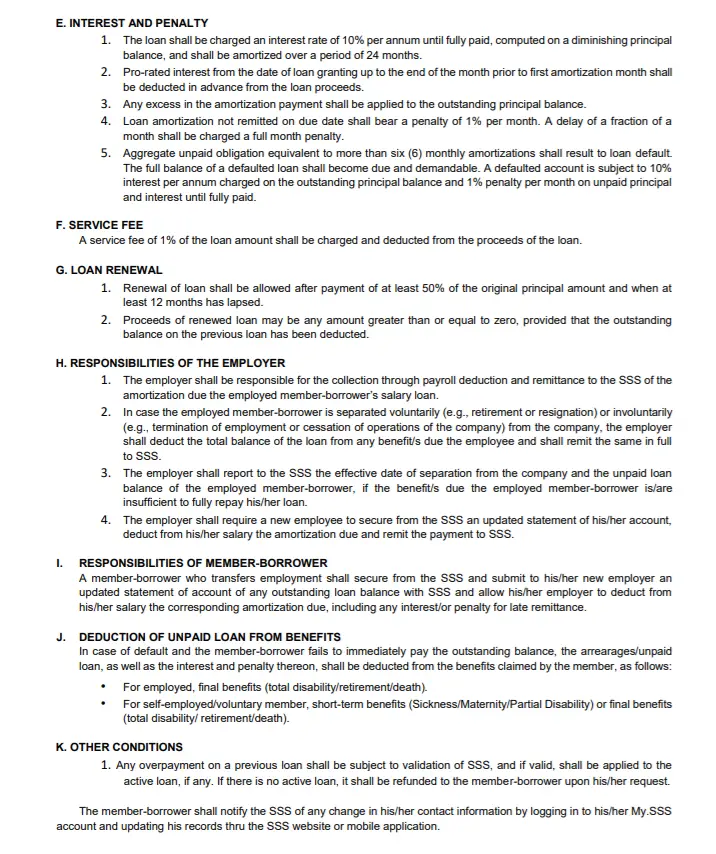

SSS charges an interest of 10% per annum (year) based on the diminishing principal balance, until your loan is fully paid. In addition, there is a 1% service fee which will be deducted from the loan amount.

If you fail to pay on or before the payment deadline, you will be charged a 1% penalty per month until you settle your dues. Any excess payments will be applied to the outstanding principal balance, which means that you can pay your loan in advance.

Non-Payment of Loan

As a member-borrower, it is your obligation to pay your dues on time. But if you become delinquent and failed to pay your SSS Loan, you may wait for SSS LOan Condonation so that you may pay your SSS Loan without Penalty .

If you are not able to pay for your SSS Loan, For self-employed and voluntary members, the unpaid loan will be deducted from his or her short-term benefits such as sickness, maternity or disability benefits.

If the member-borrower dies, becomes disabled, or retires, the unpaid loan including interests and penalties will be deducted from the corresponding benefit (death, disability or retirement).

If the approved date is June 16,2022 then until today the status of loan is “Disbursement thru the bank-G”, should I wait to change the status for the next one to check bank account if the money is already credited in the given bank account?

Ilang days po ba bago pumasok sa card yung pera ? june 25 po sya na approved hanggang ngayon wala padin po.