How to File for adjustment of SSS Maternity Benefit

The following cases for adjustment may also be filed online:

- Member is qualified as a solo parent

- Correction of type of claim

- From Normal to Caesarian Section (CS) delivery; or

- From Miscarriage to Ectopic Pregnancy with Operation

- SSS computation is higher than employer’s computation.

- Additional posted contributions will increase the amount of benefit

- Correction of the approved number of days from 60 (normal delivery) or 78 (CS delivery) days to 105 days.

- Allocated leave credits not used due to separation from employer of the child’s father or qualified caregiver.

Related Articles:

- How to Apply and Qualify for SSS Maternity Benefit

- Frequently Asked Question about SSS Maternity Benefit

- How to Know How Much is your SSS Maternity Benefit

- Common reasons why your SSS Maternity Benefit is denied

- Affidavit of Undertaking Template

- How to Comply with Disbursement Account Enrollment Module?

- How to Submit SSS Maternity Application (MAT2) in SSS Website for Self Employed, Voluntary, OFW, Non Working Spouse and Separated from Employers?

- How to File for SSS Maternity Reimbursement for Regular and Household Employer?

How to File for Adjustment of SSS Maternity Benefit for female Self Employed, Voluntary, OFW, Non Working Spouse and Members Separated from Employers?

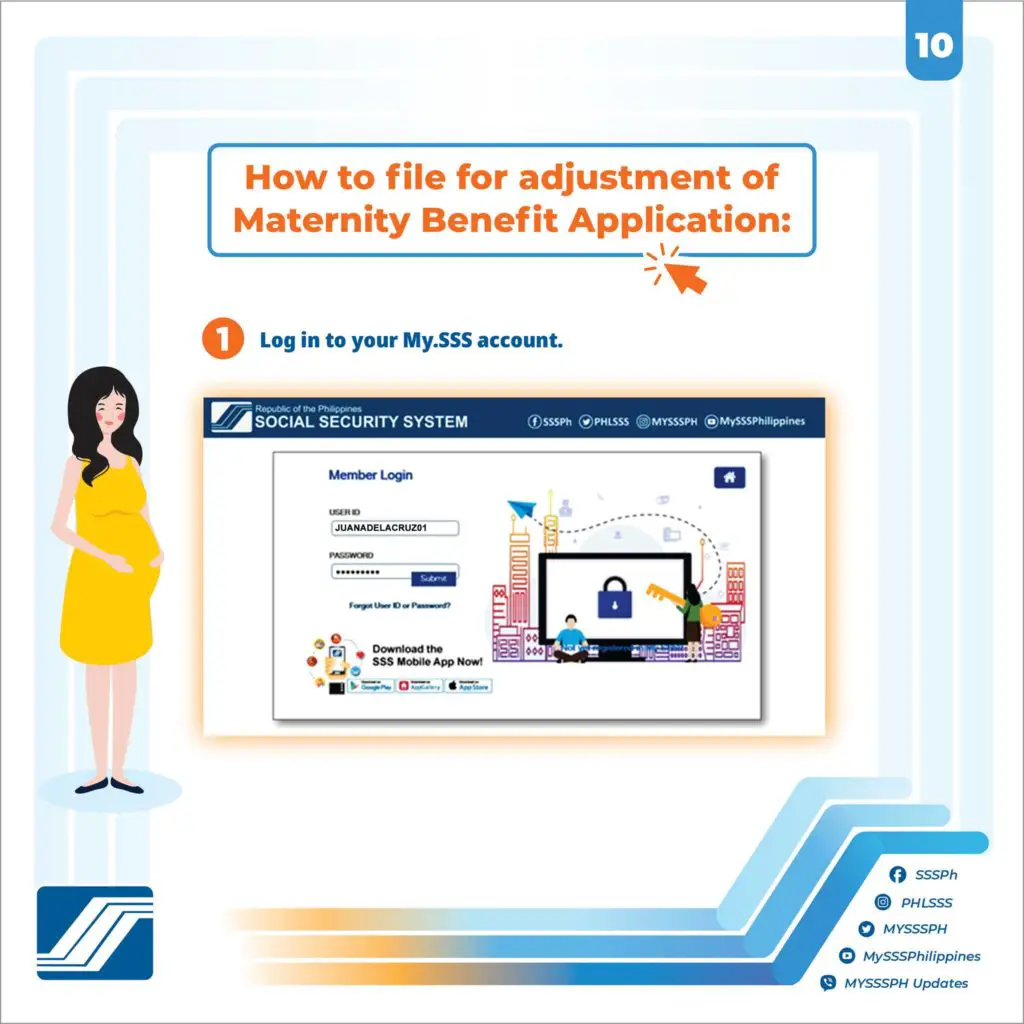

- Login to your My.SSS Account.

