For SSS members who are filing for a SSS Loan or SSS Benefit, it is now a requirement that each to have a disbursement account or bank account that is named after them. Member has to enroll their Disbursement Account in their SSS Online Account, and wait for SSS approval. Remittance of SSS Loan/Benefits of the member will be on his/her enrolled disbursement account.

If you do not have a bank account yet, you can open a Bank account for free online thru the UnionBank App. Open a bank account thru the UnionBank Mobile app without going to the bank.

Related Article:

- How to Enroll your Disbursement Account on My.SSS for your Benefits Loan Proceeds?

- How to Apply for SSS Salary Loan Online?

- How to Check your SSS Loanable Amount Online?

- List of SSS Branches Where You Can Avail of Free Unionbank Quick Card for SSS Loan?

- How to correct or replace Disbursement Account in My.SSS and request for re-disbursement of Loan or Benefits?

Benefits of Opening your Bank Account in UnionBank

- Open an Account through the app within minutes. Upload an ID, take a selfie, and get a UnionBank account instantly

- Choose from a variety of savings account that suits your lifestyle with no maintaining balance required

- Request for a Card and have it delivered right at your doorstep

- Activate your card instantly through the app

Step by Step Guide on How to Open a UnionBank Bank Account Online

1. Download the app.

Download links here:

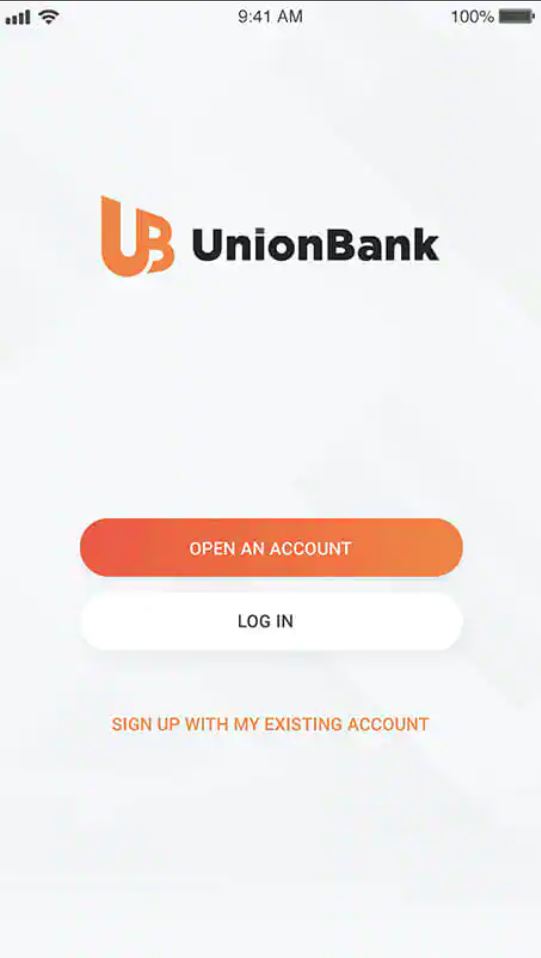

2. Open the App and tap OPEN AN ACCCOUNT.

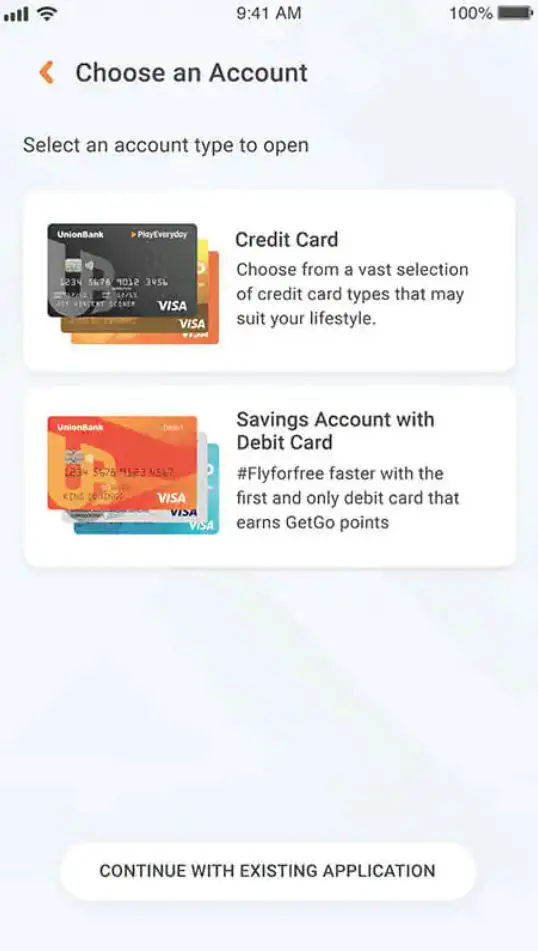

3. Choose Savings Account with Debit Card.

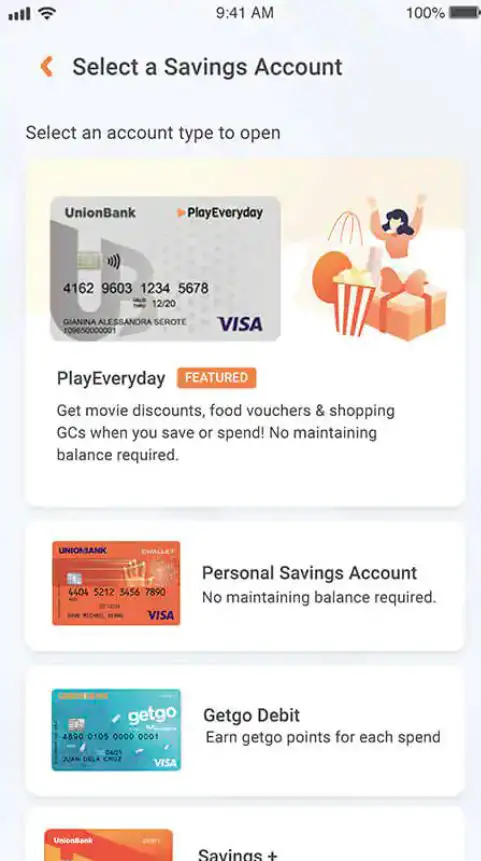

4. Select your preferred Savings Account and view product details.

If you do not know what to choose from the list, you may choose Personal Savings Account. No maintaining balance required.

