Good news! SSS has now opened the SSS Loan Condonation 2021 which will be a great help for us Filipino in repaying past due loans that we became delinquent due to the past pandemic. Grab your chance since this program is not being offered every regularly, and it will be offered until February 14, 2022 only.

Guidelines for Pandemic Relief and Restructuring Program 5 – Short Term Member Loan Penalty Condonation Program (STMLCP).

I. Coverage of the Program

All member-borrowers with past due short term member loan/s whether or not the original or previously restructure term has already expired. Shor Term Member Loans shall include the following:

- Salary Loan:

- Calamity Loan:

- Salary Loan Early Renewal Program (SLERP);

- Emergency Loan; and

- Restructured Loans under the Loan Restructuring Program (LRP) implemented in 2016 to 2019.

*Past due shall mean that the loan is delinquent for a period of at least six (6) months as of the first day of the condonation period.

II. Availment Period

The availment period for the condonation program is up to May 14, 2022.

III. Terms and Conditions

A. Eligibility

- All member-borrowers with past due loans for at least six (6) months as of the first day of condonation period.

- Member-borrowers who

- Are under sixty-five (65) years old at the end of the installment term (for installment payment),

- Have not been granted any final benefit, i.e. permanent total disability or retirement; and

- Have not been disqualified due to fraud committed against the SSS

- Member-borrowers who will file their final benefits application for permanent total disability or retirement, whose contingency date is on or before the last day of the availment period of the condonation program. Said final benefit claim must be filed within the availment period

- Heirs or beneficiaries of deceased member borrowers who will file the death benefit application, whose contingency date is on or before the last day of the availment period of the condonation program. Said death claim must be filed within the availment period.

B. Loan Amount

The sum amount of all due and demandable arrears composed of outstanding principal and interest of the member-borrower’s past due loan/s shall be consolidated into one Consolidated Loan.

C. Payment Terms

1. One-time Payment

Full payment of the Consolidated Loan within thirty (30) calendar days from receipt of the notice of approval of the Penalty Condonation Application in a single payment transaction. No staggered/partial payments are allowed even if the required payment is completed within the 30-day prescribed period. Member-borrowers who are sixty-five (65) years old or older who will not file their final benefit claim within the availment period may avail of One-Time Payment term only.

2. Installment term

- 50% Downpayment — full payment of 50% of the Consolidated Loan within thirty (30) calendar days from receipt of the notice of approval of the Penalty Condonation Application in a single payment transaction. No staggered/partial payments shall be allowed even if the required payment is completed within the 30- day prescribed period.

- The remaining 50% shall become Restructured Loan 1 (RU) and shall be paid in six (6) equal monthly installments starting from the month following the end of the 30-calendar day period stated in Item 2.a. Late payments shall be subject to imposition of penalty under Item D.2 hereof.

Notes:

- Under installment, the member-borrower must be under 65 years old at the end of the installment term, otherwise, member- borrower shall only qualify under the One-time Payment term.

- Applicants mentioned in Item IV, A.3 and A.4 shall only be allowed to avail of the one-time payment term through deduction from the proceeds of the final benefit claim.