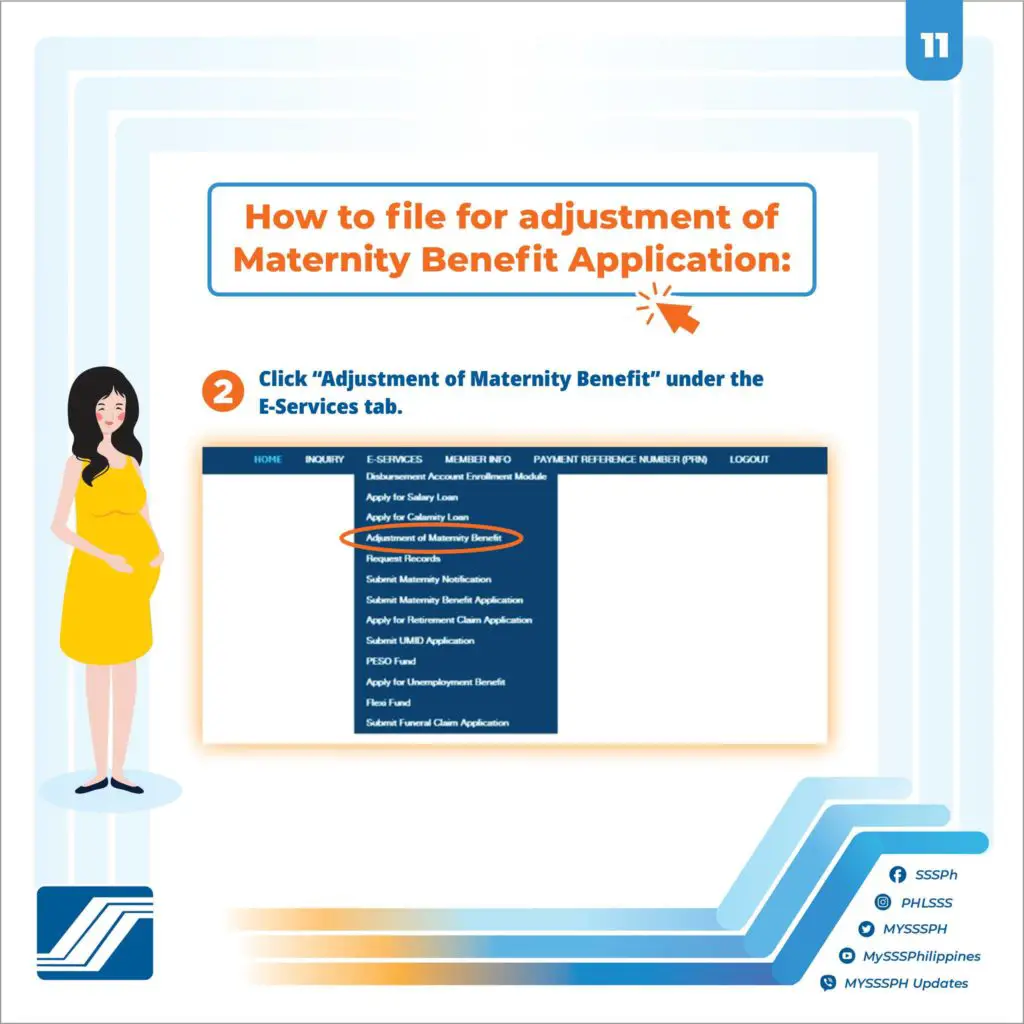

2. Click the “Adjustment of Maternity Benefit” under the E-Services Tab.

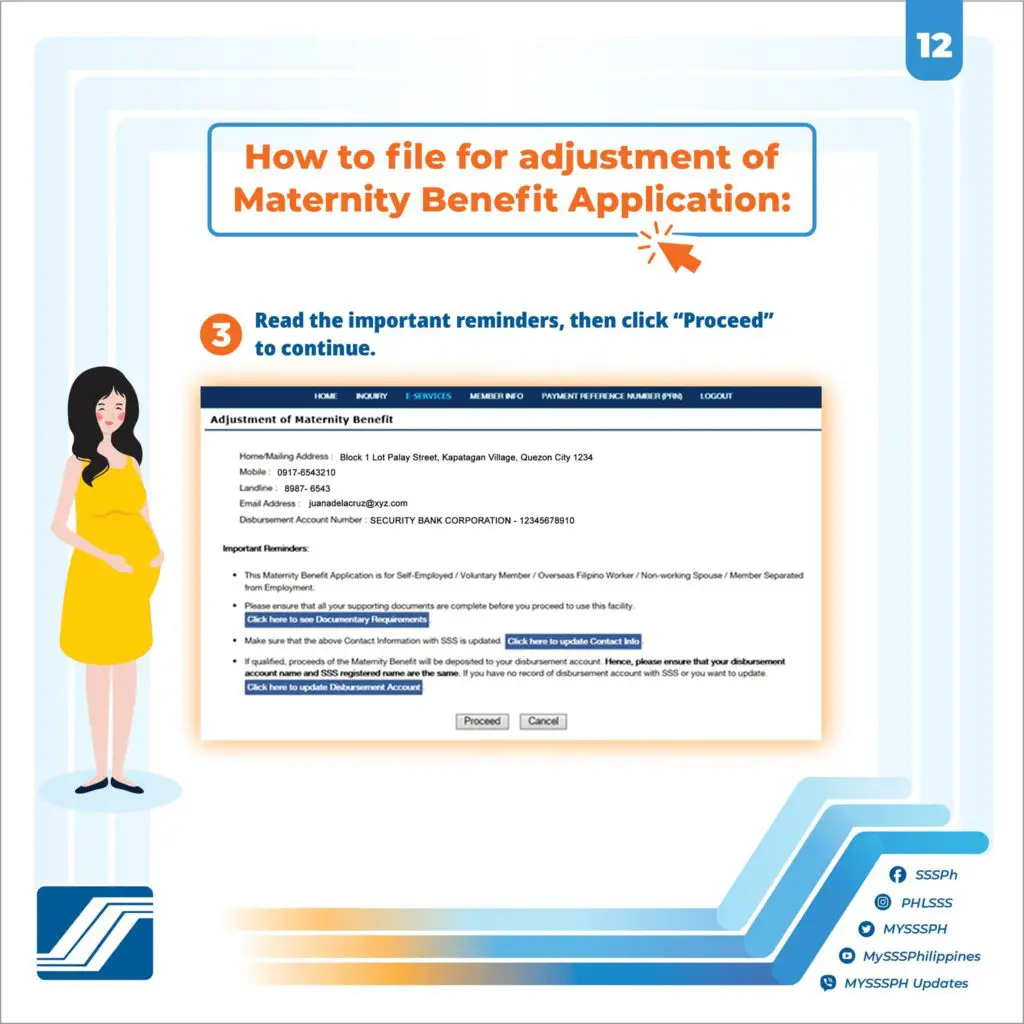

3. Read the important reminders, then click “Proceed” to continue.

