How to qualify, apply and compute for the SSS Maternity Benefit is the number one commonly question being asked in the SSS Inquiries. We have previously created a guide on how to apply for SSS Maternity Benefit, but we realized that our guide did not cover most of the common question of all our SSS Inquiries readers especially those that are voluntary members. So here, we are creating an Ultimate Guide How to Qualify, Apply and Compute for SSS Maternity Benefit! The Guide will also answer how to know your Semester of Contingency, the process, and requirements for application and how to compute how much you will receive.

Related Articles:

- How to Apply and Qualify for SSS Maternity Benefit

- Frequently Asked Question about SSS Maternity Benefit

- How to Know How Much is your SSS Maternity Benefit

- Common reasons why your SSS Maternity Benefit is denied

- Affidavit of Undertaking Template

- How to Comply with Disbursement Account Enrollment Module?

- How to Submit SSS Maternity Application (MAT2) in SSS Website for Self Employed, Voluntary, OFW, Non Working Spouse and Separated from Employers?

- How to File for SSS Maternity Reimbursement for Regular and Household Employer?

What is SSS Maternity Benefit?

The SSS Maternity Benefit is a daily cash allowance granted by the SSS to a female SSS member who is unable to work due to childbirth or miscarriage. The SSS female member can avail of the SSS maternity benefit for her first four (4) delivery or miscarriage.

Question: My husband is paying as an SSS Member. Me (a housewife) is not an SSS member. Can my husband apply for an SSS Maternity Benefit for me?

Answer: No. You should be an SSS Member and should have the required contribution to qualify for the SSS Maternity Benefit. You may register as a Non Working Housewife, or as Self Employed and pay regularly for your SSS Contribution for you to qualify for SSS Maternity Benefit when you get pregnant.

Question 2: I wasnt’t able to apply for SSS Maternity Benefit when I gave to birth to my child. Now he is 7 years old, can I still apply?

Answer: Yes. Application for the SSS Maternity Benefit can still be done until the child is 10 years old. Go immediately to SSS Branch near you to ask and submit your requirements.

Question 3: I am bearing my fifth child, but I haven’t claimed yet an SSS Maternity Benefit in my first four children. Can I still apply for an SSS Benefit?

Answer: No. Only the first four pregnancy can be applied to claim for the SSS Maternity Benefit even if you haven’t claimed for SSS Maternity Benefit on your previous pregnancy.

Question 4: I am already pregnant. Can I pay for my SSS to qualify a maternity benefit?

Answer: It depends on your Contribution. Some may qualify if they can still pay previous quarter immediately after they knew they are pregnant. Read carefully on How to know if I am Eligible for SSS Maternity Benefit.

How to Know if I am Eligible for SSS Maternity Benefit?