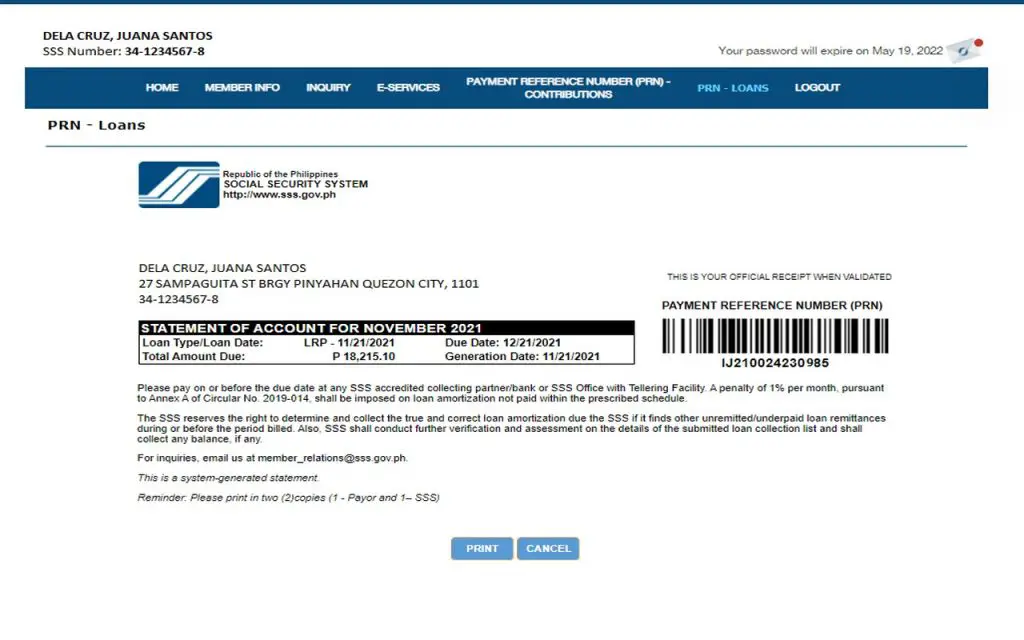

- A Payment Reference Number (PRN) shall be issued with the amount and due date for each required payment.

- “Receipt of notice” shall be deemed the date when the electronic notice was sent to the applicant’s email address.

Step by Step Guide on How to Apply for SSS Loan Penalty Condonation 2021 (STMLPCP/PRRRP5)