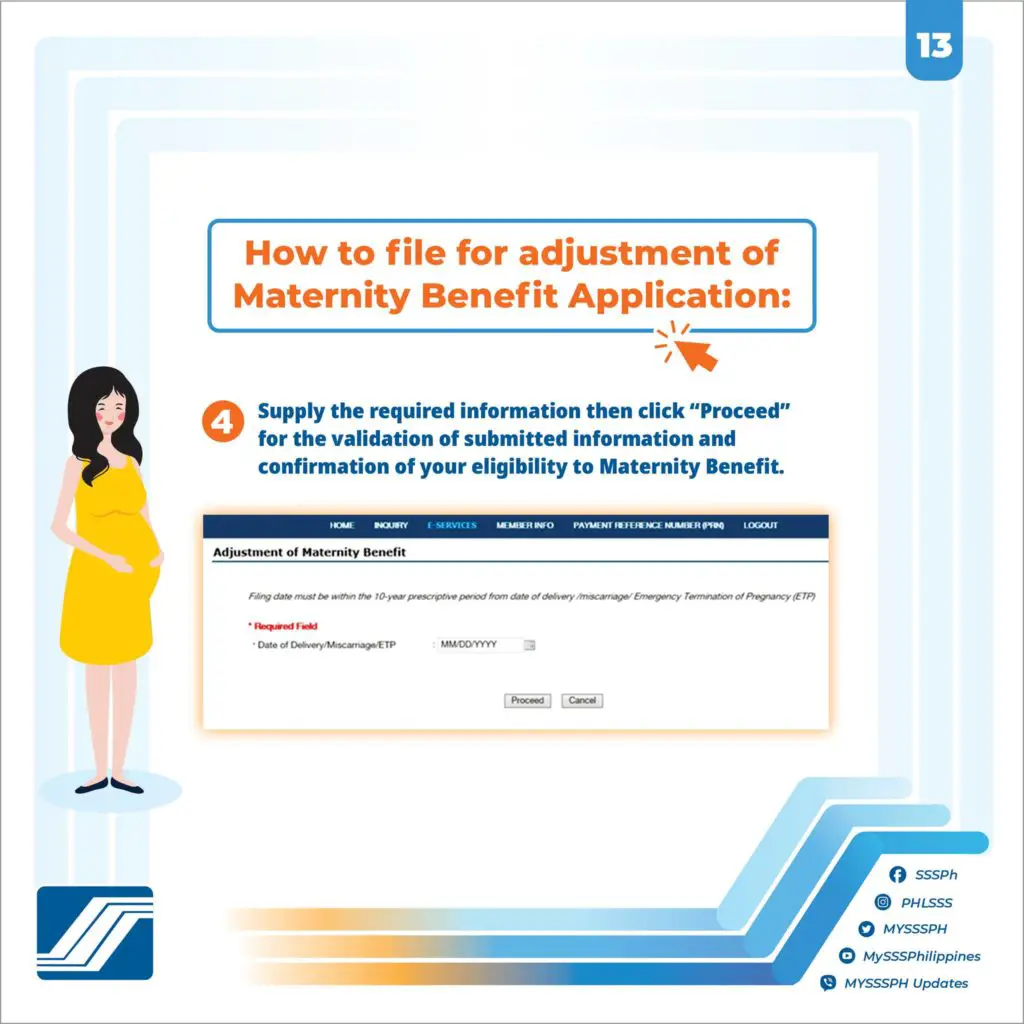

4. Supply the required information then click “Proceed” for the validation of submitted information and confirmation of your eligibility to Maternity Benefit.

