Are you filing for an SSS Benefit for yourself or for your employees like Maternity, Sickness or Unemployment Benefit? Or filing for a Salary or Calamity Loan? Make sure to enroll your Disbursement Account in My.SSS correctly to receive your SSS Benefit or Loan proceeds without hassle.

The Enrollment of Disbursement Account in My.SSS is for ALL Employers, employed, individually paying members such as self-employed, OFW, and voluntary. Exempted from enrollment are those with UMID-ATM cards, where in all proceeds (amount of benefit or loan) shall automatically be deposited into their UMID-ATM account. The SSS will deposit proceeds of the benefit or loan application directly the member’s preferred disbursement account. Loan proceeds shall be disbursed through PESONet participating banks only.

Related Articles:

- How to Get SSS Number Online

- How to Create My SSS Account Online

- How to Reset My Locked SSS Account Online

- How to Check My SSS Contributions Online

- How to Check My Loan Balance Online

Before I guide to the Step by Step Process on how to Enroll your Bank Account/Disbursement Account online, here are few things that you have to look out

Important Reminders on Disbursement Account Enrollment

- Make sure to provide only valid and active bank account details or mobile numbers. Kindly DO NOT use the following bank accounts:

- Closed, Dormant or Frozen Accounts – bank account that is not active for a certain period and bank has closed it or made it dormant

- Dollar Account – bank account should be in Peso Account

- Joint (and/or) – bank account that is named after you and/or your partner

- Time-Deposit Account

- Invalid Mobile Number – if you are using Paymaya/Gcash, double check your mobile number digits

- Account Name differs from Member Name – make sure that the registered name in your bank account is the same as your registered name in your SSS.

- Different Disbursing Bank – like for example, your Bank account is BPI but you chose in your Disbursement Registration that it is BDO. Make sure to always double check.

- Prepaid Account

- Account with Restrictions

2. Duplicate account/mobile numbers will be rejected. So for example, you are planning to use your spouse Gcash account as your disbursement account, make sure that he hasn’t used it as his SSS Disbursement account. It is advised that you register or make your own disbursement account and use it on your My.SSS to avoid problems on your benefit/loan disbursement.

3. Errors in the details of your enrolled disbursement account shall result to non-crediting of your benefit proceeds. Re-crediting of the benefit amount may take up to 30 days processing time upon correction of erroneous account details.

4. For bank accounts:

- Employers, or their authorized personnel, must enroll only (1) PESONet-participating bank account, which may be used for all its branches and subsidiaries.

- Employed and individually-paying members may enroll up to three (3) active bank accounts, but must nominate only one of these accounts for benefit or loan disbursement.

Enter the bank account number and not the ATM card number. Please check the correct bank account number from your disbursing bank.

Bank account numbers should be written as a continuous string of number and do not include the dash and other symbols in between.

For CASH Card, please ensure that the issuing bank allows the use of the same for SSS disbursement.

5. For Remittance Payout Companies (RTCs) and Cash Payout OutletsA(CPOs):

- The SSS will send the reference Number needed to claim the benefit proceeds via Text Message, thus ensure that your mobile number is correct and active.

- Encode mobile numbers in its 11-digit format (e.g 0917234567), without the +63, or dash (-) or any non-numeric characters.

6. For E-Wallets, such as Paymaya, make sure that your account is Upgraded sot hat it can receive the full amount of proceeds beyond the usual limit. An Upgraded account has a green beside the owner’s profile in the PayMaya app.

- The maximum allowable amount for disbursement thru RTC/CPO is Php100,000.

- RTCs/CPOs, such as MLhuiller, will charge transaction fees based on its prevailing rates.

IN case of wrong mobile number encoded in the DAEM or lost mobile phone (ie. Lost Reference Number), re-crediting of the benefit amount to the correct or new mobile number may take up to 30 days processing time upon receipt of request.

How to Enroll your Disbursement Account on My.SSS for your Benefits Loan Proceeds

If you are not sure if your bank account is an SSS Payment Partner of SSS, here are the comprehensive List of PESONet Participating Banks you can use for your SSS Benefits and Loans

