Self-employed

Ang isang self-employed na kumikita ng hindi bababa sa P1,000 sa loob ng isang buwan at hindi pa lumalampas sa edad na 60 years old ay kailangang magparehistro sa SSS. Ang kita ay mula sa kahit ano pa mang negosyo o trabaho. Itinuturing na self-employed ang isang indibidwal, ngunit hindi limitado, kung siya ay:

- self-employed professionals;

- business partners, board directors, at single proprietor (may maliit na negosyo);

- actors, actresses, scriptwriters, news reporters, etc. na walang employee-employer relationship;

- professional athletes, coaches, trainers, and jockeys;

- magsasaka at mangingisda, manggagawa sa informal sector tulad ng cigarette vendors, watch-your-car boys (bantay ng sasakyan sa parking), hospitality girls (nagtatrabaho sa club), at iba pa.

Voluntary Coverage

Separated Members – SSS member na nawalan ng trabaho at hindi kasalukuyang self-employed/OFW/non-working spouse ngunit nais pa ring ituloy ang kanyang contribution.

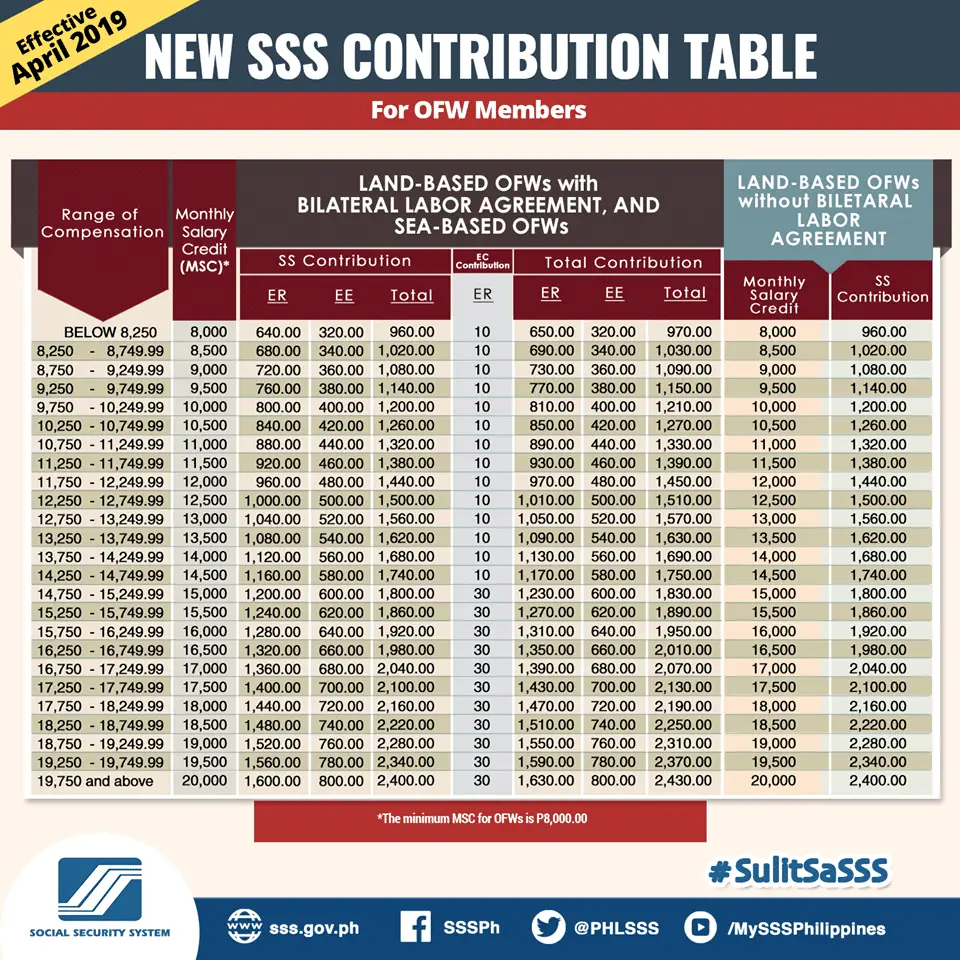

Overseas Filipino Workers (OFW)

Overseas Filipino Workers (OFWs) – Pilipino na na-recruit sa Pilipinas ng isang foreign-based employer upang magtrabaho sa abroad o kaya ay Pilipino na legal na pumasok sa ibang bansa (tulad ng tourists, students) at nakakuha ng trabaho sa bansang iyon.

Non-working Spouse (NWS)

Non-working Spouses of SSS members – ang isang legal na asawa – ng indibidwal na kasalukuyang employed at aktibong SSS paying-member – na siyang naiiwan at nangangasiwa ng mga gawaing bahay ay maaaring maging voluntary member na may pag-sang ayon ang asawang nagtatrabaho (working spouse). Siya ay dapat na hindi pa naging SSS member. Ang contribution ay batay sa 50% ng working spouse’s last posted monthly salary credit ngunit hindi dapat bababa sa P1,000 salary credit.

Pero kung ikaw ay nagtayo ng iyong negosyo, maaaring maging miyembro sa pamamagitan ng self employed at magtungo sa pinakamalapit na SSS branch sa iyong lugar para ipa-register ang iyong business at isumite ang mga kinakailangang dokumento.