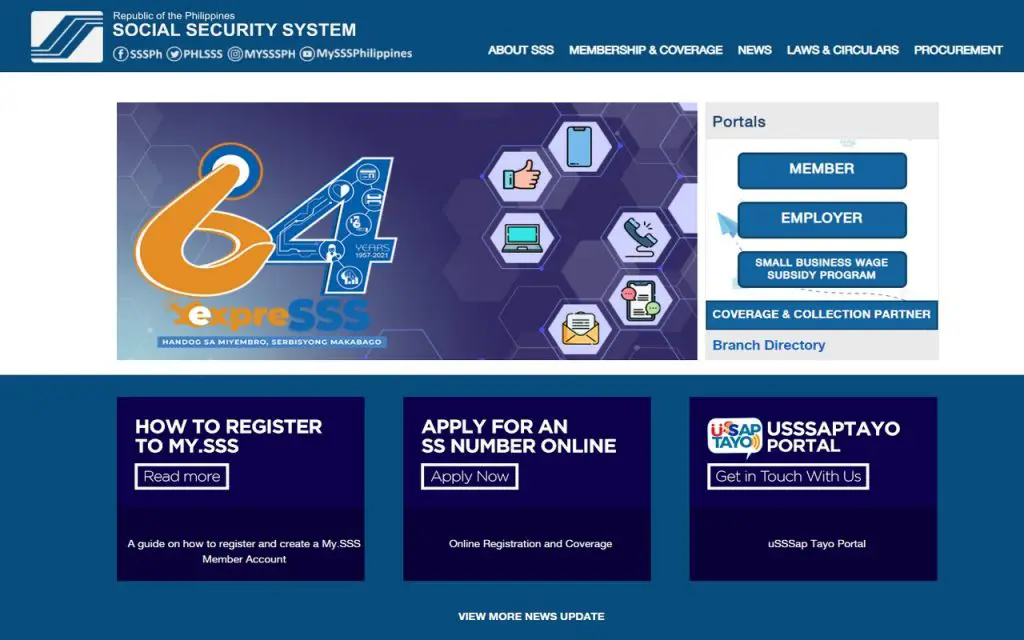

1. Open your browser and type www.sss.gov.ph

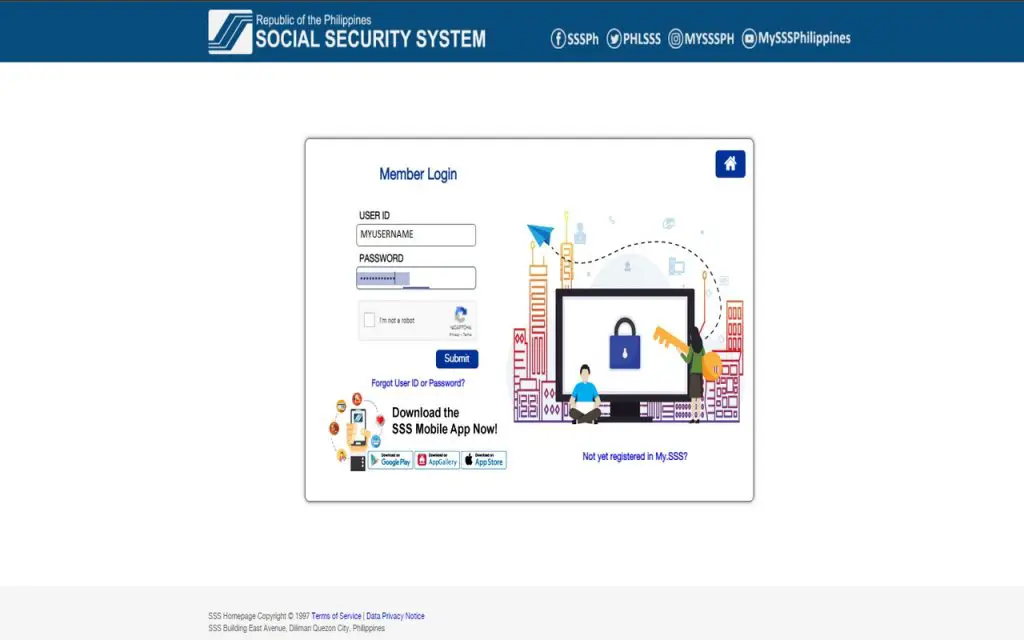

2. Login to your SSS Online Account using your username and password registered in SSS Account.

Related Articles:

- How to Create SSS Online Account?

- How to Reset SSS Online Account?

- What to Do if I forgot my username and password used in SSS Website?

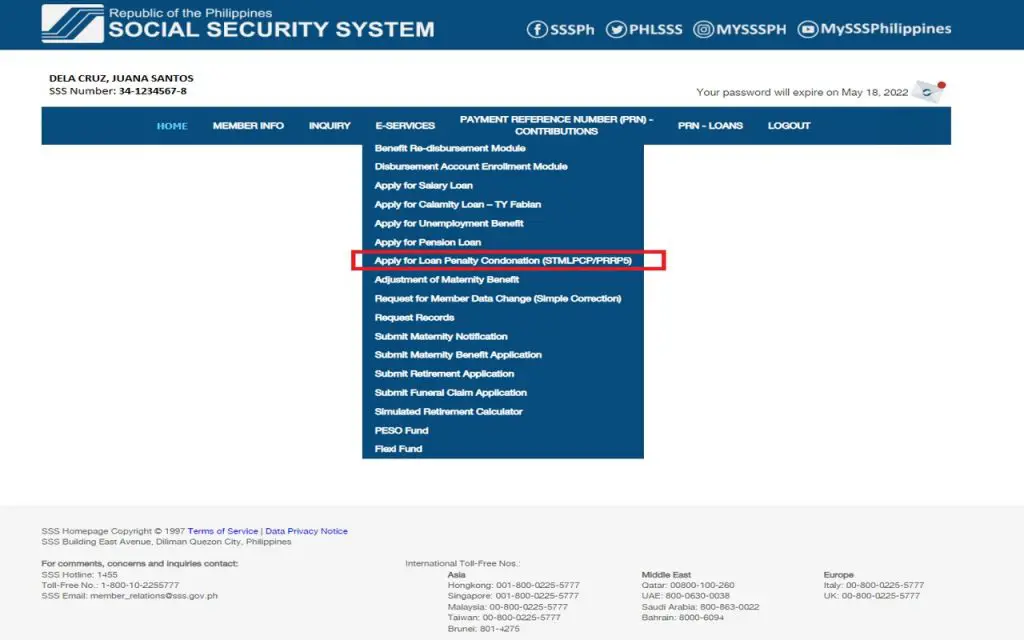

3. After successfully logging in, hover your mouse to E-Services and click Apply for Loan Penalty Condonation (STMLPCP/PRRRP5)

