The SSS Contributions Table 2019 displays the amount of SSS Contributions that the SSS Members will pay if voluntary, or the distribution of SSS Contribution shared both by the SSS Employer and Employee.

The monthly contributions are based on the compensation of members. The current SSS contribution rate is 11% of the monthly salary credit (as of January 2019) not exceeding P16,000 and this is being shared by the employer (7.37%) and the employee (3.63%).

Self-employed and voluntary members pay the 11% of the monthly salary credit (MSC) based on the monthly earnings declared at the time of registration.

For OFWs, the minimum monthly salary credit is pegged at P5,000.

For the non-working spouse, the contribution will be based on 50% of the working spouse’s last posted monthly salary credit but in no case shall it be lower than P1,000.

SSS Contributions Table for Voluntary Members (Self Employed, Voluntary, OFW and Non Working Spouse)

| Range of Compensation | Monthly Salary Credit | Contribution |

|---|---|---|

| 1,000-1,249.99 | 1,000 | 110.00 |

| 1,250-1,749.99 | 1,500 | 165.00 |

| 1,750-2,249.99 | 2,000 | 220.00 |

| 2,250-2,749.99 | 2,500 | 275.00 |

| 2,750-3,249.99 | 3,000 | 330.00 |

| 3,250-3,749.99 | 3,500 | 385.00 |

| 3,750-4,249.99 | 4,000 | 440.00 |

| 4,250-4,749.99 | 4,500 | 495.00 |

| 4,750-5,249.99 | 5,000 | 550.00 |

| 5,250-5,749.99 | 5,500 | 605.00 |

| 5,750-6,249.99 | 6,000 | 660.00 |

| 6,250-6,749.99 | 6,500 | 715.00 |

| 6,750-7,249.99 | 7,000 | 770.00 |

| 7,250-7,749.99 | 7,500 | 825.00 |

| 7,750-8,249.99 | 8,000 | 880.00 |

| 8,250-9,749.99 | 8,500 | 935.00 |

| 8,750-9,249.99 | 9,000 | 990.00 |

| 9,250-9,749.99 | 9,500 | 1,045.00 |

| 9,750-10,249.99 | 10,000 | 1,100.00 |

| 10,250-10,749.99 | 10,500 | 1,155.00 |

| 10,750-11,249.99 | 11,000 | 1,210.00 |

| 11,250-11,749.99 | 11,500 | 1,265.00 |

| 11,750-12,249.99 | 12,000 | 1,320.00 |

| 12,250-12,749.99 | 12,500 | 1,375.00 |

| 12,750-13,249.99 | 13,000 | 1,430.00 |

| 13,250-13,749.99 | 13,500 | 1,485.00 |

| 13,750-14,249.99 | 14,000 | 1,540.00 |

| 14,250-14,749.99 | 14,500 | 1,595.00 |

| 14,750-15,249.99 | 15,000 | 1,6500.00 |

| 15,250-15,749.99 | 15,500 | 1,705.00 |

| 15,750-over | 16,000 | 1,760.00 |

SSS Contributions Table for Employers/Employed Members

| Range of Compensation | Monthly Salary Credit | Employer Share | Employee Share | SS Contribution | EC Contribution |