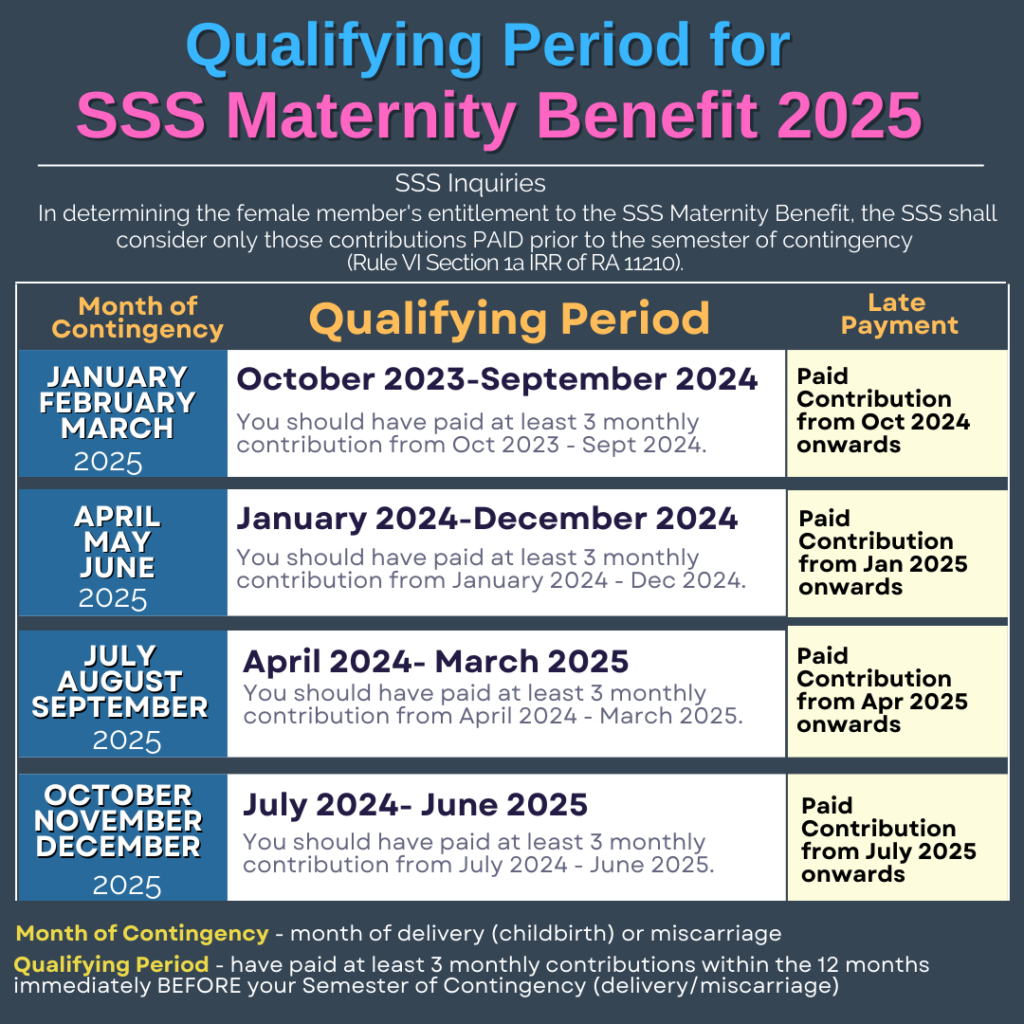

You are Eligible for the SSS Maternity Benefit if you have paid at least 3 monthly contributions within the 12 months immediately BEFORE your Semester of Delivery/Contingency (childbirth or miscarriage).

Common Misconceptions on the Eligibility on SSS Maternity Benefit

- Many were confused that they only need to have atleast 3 months of contribution before they give birth to qualify for the SSS Benefit, but that is wrong.

- Having an SSS Contribution from prior years does not guarantee you that you will be entitled to an SSS Maternity Benefit

The qualification on the paid SSS monthly contribution is tricky, especially for those that are paying voluntarily. So allow us to explain how to be qualified for an SSS Maternity benefit.

To know if you are qualified:

- Identify your Delivery Month. Consult your doctor to know your expected delivery month. Or you may estimate by adding 9 months from the date of your conception. Let us assume that your Expected Delivery Month is December 2018, we will use this on our example.

- Identify the Quarter of your Delivery Month. Then based on your expected delivery month, identify the quarter where it will fall. If you are still confused on how to identify which quarter your month of delivery falls, here is a table of Quartering being observed by the SSS.

Quarter Months Covered Quarter 1 January – March Quarter 2 April – June Quarter 3 July – September Quarter 4 October – December On our example, if your expected month of delivery is December 2018, then it falls on the 4th quarter of the year. - Identify the Semester of Contigency. After knowing the Quarter of your Delivery month, now let us identify the Semester where your delivery month falls. A semester refers to a two consecutive Quarters. To identify the semester of your Delivery Month, add one quarter prior to the quarter of your delivery month.