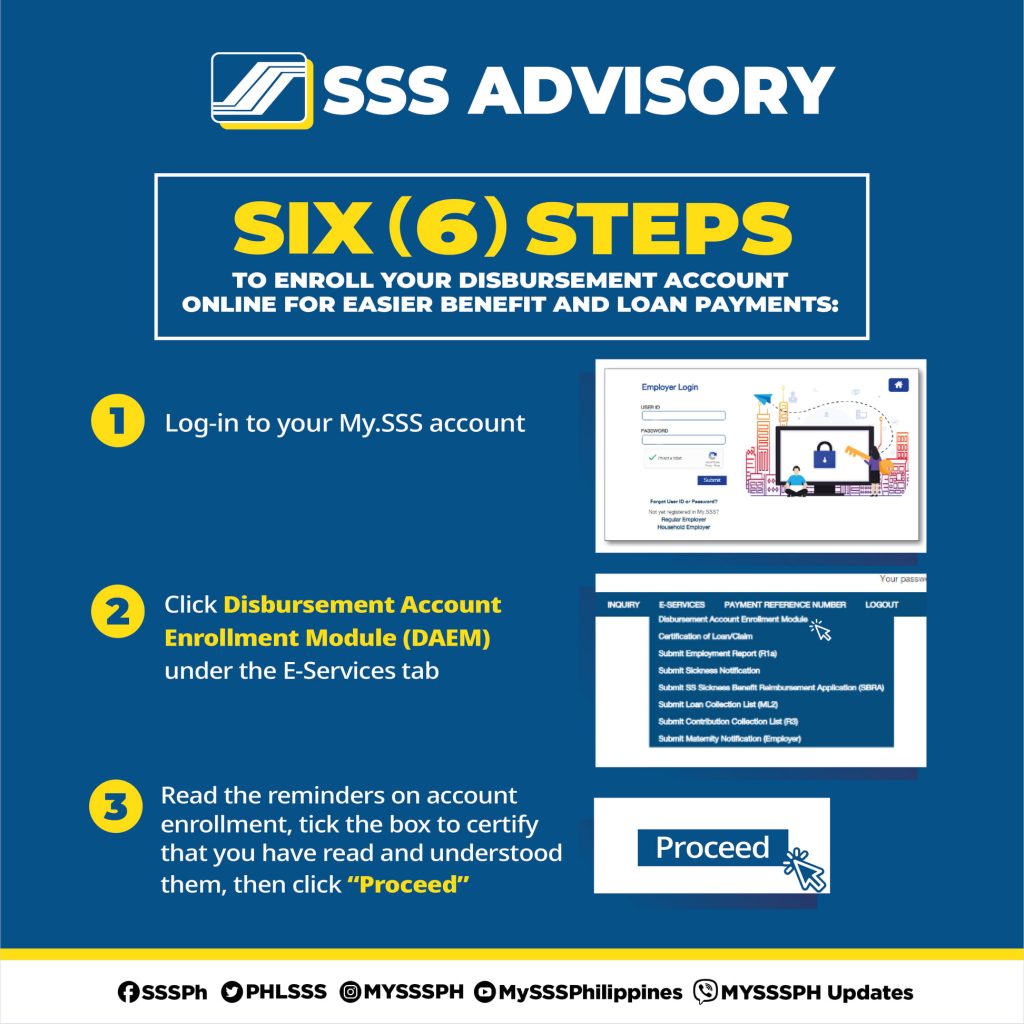

- Log in to your My.SSS Account.

- Click Disbursement Account Enrollment Module (DAEM) under the E-Services tab.

- Read the reminders on account enrollment, tick the box to certify that you have read and understood them, then click “Proceed”