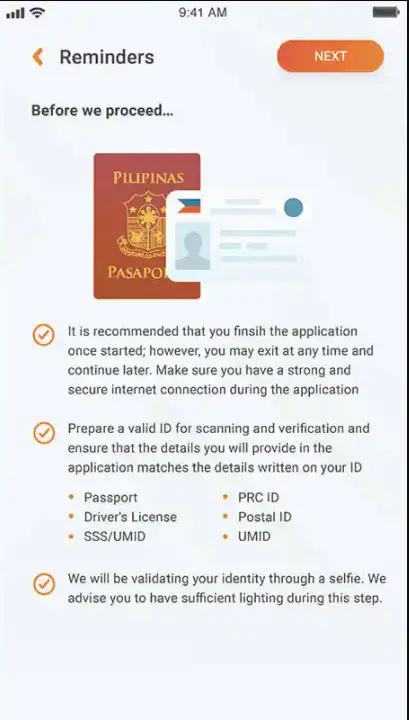

5. Read the Reminders before proceeding.

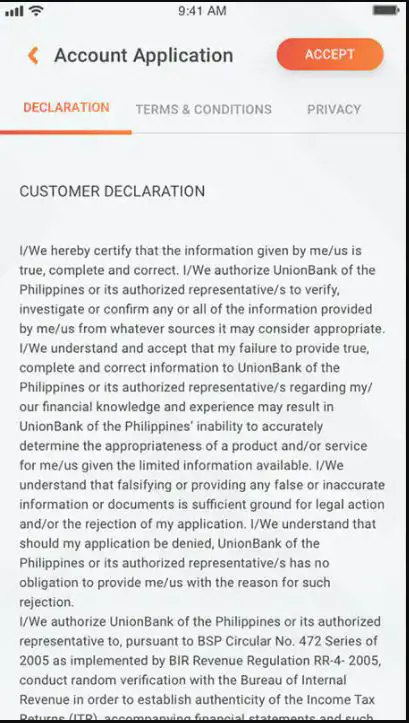

6. Read and accept Customer Declaration, Terms & Conditions and Privacy.

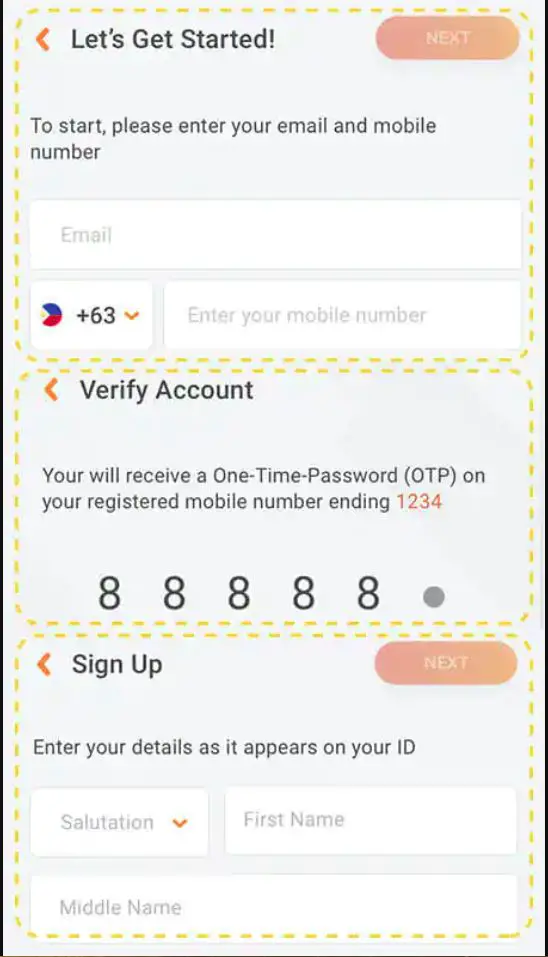

7. Input Email Address and Mobile Number then verify account via OTP.

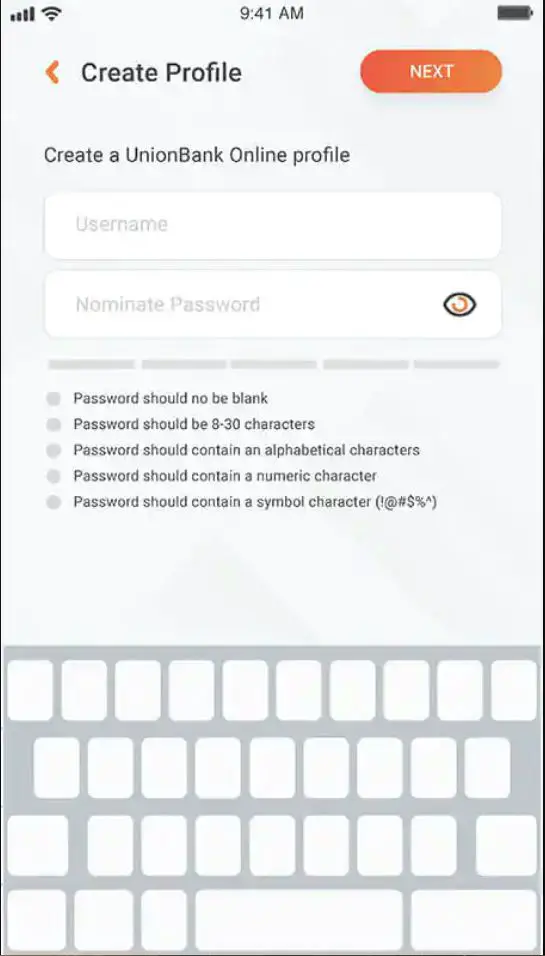

8. Sign up and create your profile.

9. Tap ENABLE to allow Touch ID.