Semester Quarters Covered Semester A Quarter 1 and 2 Semester B Quarter 2 and 3 Semester C Quarter 3 and 4 Semester D Quarter 4 and 1 So in our example, December 2018 falls on the 4th quarter of the year. The Quarter before that is the third Quarter (July 2018). The 3rd and 4th quarter or the July-December 2018 is your Semester of Contingency. Let’s take another example. Your Expected Delivery Month is July 2018 and it falls under the third quarter (July-September) of the year. The quarter before that is the second quarter (April-June). The second and third quarter of 2018 or the April – September is your Semester of Contingency. - Check your Contributions posted if you have at least 3 months within 12 months prior to your Semester of Contigency. Now that you know your Semester of Contingency, you should have at least 3 months contribution within the 12 month period BEFORE your Semester of Contingency.

For our Example No 1.

Expected Month of Delivery is December 2018.

Semester of Contingency is July-December 2018.

12 Month Period prior to Semester of Contingency: July 2017-June 2018.

From July 2017-June 2018, the SSS member should have at least 3 months contribution posted to qualify for the SSS Maternity Benefit.

For our Example No 2.

Expected Month of Delivery is July 2018.

Semester of Contingency is April-September 2018.

12 Month Period prior to Semester of Contingency: April 2017 – March 2018.

From April 2017 – March 2018, the SSS Member should have at least 3 months contribution to qualify for the SSS Maternity Benefit.

Now that you already know the contribution eligibility to be qualified for the SSS Maternity Benefit, you may check your posted contributions online. If can still cope up for your Contributions by paying quarterly payment (as a Voluntary Member) or paying for the whole year contribution (if you are an OFW member), then do so. You may check the SSS Contributions Schedule and Deadline of payment thru this link. If you are Employed and you found out that your Contributions are not completely posted, go directly to the Payroll officer of your company to know the status of your contribution remittance.

Now that you know if you are qualified or not, now, let us proceed on how to Apply for SSS Maternity Benefit.

How to Apply for SSS Maternity Benefit?

Step 1: Notify SSS of your Pregnancy

tep 1 should be done within 60 days after you confirmed your pregnancy. Make sure to keep your SSS-approved/acknowledged Maternity Notification document as this will be one of the documents you will present when filing your SSS Maternity Reimbursement in Step 2.

Here are three ways on how to Notify SSS About your Pregnancy:

A. Thru your Employer (if Employed) or thru SSS Branch (if Voluntary Member)

As soon as you have confirmed that you are pregnant (either thru your Pregnancy test kit or ultrasound), you must immediately notify your employer if you’re employed, or notify SSS directly if you are an SSS Voluntary member.

To notify of your Pregnancy, you must submit of the following documents with your estimated date of delivery:

- SSS Maternity Notification Form (click here to download the form)

- Proof of Pregnancy (Ultrasound Result)

- UMID or any two valid IDs, both with signature and at least 1 with photo and date of birth

You must submit these documents to your Employer or SSS at least 60 days from the date of conception.

For employed members, once you submitted these documents to your employer (or through your HR officer), your employer will then immediately notify SSS about your pregnancy.

B. Thru SSS Website

If you are registered to My.SSS online, you can file or submit the SSS Maternity Notification at the SSS website. You don’t need to submit any other documents.

C. Thru Text Notification

You can notify your SSS Maternity thru Text Message following this format.

SSS REG <SS NUMBER> <DATE OF BIRTH> then send to 2600.

Example: SSS REG 031234567 01/01/80

SSS MATERNITYNOTIF at isend sa 2600.

Each text costs P2.50 for Globe/Touch Mobile and Smart Subscribers and P2.00 for Sun Cellulars. You will receive a Text confirmation after the SSS received your text notification. Make sure to keep your PIN for your next SSS Text Service Transaction.

Here is the list of SSS Transactions that you can do in SSS Text Services

D. Thru SSS Self Service Information Terminals you can find in SSS Branch and some Malls.

No documentation needed for Maternity Notification filed thru SSS website, text or SSIT.

