The SSS Payment Reference Number (PRN) for Contributions is now required for paying your SSS monthly contributions whether you are a Self Employed, Voluntary, OFW or Non Working Spouse SSS Member. SSS Employers on the ther hand is required to generate a Payment Reference Number when paying the contributions of its employees.

The SSS stated that the implementation of SSS PRN aims to:

- make posting of SSS Contributions accurate by attributing the PRN to the correct SS number, correct member, correct SSS Amount and Applicable Month

- posting of SSS Contributions real time (your contributions will be posted in your SSS Account within seconds). You can immediately check your contribution if posted immediately after you paid your contribution.

The SSS PRN is a unique series of number which you will present/encode in the SSS Payment Partners (like Bayad Center, Gcash, Paymaya, Banks). You will need to generate a new Payment Reference Number every time you will pay your SSS Contribution either monthly or quarterly.

Related Articles:

- 5 Easy Ways on How to Generate your SSS Payment Reference Number

- SSS Contributions Schedule 2022

- How to Generate SSS Payment Reference number thru SSS Mobile App

Youtube Video on How to Get your SSS PRN for Contributions in SSS Website

How to Get your SSS Payment Reference Number (PRN) for Contributions?

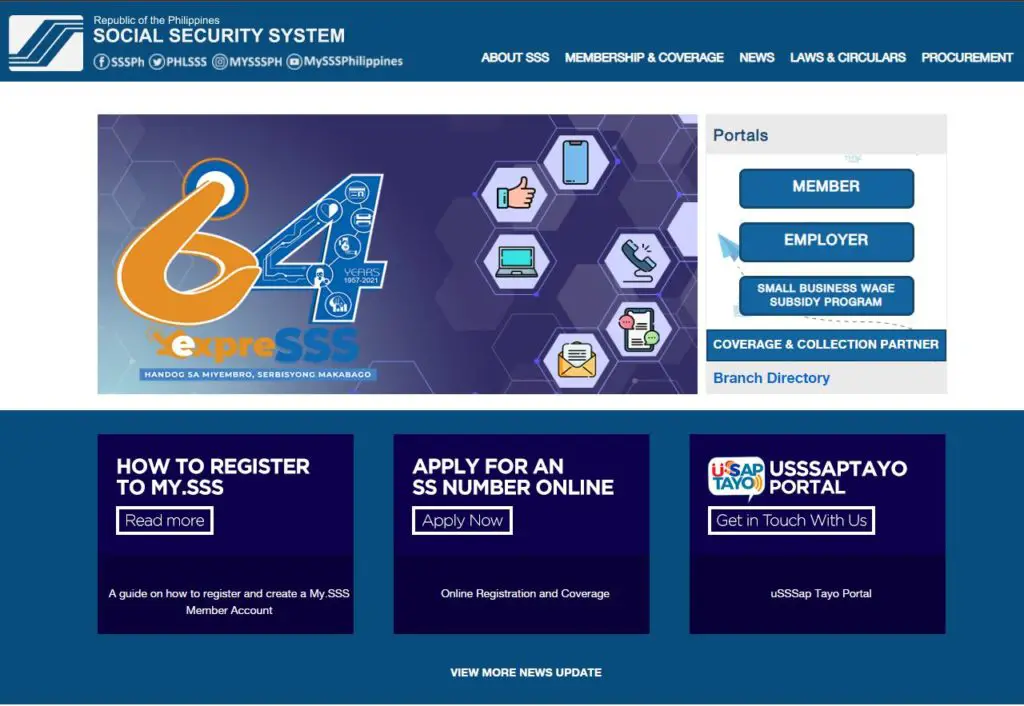

1. Open the SSS Website on your browser.

Type www.sss.gov.ph then wait for the website to fully load. Click the I am not a robot check box on the window.

2. Login to your SSS Online Account by filling in your username and password. Click the I am not a robot checkbox then click Submit button.