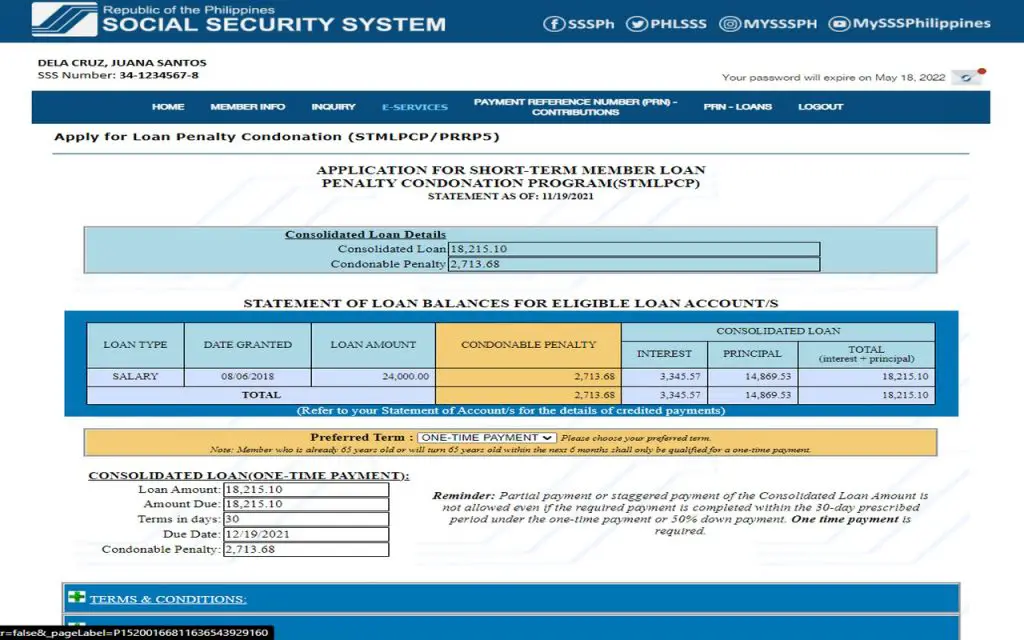

4. You will see in the page, the Statement of Loan Balances for Eligible Loan Accounts

You will see the Total Amount (Loan Amount with accrued interest and penalty), the condonable penalty (in Yellow column), and the Consolidated Loan Amount (Principal + Interest).

You have an option to pay one time or via installment in 6 months (with downpayment).

5. For One Time Payment, click the Preferred Term – ONE TIME.

You will see the Loan Amount, Amount Due, Due Date, and the Condonable Penalty.