Step 2: Application for Maternity Benefit Reimbursement

Step 2 should be done before you take a maternity leave if you are employed or after you have delivered if you are a Self Employed, Voluntary member. For Self Employed, Voluntary Members, the Maternity Benefit Reimbursement can be filed at any SSS Branch convenient to the member. After giving birth, you have 10 years to file your MAT2, but of course, you file your claim as soon as you have completed your documents.

A. For employed members

The benefit is advanced in full by the Employer to the qualified female employee within 30 days from the date of filing of the maternity leave application. The SSS, in turn, shall immediately reimburse the Employer 100% of the amount of maternity benefit advanced to the female employee upon receipt of satisfactory proof of such payment.

Requirements:

- Maternity Notification Form duly stamped and received by SSS

- Maternity Reimbursement Form

- SSS UMID or or any two (2) valid IDs, both with signature and at least one (1) with photo and date of birth

B. For Self-Employed/Voluntary Members

The maternity benefit is paid directly to them by the SSS thru their single savings/current/cash card/prepaid account in an SSS-accredited bank under the Sickness Maternity Benefit-Payment Thru the Bank. If the member does not have an existing bank account, the SSS shall issue a Letter of Introduction (LOI) form that must be presented to the SSS-accredited bank chosen by the member for the purposes of opening a single savings account or cash card account.

Requirements:

- Maternity Notification Form duly stamped and received by SSS

- Maternity Reimbursement Form

- SSS UMID or or any two (2) valid IDs, both with signature and at least one (1) with photo and date of birth

C. For Separated Members

Requirements:

Requirements:

- Maternity Notification Form duly stamped and received by SSS

- Maternity Reimbursement Form

- SSS UMID or or any two (2) valid IDs, both with signature and at least one (1) with photo and date of birth

- Certification from last employer showing the effective date of separation from employment or notice of company’s closure/strike or certification from the Department of Labor and Employment that the employee or employer has a pending labor case.

- Certification that no advance payment was granted (if confinement days applied for are within or prior to separation).

Additional Requirements depending on the case of Maternity:

Normal delivery

- Submit the certified true or authenticated copy of duly registered birth certificate with the Local Civil Registry. In case the child dies or is a stillborn, duly registered death or fetal death certificate.

certified true or authenticated copy of

Cesarean delivery

- Submit the certified or authenticated copy of duly registered with the Local Civil Registry

- Submit the certified true copy of operating room record/surgical memorandum.

- Discharge Summary Report

- Medical/Clinical Abstract

- Delivery Report

- Detailed Invoice showing cesarean delivery charges, for deliveries abroad only

For Complete Miscarriage

- Obstetrical History indicating the number of pregnancy/ies, duly certified by attending physician with his/her Professional Medical License number with printed name and signature; and

- Any of the following:

- Ultrasound report indicating proof of pregnancy

- Medical Certificate issued by attending physician on the circumstances of pregnancy

For Incomplete Miscarriage

- Obstetrical History indicating the number of pregnancy/ies duly certified by attending

physician with his/her Professional Medical License number with printed name and signature; and - Any of the following:

- Certified true copy of hospital/medical record/s

- Dilation & Curettage (D & C) report

- Histopathological report

- Pregnancy test before and after miscarriage

- Ultrasound report indicating proof of pregnancy

For Ectopic Pregnancy

- Obstetrical History indicating the number of pregnancy/ies duly certified by attending physician with his/her Professional Medical License number with printed name and signature; and

- Any of the following:

- Certified true copy of hospital/medical record/s

- Certified true copy of ORR

- Histopathological report

- Pregnancy test before and after the miscarriage

When will I receive my SSS Maternity Benefit?

If you are employed, your SSS Maternity Benefit is advanced in full by the Employer to the qualified female employee within 30 days from the date of filing of the maternity leave application. The SSS, in turn, shall immediately reimburse the Employer 100% of the amount of maternity benefit advanced to the female employee upon receipt of satisfactory proof of such payment.