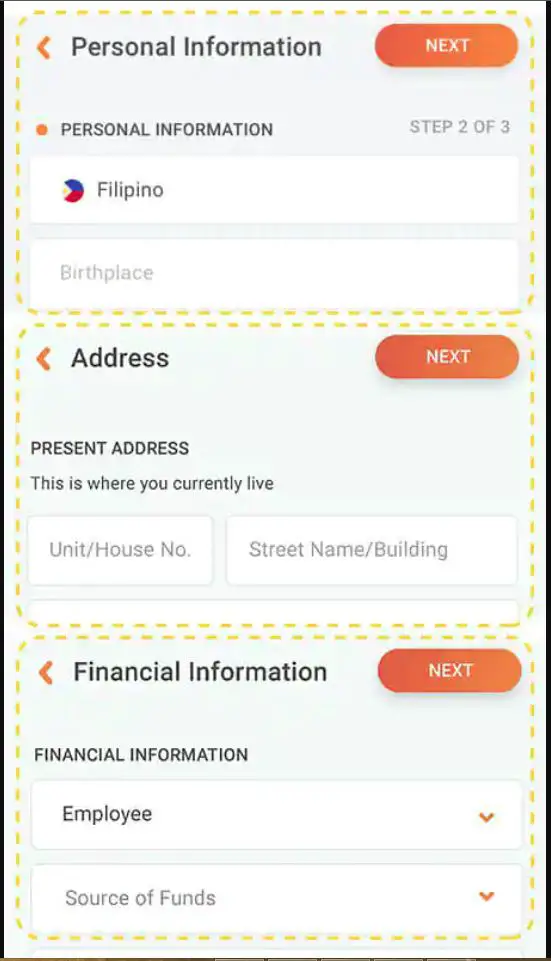

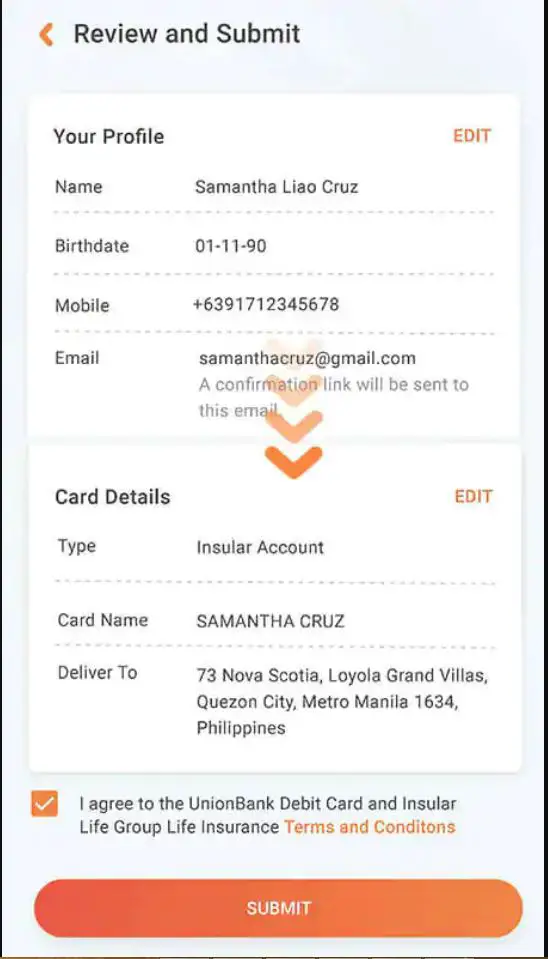

10. Input required information and account details.

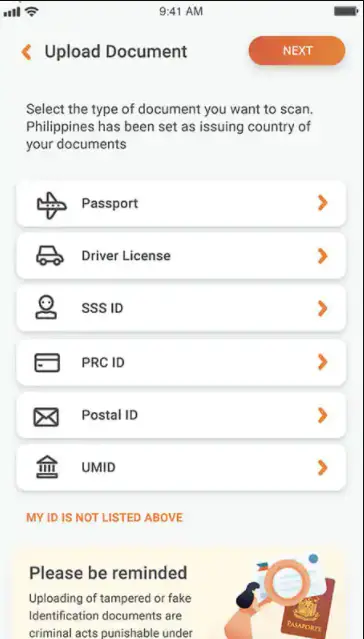

11. Select ID to upload. Accepted IDs are Passport, SSS, UMID, PRC, Digitized Postal ID, and Driver’s License.

14. Take a photo and submit. Make sure all data is visible and clear.

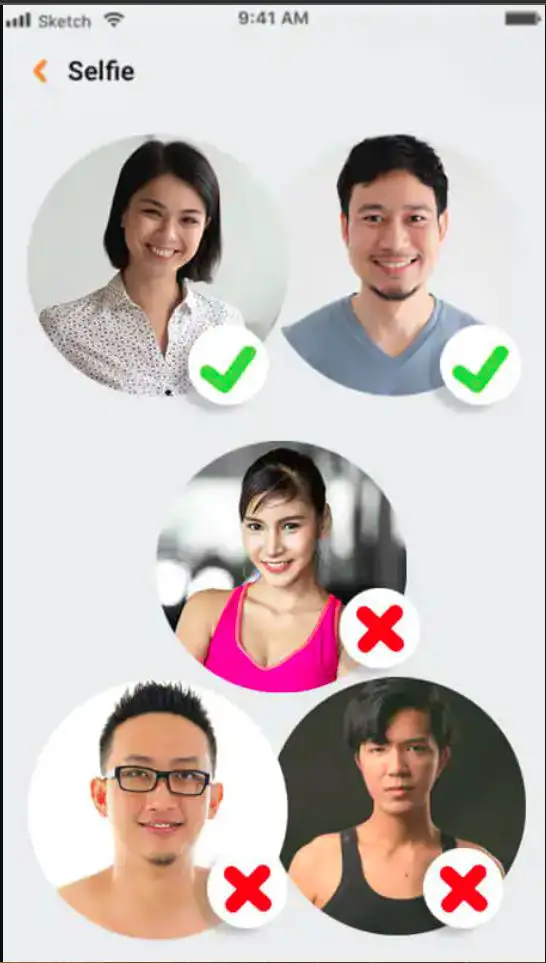

15. Take your selfie.

Make sure to wear appropriate clothing.