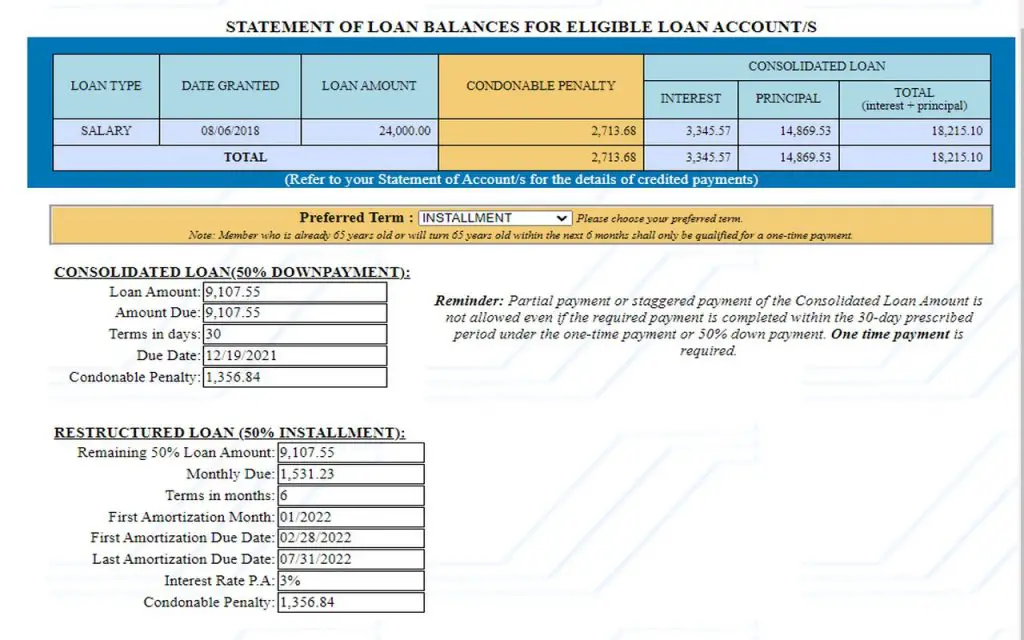

6. For Installment, click the Preferred Term – Installment.

You will see the Loan Amount, Amount Due, Due Date, and the Condonable Penalty.

Downpayment is 50% of the Loan Amount and due date is one month after the loan restructuring application.

The remaining 50% shall be paid in installment and it is divided in 6 months.

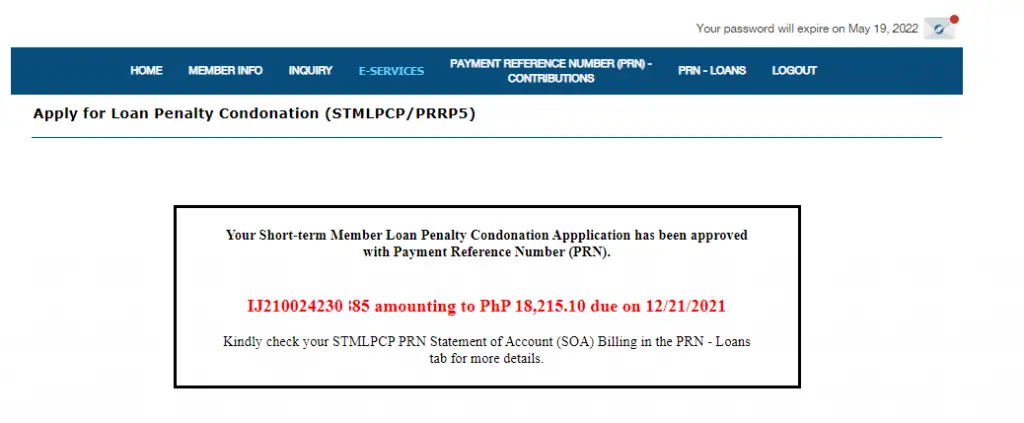

7. Read the Terms and Condition, Promissory Note and Certification. Click the Confirm button to continue. You will see your Loan Condonation Application confirmation with Total Amount and Payment Reference Number.

The Payment Reference Number (PRN) starting with IJ is payable in any SSS Branch with Tellering Facility or any SSS Payment Partner.