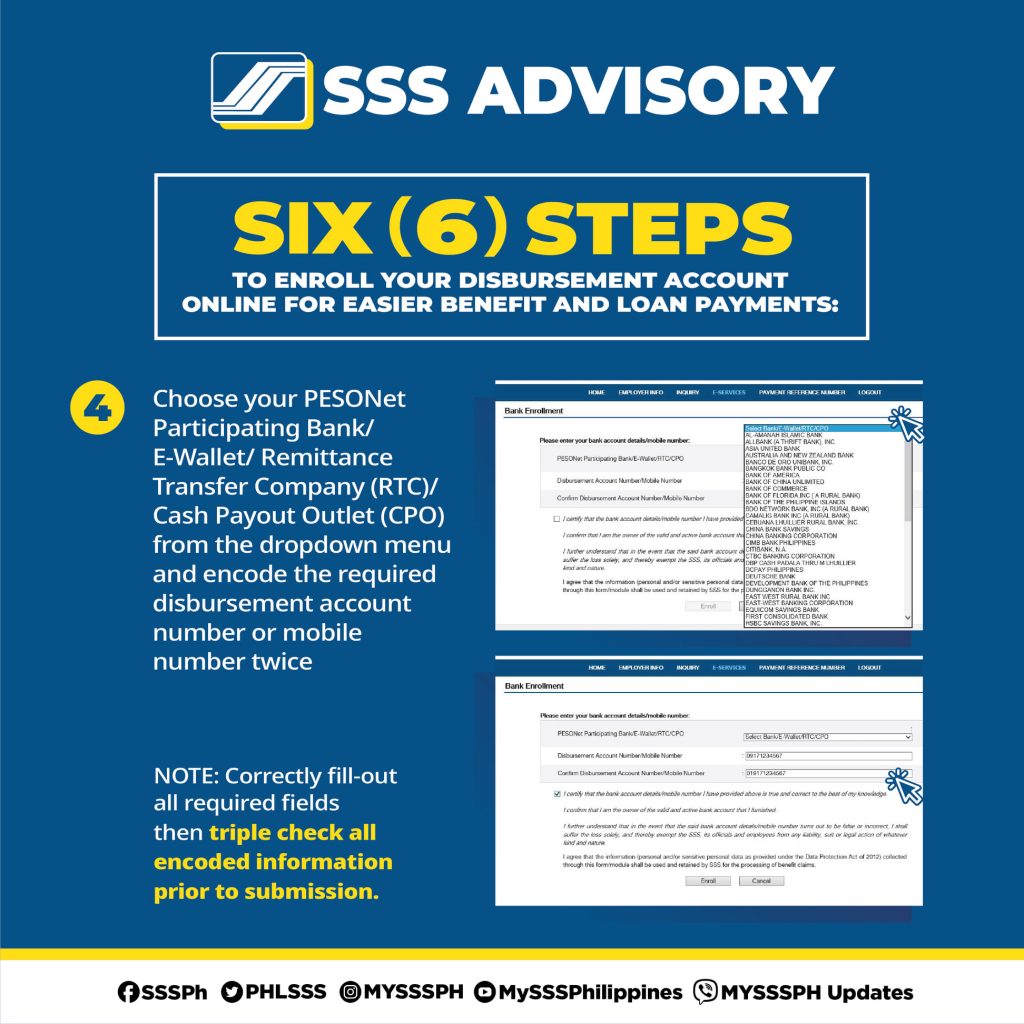

4. Choose your PESONet Participating Bank/E-Wallet/Remittance Transfer Company (RTC)/Cash Payout Outlet (CPO) from the dropdown menu ane encode the required disbursement account number of mobile number twice.

Correctly fill out all required fields then triple check all encoded information prior to submission. Errors in the details of your enrolled disbursement account shall result to non-crediting of your benefit proceeds. Re-crediting of the benefit amount may take up to 30 days processing time upon correction of erroneous account details

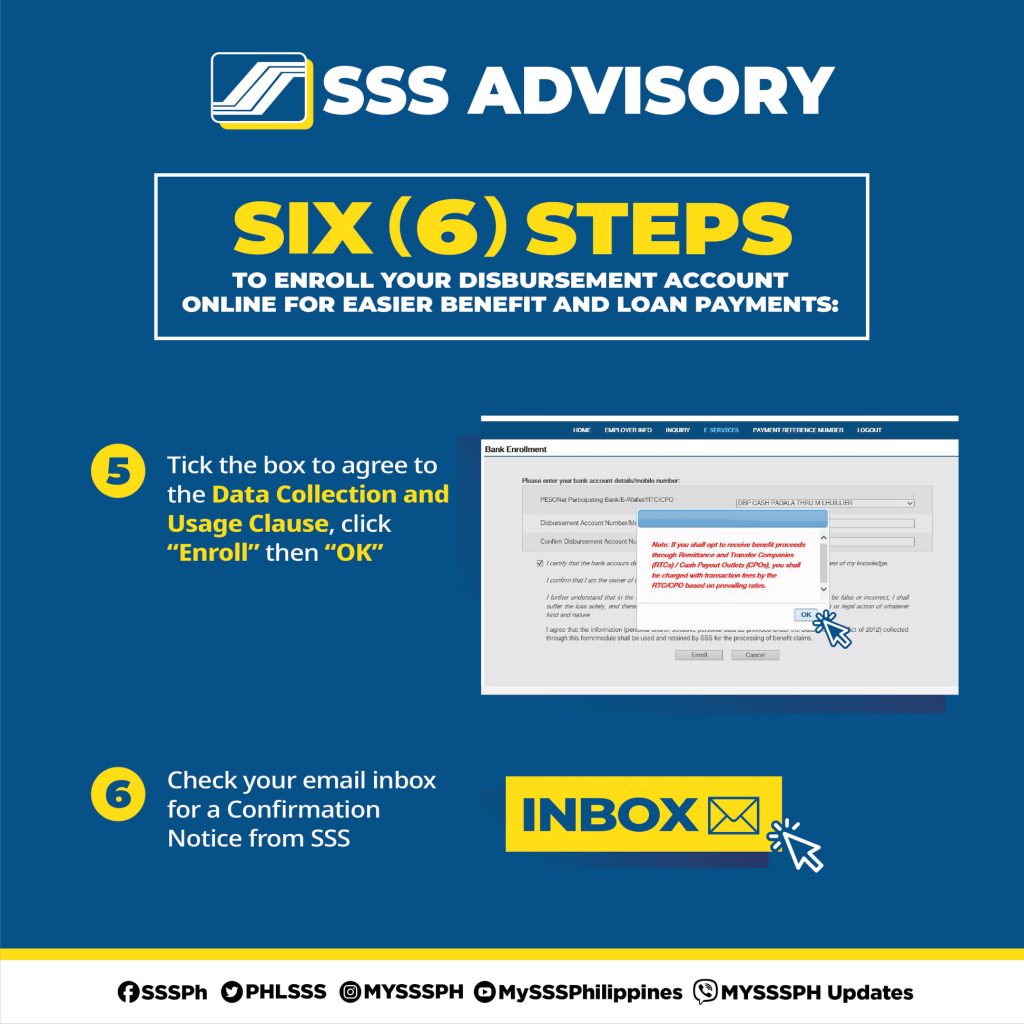

5. Tick the box to agree to the Data Collection and Usage Clause, click Enroll then OK.

6. Check your email inbox for a Confirmation Notice from SSS.