Narito ang paraan para makapagregister sa SSS:

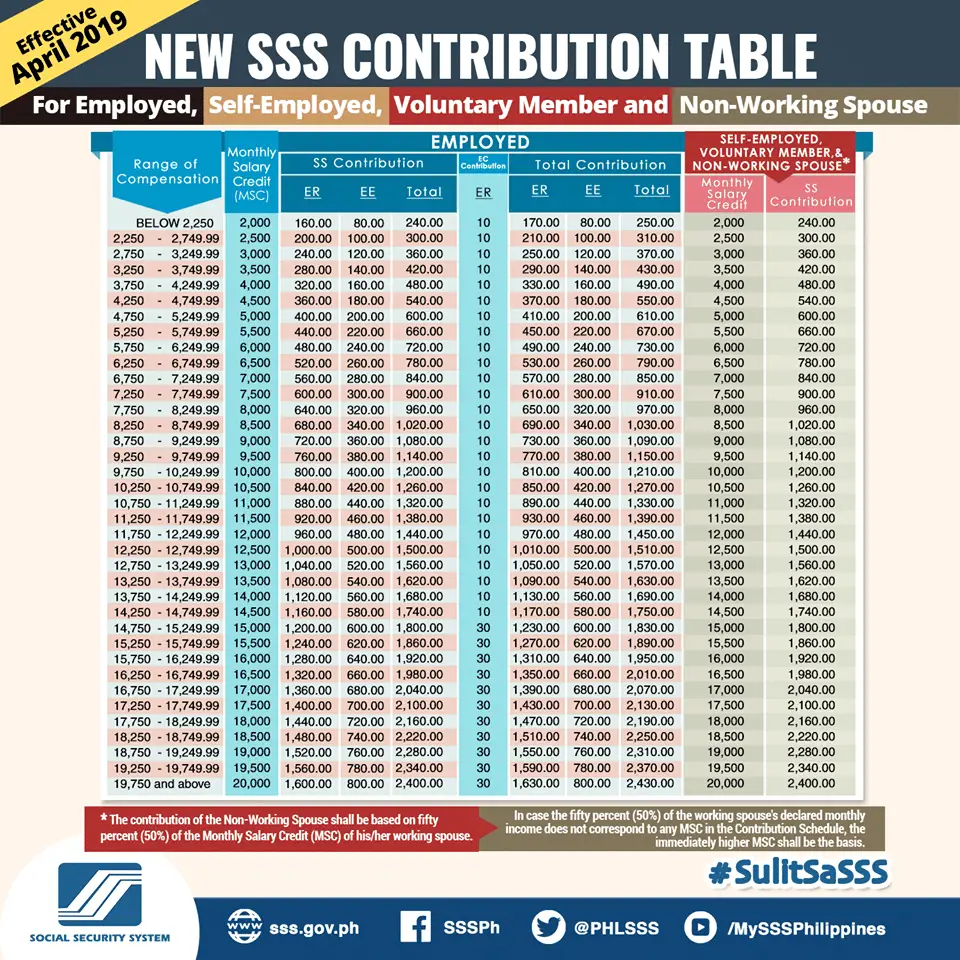

How much is the SSS Contribution for Self Employed/Voluntary/OFW and Non Working Spouse Members?

How to Pay My SSS Contributions as a Self-Employed/Voluntary/OFW/Non Working Spouse Member?

First, get an SSS Payment Reference Number for Contributions.

You may check 7 Ways on How to Get SSS Payment Reference Number

Second, present your SSS Payment Reference Number then pay in the SSS Branch with Teller Facility or any SSS Accredited Banks or Payment Partners.

As of August 24, 2018, the following are the SSS Partner banks and non-banks are only accredited to receive the SSS Payment Reference Number for Employers and Voluntary paying members.

| BANKS | NON-BANKS |

|---|---|

| 1. Asia United Bank (selected branches only) | 1. CIS Bayad Center, Inc. (selected branches and tie ups) |

| 2. Bank of Commerce | 2. GCash (for Household Employer PRN only) |

| 3. Bank of the Philippine Islands (with bank account with BPI) | 3. I-Remit, Inc. |

| 4. Philippine Business Bank | 4. Pinoy Express Hatid Padala Services, Inc. |

| 5. PNB Savings Bank | 5. Sky Freight Forwarders, Inc |

| 6. Security Bank (with bank account with Security Bank) | 6. Ventaja International, Inc. |

| 7. Union Bank of the Philippines | 7. eCPay (all partners except 7/11) |

| 8. Wealth Development Bank, Inc. | |

| 9. Rural Bank of Lanuza (Surigao) |

SSS added that some other banks and payment partners are currently enhancing their system to become RTPC-compliant in order to receive contribution payments using the PRN.

Can a Self-Employed/Voluntary/OFW/Non Working Spouse Member increase his/her SSS Contributions anytime?

1. If you are younger than 55 years of age, you are allowed to increase your SSS monthly contributions any time, by any number of brackets, and by any number of times within a year.

2. If you’re already 55 years old or older than 55, you are no longer allowed to increase many times within a year. You are now limited. You can increase your monthly SSS contribution once within a calendar year, and by only one bracket within a calendar year.