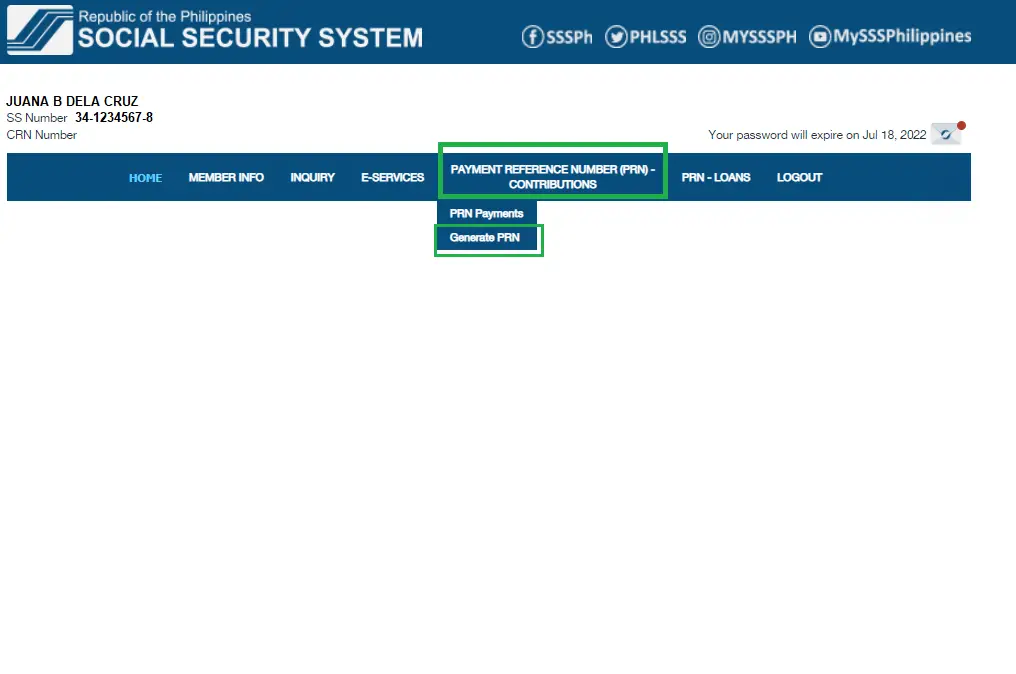

3. After successfully logging in, click the Payment Reference Number (PRN) – Contributions then a submenu will display. Click the Generate PRN submenu.