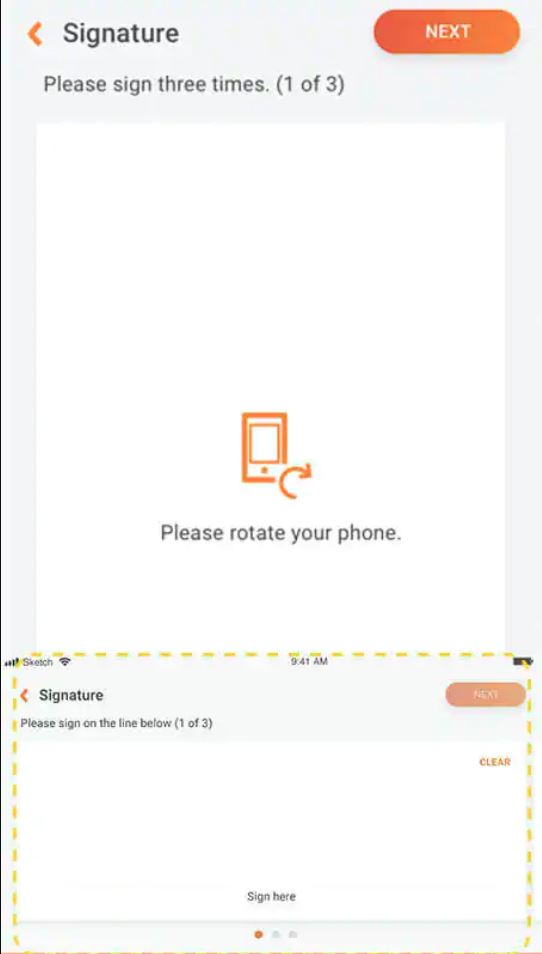

16. Affix your signature three times.

17. Review your application and tap SUBMIT.

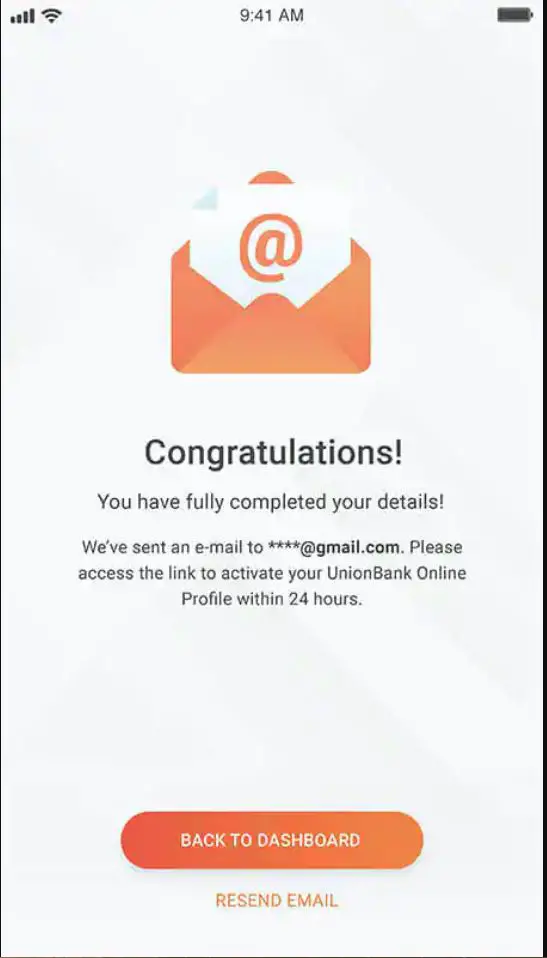

18. Once completed, an email confirmation will be sent to your email address.

Youtube Video – How to Open an Account thru UnionBank Online

Source: UnionBank Official Youtube Channel

Check out the video on how easy it is to open an account on the UnionBank Online app.