For this purpose, all Employers are required to enroll in the “Sickness and Maternity Benefits Payment thru-the-Bank Program” (SMB-PTB), wherein SSS reimbursements will be deposited directly to the existing savings/current account of the Employer in an SSS-accredited bank. The Payment Advice containing the payment details of the Sickness-Maternity reimbursement will be sent to the ER thru his/her My.SSS account in the SSS website

If you are a Self-Employed/Voluntary Member, the maternity benefit is paid directly to you by the SSS thru their single savings/current/cash card/prepaid account in an SSS-accredited bank under the SMB-PTB.

If you does not have an existing bank account, the SSS shall issue a Letter of Introduction (LOI) form that must be presented to the SSS-accredited bank chosen by the member for the purposes of opening a single savings account or cash card account.

How much will be my SSS Maternity Benefit Amount?

The computation and the amount of your SSS Maternity benefit are based on your Monthly Salaey Credit of your SSS contribution. The Monthly salary credit (MSC) means the compensation base for contributions and benefits related to the total earnings for the month. The maximum compensation is P16,000, effective January 1, 2014. The higher your MSC are, the higher the amount you’ll get from SSS.

Before we jump in to the computation of your would be SSS benefit, let us first dig in to what MSC is.

For example, if your monthly salary is P20,000 and you pay P1,760 per month for your SSS contribution, your monthly salary credit or MSC is P16,000.

As of August 2018 (time of writing of this post), P16,000 is the maximum MSC based on the Table of Contribution. It means that even if you receive a monthly income of P30,000 or P100,000 or any amount greater than P15,750, your MSC still remains at P16,000.

On the other hand, the minimum salary credit is P1,000 for members with a declared monthly income of P1,000 to P1,249.99 who pay the minimum SSS contribution of P110 per month.

Youtube Video on How to Know How much will be your SSS Maternity Benefit thru the SSS Website

So, how do you compute the SSS Maternity Benefit?

Generally, these are the steps when computing for the SSS Maternity Benefit:

- Identify your Semester of Contingency. Remember the Semester of Contigency we mentioned in the early part of the article?

Exclude the semester of contingency (delivery or miscarriage) by counting 12 months backwards starting from the month prior to your semester of contingency. - Identify the six highest monthly salary credits within the 12-month period.

Add the 6 highest monthly salary credits to get the total monthly salary credit. If you have only 3 or 4 or 5 contributions within those 12 months prior to your semester of contingency then only add the monthly salary credit within those months available. - Divide the total monthly salary credit by 180 days to get the average daily salary credit.

- Multiply the daily maternity allowance by the number of days based on Condition (see below) to get the total amount of maternity benefit.

- For Normal Deliver – 105 days

- For Ceasarean Delivery – 105 days

- Abortion, Miscarriage – 60 days

- Solo Parent (either Normal or Ceasarean) – 120 days

The lowest Maternity Benefit amount is P1,000 for Normal Delivery and P1,300 for Ceasarean Delivery, if a member’s Monthly Salary Credit was only P1,000 and has only three monthly contribution within the twelve month period prior to the semester of delivery.

The maximum Maternity Benefit possible is P32,000 pesos for Normal Delivery and 41,600 for Ceasarean Delivery provided that the member has at least six monthly contribution of Monthly Salary Credit P16,000.

We will continually update this article, if a new procedure or computation will be adopted by SSS.

Kindly like and share with your relative and friends who may benefit from this article. Because sharing, is caring!

Related Articles

- Ultimate Guide: How to Qualify, Apply for SSS Maternity Benefit for Voluntary Members

- Possible Reasons why SSS Maternity Benefit is denied

- SSS Maternity benefit ups to Php70,000

- How to Compute for SSS Maternity Benefit under the Expanded Maternity Law

- How to Notify SSS Maternity Notification thru Text

- How to check my SSS Contributions Online