|---|---|---|---|---|---|

| 1000 – 1249.99 | 1000 | 73.7 | 36.3 | 110 | 10 |

| 1250 – 1749.99 | 1250 | 110.5 | 54.5 | 165 | 10 |

| 1750 – 2249.99 | 1750 | 147.3 | 72.7 | 220 | 10 |

| 2250 – 2749.99 | 2250 | 184.2 | 90.8 | 275 | 10 |

| 2750 – 3249.99 | 2750 | 221 | 109 | 330 | 10 |

| 3250 – 3749.99 | 3250 | 257.8 | 127.2 | 385 | 10 |

| 3750 – 4249.99 | 3750 | 294.7 | 145.3 | 440 | 10 |

| 4250 – 4749.99 | 4250 | 331.5 | 163.5 | 495 | 10 |

| 4750 – 5249.99 | 4750 | 368.3 | 181.7 | 550 | 10 |

| 5250 – 5749.99 | 5250 | 405.2 | 199.8 | 605 | 10 |

| 5750 – 6249.99 | 5750 | 442 | 218 | 660 | 10 |

| 6250 – 6749.99 | 6250 | 478.8 | 236.2 | 715 | 10 |

| 6750 – 7249.99 | 6750 | 515.7 | 254.3 | 770 | 10 |

| 7250 – 7749.99 | 7250 | 552.5 | 272.5 | 825 | 10 |

| 7750 – 8249.99 | 7750 | 589.3 | 290.7 | 880 | 10 |

| 8250 – 8749.99 | 8250 | 626.2 | 308.8 | 935 | 10 |

| 8750 – 9249.99 | 8750 | 663 | 327 | 990 | 10 |

| 9250 – 9749.99 | 9250 | 699.8 | 345.2 | 1045 | 10 |

| 9750 – 10249.99 | 9750 | 736.7 | 363.3 | 1100 | 10 |

| 10250 – 10749.99 | 10250 | 773.5 | 381.5 | 1155 | 10 |

| 10750 – 11249.99 | 10750 | 810.3 | 399.7 | 1210 | 10 |

| 11250 – 11749.99 | 11250 | 847.2 | 417.8 | 1265 | 10 |

| 11750 – 12249.99 | 11750 | 884 | 436 | 1320 | 10 |

| 12250 – 12749.99 | 12250 | 920.8 | 454.2 | 1375 | 10 |

| 12750 – 13249.99 | 12750 | 957.7 | 472.3 | 1430 | 10 |

| 13250 – 13749.99 | 13250 | 994.5 | 490.5 | 1485 | 10 |

| 13750 – 14249.99 | 13750 | 1031.3 | 508.7 | 1540 | 10 |

| 14250 – 14749.99 | 14250 | 1068.2 | 526.8 | 1595 | 10 |

| 14750 – 15249.99 | 14750 | 1105 | 545 | 1650 | 30 |

| 15250 – 15749.99 | 15250 | 1141.8 | 563.2 | 1705 | 30 |

| 15750 – over | 15750 | 1178.7 | 581.3 | 1760 | 30 |

Due Dates of Contributions for SSS Regular and Household Employer

| 10th digit of 13 Digit SSS employer number | Payment Deadline (following the applicable month) |

|---|---|

| 1 or 2 | 10th of the month |

| 3 or 4 | 15th of the month |

| 4 or 6 | 20th of the month |

| 7 or 8 | 25th of the month |

| 9 or 0 | of the month |

Due Dates of Contributions for SSS Voluntary, Self Employed Members (Except OFW)

| 10th digit of 13 Digit SSS employer number | Payment Deadline (following the applicable month/quarter) |

|---|---|

| 1 or 2 | 10th of the month |

| 3 or 4 | 15th of the month |

| 4 or 6 | 20th of the month |

| 7 or 8 | 25th of the month |

| 9 or 0 | last day of the month |

Applicable Month/Quarter means the month or the quarter that you will be paying for. For example, if you will be paying as a Voluntary member for the month of April 2019, and your SS Number end digit is zero, your Oayment deadline for your contribution for April 2019 will be on May 31, 2018.

If you will be paying for the second quarter of 2018 (April-June), then your payment deadline is on July 2019.

For OFWs

Payment of contributions for the months of January to December of a given year may be paid within the same year; contributions for the months of October to December of a given year may also be paid on or before the 31st of January of the succeeding year.

For Employed members

It is important that you are aware of the payment deadlines for contributions and member loans in order to avoid incurring penalties. If you are an employee-member, your employer must pay your contributions and member loans monthly in accordance with the prescribed schedule of payment which is according to the 10th digit of the Employer’s ID Number. Late payments will result to penalties and delays in the processing of your benefits and loans.

The frequency of payment is on a monthly basis for business and household employers.

For Self-employed and Voluntary members

If you are a self-employed or a voluntary member, the prescribed schedule of payment is also being followed, (depending on the 10th (last digit) of the SE/VM SS number). However, the frequency of contribution payments for self-employed or a voluntary member can be on a monthly or quarterly basis. A quarter covers three (3) consecutive calendar months ending on the last day of March, June, September and December. Any payment for one, two or all months for a calendar quarter may be made

Due Dates of Loan Payments

For member loans, payment should be made monthly in accordance with the prescribed schedule of payment which is according to the 10th digit of the SS ID/Number.