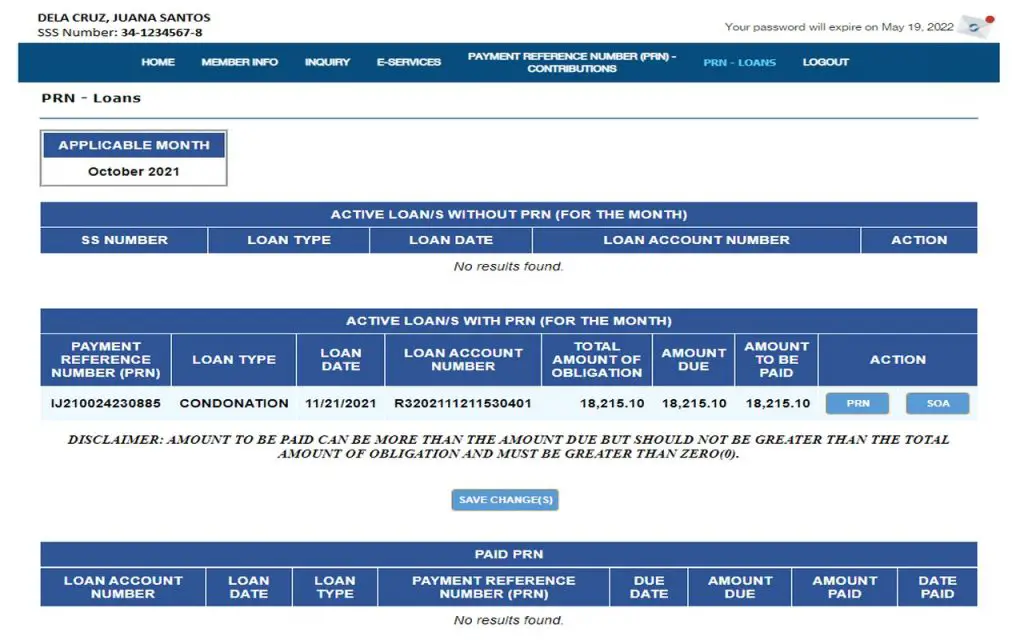

If you forgot to take note of Loan Condonation Payment Refernce Number, click the PRN-Loans menu then you will see the statement accounts of your loan. Refer to the Active Loans with PRN (for the month).

8. Print the Loan Penalty Condonation Statement of Account and present to any SSS Branch with Tellering Facility or any SSS Payment partner to pay.

Make sure to pay the total amount on or before the due date so that your Loan Condonation Application will not be forfeited.

Deadline of SSS Loan Penalty Condonation 2021/ Loan Condonation application is extended until May 14, 2022 only.

E. CONDITIONAL CONDONATION

- Unpaid penalties of the loans shall be condoned as follows:

a. Under One-time Payment Term — 100% of the consolidated penalty shall be condoned upon full payment of the Consolidated Loan within the approved payment period.

b. Under Installment Term — 50% of the consolidated penalty shall be condoned upon payment of the 50% downpayment within the approved payment period. The remaining 50% penalty shall be fully condoned after full payment of the RL1 within the approved terms and conditions.

2. Any partial payment made for the Consolidated Loan under One-time Payment or 50% downpayment shall not entitle the member-borrower to condonation of penalty. The Penalty Condonation Application shall be deemed cancelled, without prejudice to re-submission of the application within the availment period. However, any partial payment made for the cancelled application shall be treated as regular payment and shall be applied to the oldest outstanding short-term member loan in the following order of priority: penalty first, then to interest and last to principal. Any excess after posting of payment shall be applied to the second oldest outstanding short-term member loan and so on.

3. The balance of the RU should be zero at the end of the term. Otherwise, the unpaid principal of RU and the proportionate balance of condonable penalty shall become part of a new principal under Restructured Loan 2 (RL2). The RU shall be closed and RL2 shall be setup

F. INTEREST RATE AND PAYMENT TERM OF RL2

1. RL2 shall be charged with an interest rate of 10% per annum until fully paid.

2. The full amount of RL2 including all accrued interests shall be immediately due and demandable.

G. OTHER CONDITIONS

- Except for the following members with Death, Disability, Retirement (DDR) claims which can only be filed through over-the-counter (OTC) filing, all member-borrowers must apply for the Penalty Condonation Program through the SSS website by accessing his/her My. SSS account.

- Self-Employed (SE);

- With dependents;

- Mine Workers;

- Racehorse Jockeys; and

- Incapacitated retiree subject for representative payee.

Payment Reference Number (PRN) under the Real Time Processing of Loan (RTPL) shall be used for Consolidated or Restructured Loan payments.

- In case the full amount for the One-time Payment term or the 50% downpayment of the Consolidated Loan was not settled within thirty (30) calendar days, a re-submission of the condonation application may be allowed, provided that it is made on or before the last day of the program implementation.

- Amount due under the approved condonation application under the RU or RL2 including all accrued interests and penalties must be fully paid before the member-borrower can avail of other SSS short-term member loan programs.