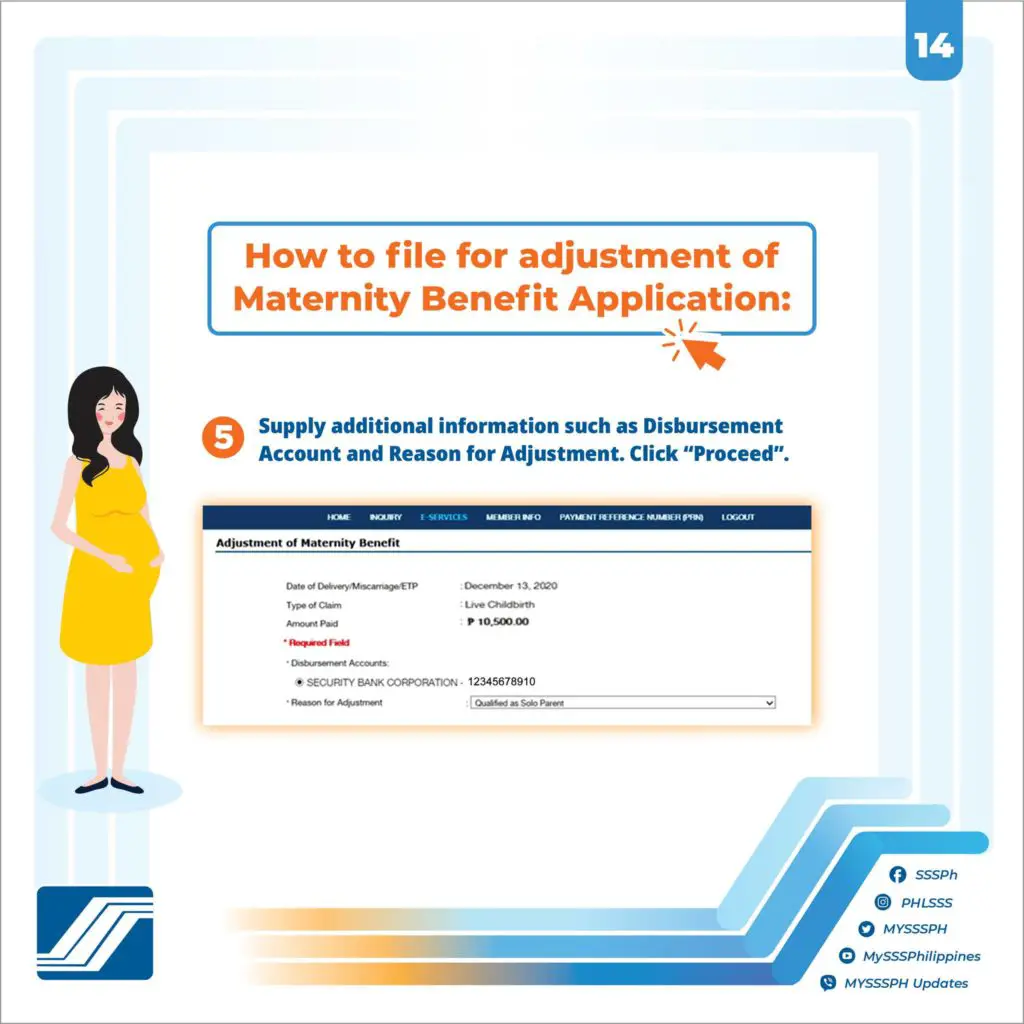

5. Supply additional information such as Disbursement Account and Reason for Adjustment. Click “Proceed”.

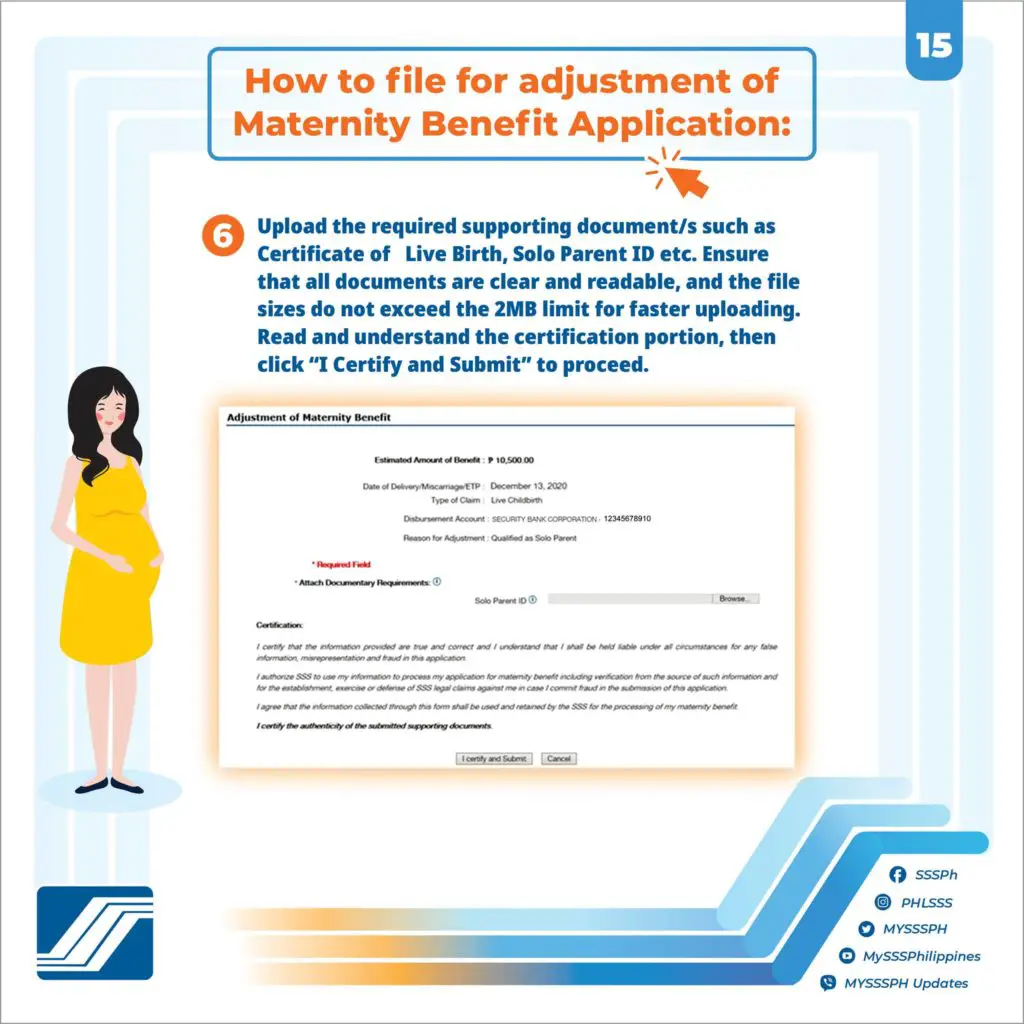

6. Upload the required supporting document/s such as Certificate of Live Birth, Solo Parent