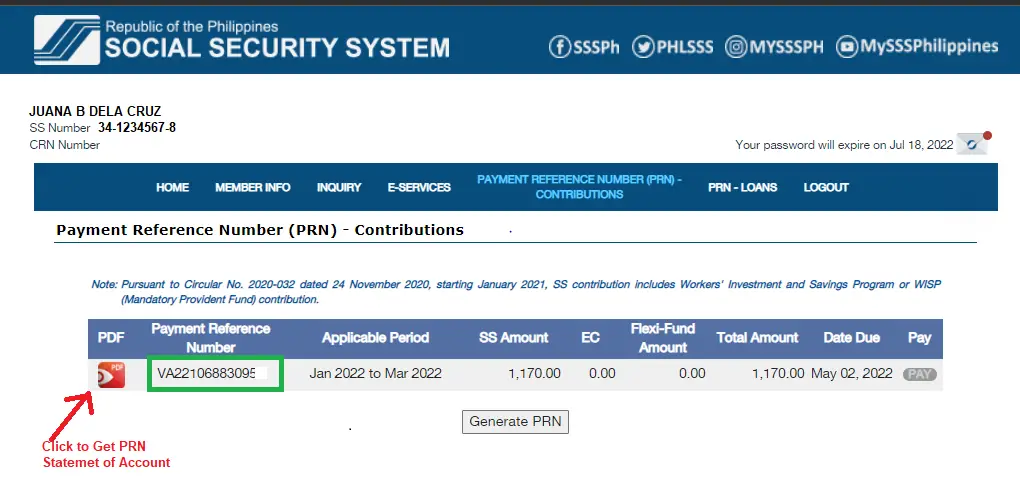

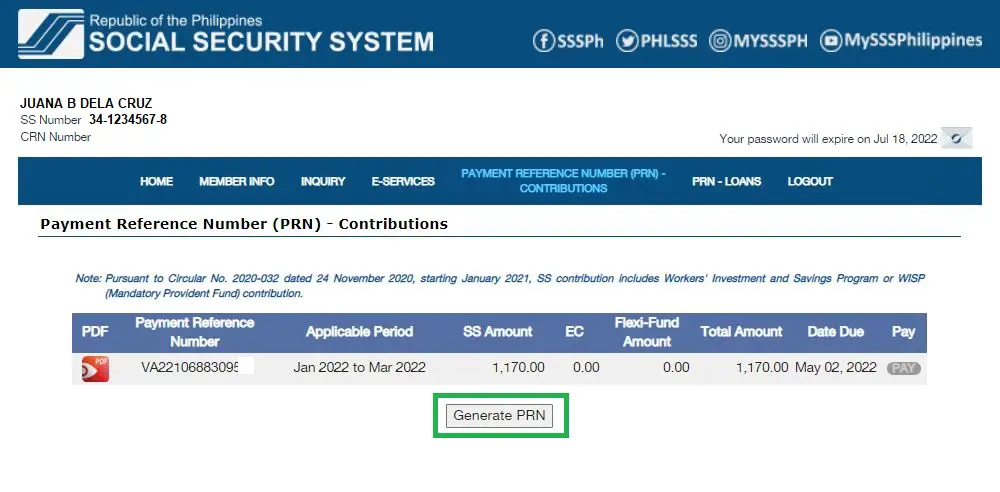

4. You will see your pre-generated PRN under the Payment Reference Number column.

If you have previously paid your Contributions PRN for the past month or quarter, SSS will automatically generate your PRN based on the Monthly Salary Credit that you have prepaid before. If you will pay the same SS Amount, you can simply take note or copy the Payment Reference Number then pay thru SSS Payment partners like Gcash, Paymaya and other banks with online facility.

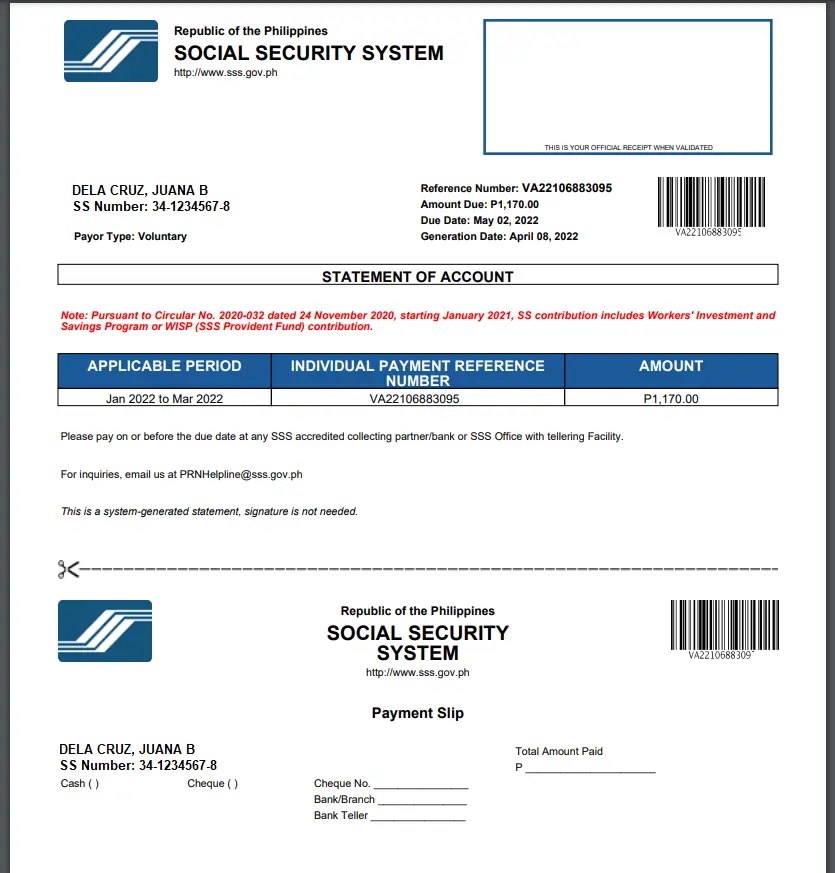

5. Click the PDF (Red icon) to open the PRN Statement of Account – this is the printable form that you may use to present to the SSS Payment partners to pay your PRN.

If you want to change the amount or the applicable month that you want to pay, then here’s to manually create your SSS PRN Payment Reference Number for Contributions.