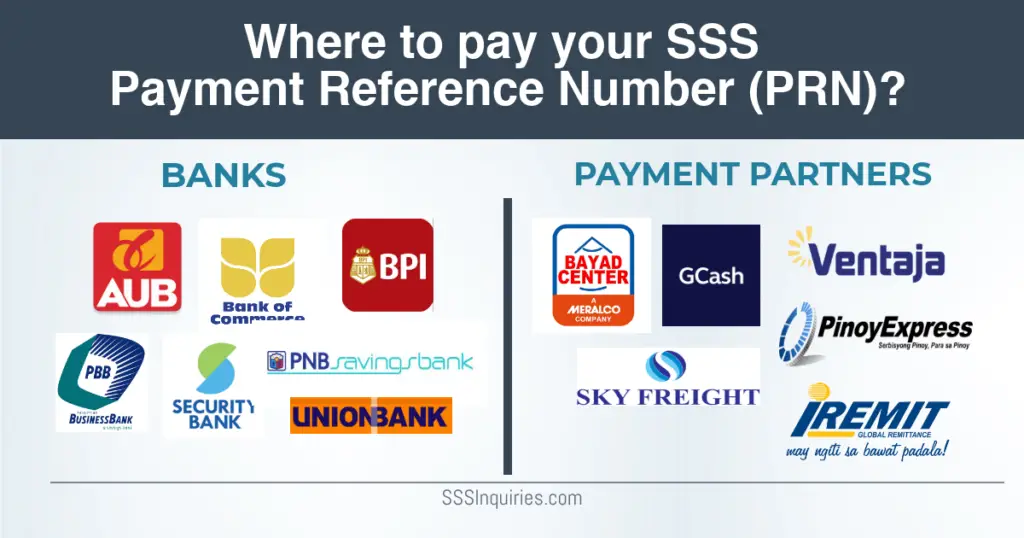

List of Accredited Banks and Collecting Agents that accept SSS Payment Reference Number

| BANKS | NON-BANKS |

| 1. Asia United Bank | 1. CIS Bayad Center, Inc. |

| 2. Bank of Commerce | 2. G-Xchange, Inc. |

| 3. Bank of the Philippine Islands | 3. I-Remit, Inc. |

| 4. Philippine Business Bank | 4. Pinoy Express Hatid Padala Services, Inc. |

| 5. PNB Savings Bank | 5. Sky Freight Forwarders, Inc |

| 6. Security Bank Corp. | 6. Ventaja International, Inc. |

| 7. Union Bank of the Philippines | |

| 8. Wealth Development Bank, Inc. |

Pede po bang ipabago yung unang registered ko sa mysss online?nkalimutan ko na po kc ang username at password ko.nagbago din po ako ng email address dhil na hack yung account ko.nais ko po sana magpa registered ng bgo sa my sss online.sna po ay matulungan nyo ako.eto na po ang bago kong email.

buntis poh aq at s july 13 poh duedate q..6mis lng poh nhulog q s sss..abot p poh b aq qng mag’aaply aq ng maternity?.

Nais ko po malaman ang status ng sss ko at kung magkano ang monthly po ang contributions ko dito po aku sa saudi arabia.

Ano podpt gwin kng nahinto q ang king paghuhulog s sss q?

Marites C Malanum Edi ituloy mo ang hulog, nahinto eh.

Good day! Ask ko lang po kung pede ko pa po kaya isettle yong mga previous months ko na hindi ko nabayaran like ung first quarter of 2018? nakaligtaan ko po kasi ang duedate lumagpas na then yong mga di ko pa po na settle last year?

yung pension nang mama ko na stop in this year janaury 2018 hanggat ngayon wala paren,Then naka fill up siya noong last year..

how many days na babalik yun?

Maam pwede ba malaman monthly contri. Ko

Ask ko lng f my need p vah requirement sa pagkuha ng umid id,nakapghulog aq dati p nastop lng,lapa aq id.

Pwede po bang magvoluntary contribution or magbayad ng lang sa bank kahit hindi nako makipag negotiate sa sss office may sss number naman po ako gusto ko lang ituloy ang paghuhulog ko thru voluntary contribution.