ID etc. Ensure that all documents are clear and readable, and the file sizes do not exceed the 2MB limit for faster uploading. Read and understand the certification portion, then click “I Certify and Submit”.

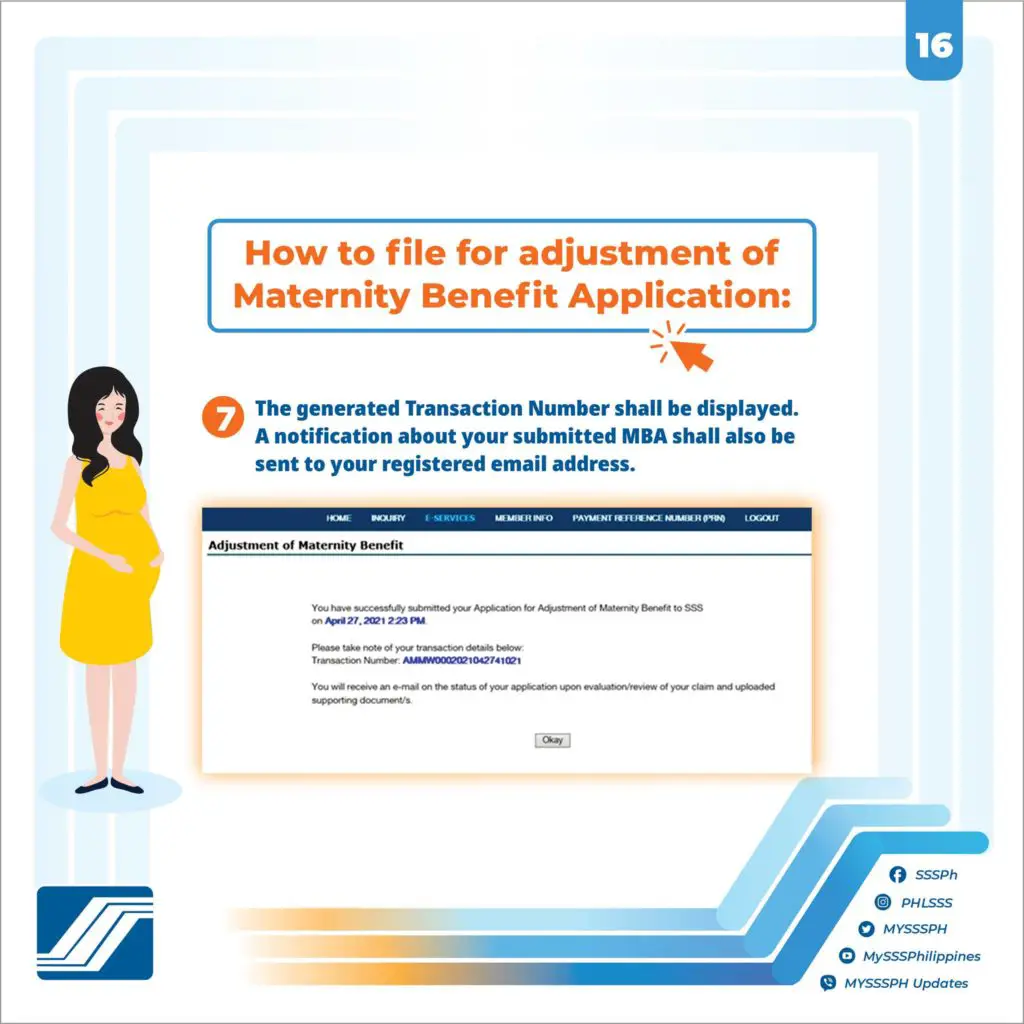

7. The generated Transaction Number shall be displayed about your submitted MBA shall also be sent to your registered email address.

Be the first to comment on "How to File for Adjustment of SSS Maternity Benefit for female Self Employed, Voluntary, OFW, Non Working Spouse and Members Separated from Employers?"