1. Click the Generate PRN button.

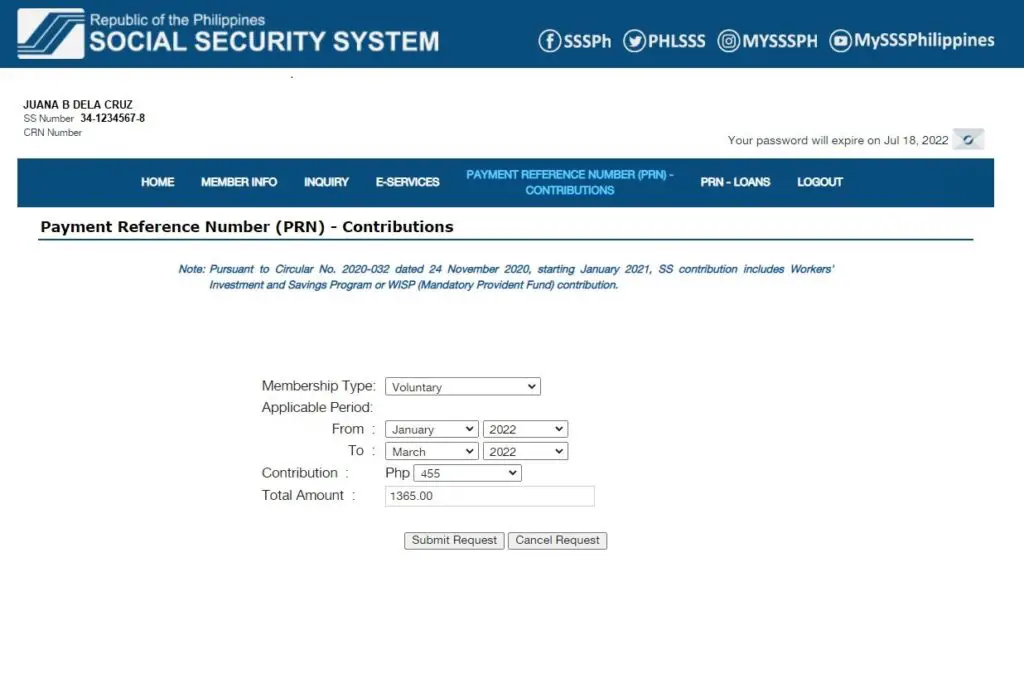

2. You will be asked to fill up the fields. Fill in your Membership Type (If Voluntary, OFW, Self Employed), the Applicable Month that you will pay, and the SSS Premium.

The SSS Premium that you will select will be the default Premium for the applicable months that you will select. So for example, you selected the applicable months January 2022 – March 2022 and you selected the P455 in the SSS Premium, the system will automatically compute that the you will pay Php455 SSS Premium from January 2022-March 2022.

If you want to create a PRN that has different SSS Premium for each month, then create a separate PRN for each month.

For example, for January 2022 you want to pay 390 only, so select Applicable Period From: January 2022, To January 2022 then select 390 only. You are generating a PRN for the month of January only.

If you want to pay Php455 for February 2022, then select Applicable Period: February 2022 – February 2022, then select Php455 only.

You can generate a PRN for one month only, providing that it is still within the generation period and is before the payment deadline.

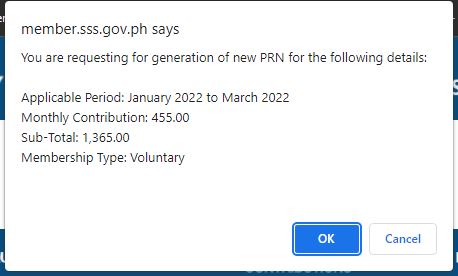

3. Click Submit Request. A confirmation dialog will appear, click OK.

4. Your new Payment Reference number will be displayed in the page together with all the details. You may print the State of Account to present it to Bayad Center or payment partners when paying.

5. Take note of the Due Date. Make sure to pay your Payment Reference Number on or before the due date.

Posting of SSS Contributions when you pay thru your Payment Reference Number is real time. Check thru your SSS Online Account or Mobile account if your SSS Contributions has been posted.

If you happen to had a problem (e.g Non posting of your SS Contribution), direct your concern thru SSS contact center:

- Toll-free hotline: 1-800-10-2255777

- Email: member_relations@sss.gov.ph.

- Email: onlineserviceasssitance@sss.gov.ph