Source: Unionbank Website

Frequently Asked Question

- How can i open an account?

Download UnionBank Online in the Apple App Store and Google Play Store. Click here to download.

UnionBank Online is also available on the Huawei AppGallery. Click here to download.

2. How much do i need to pay to open a UnionBank account online?

There is no required amount to open an account.

3. What are the IDs accepted to open the account?

Accepted IDs are Passport, SSS, UMID, PRC, Digitized Postal ID, and Driver’s License.

4. Are there any additional fees?

Each savings account has annual fees which are waived for the first year. If you maintain PHP 10,000 in your ADB, we’ll waive the fees for the succeeding year.

Personal Savings Annual Fee: P350. Waived for the first year.

5. What is the maintaining balance requirement?

There is no required amount to maintain your account however, for Savings+ you need to maintain PHP 25,000 to be qualified for insurance coverage.

6. How will I get my card?

The card will be delivered upon request through the app in 5-10 banking days to your designated delivery address.

7. What are the features of the products?

Personal Savings Account – No-frills Basic Savings Account

GetGo Debit – Rewards-earning Savings Account that converts your spend into Cebu Pacific GetGo Points

PlayEveryday – gamified savings account where you can use to claim rewards for movies, travel, shopping, dining, and more

Savings+ – Savings account that comes with life insurance

8. Can I do fund transfer to other accounts/banks?

For UnionBank to UnionBank, this is free of charge.

Fund transfers to other banks via PesoNet is free, while you can send funds instantly via InstaPay for just PHP 10.

9. Can this pay bills?

Yes, enjoy up to 300+ billers with no enrollment required.

10. Why am I getting errors when taking the selfie?

Make sure you take your selfie in a well-lit room and wait for the border to light up. This will capture your photo automatically

11. Why do I get errors in uploading IDs?

Make sure to upload the acceptable IDs indicated in the app and use the original IDs. The App will not accept scanned, photocopied, or digital copies of the ID. Align all 4 corners until they light up. This will be captured automatically.

12. What happens if I get a reject notification?

That means some details in your application did not match the ID submitted. You will need to apply again and ensure the details in your application match the ID submitted.

Once reuploaded, you will be alerted about the status of validation within 24 hours.

13. Can I still use my account even if I’ve been rejected?

No. If the validation fails, the account will be considered closed.

14. What details are being matched during validation?

Your First Name, Last Name, and Birthdate on the ID should match the details customer declared in the application.

15. How can I activate my card?

Once card is received, you may activate this through the app so you can use it for cashless transactions.

16. Why is there a new turnaround time for the account activation?

UnionBank needs to implement additional checks before the account is activated.

17. What can I do with my account if it is not activated yet?

Until the account is activated, it will not be able to receive or send funds via UnionBank Online.

18. Will I get a notification once the account is activated?

Yes, a notification will be sent to your app indicating the account is activated and ready for use.

19. Can I create another account if I have an existing profile in UnionBank Online?

Currently, this is only available for New-to-Bank customers but will soon be available for existing customers in the upcoming releases.

20. When will my Annual Fee be collected?

Your Annual Fee will automatically be deducted from your account on the anniversary of your account opening date. If you opened your account on January 1, 2020, your Annual Fee will be collected on January 1, 2021.

Your first year Annual Fee is always waived. To waive succeeding years, please maintain at least P10,000 in Average Daily Balance.

21. What are the IDs accepted for Digital Account Opening?

Accepted valid IDs are:

- Passport

- Driver’s License

- SSS ID

- PRC ID

- Postal ID

- UMID ID

22. What if I don’t have any of those IDs?

As of this time, only the IDs listed in #1 are accepted for Digital Account Opening. You may proceed to any UnionBank branch to open an account using your available IDs. You may present any one (1) of these IDs:

- NBI Clearance with receipt

- GSIS e-card / GSIS membership ID

- IBP ID

- School ID with registration of current school year and birth certificate

If you don’t have any of the IDs above, you may present any two (2) of the following:

- Senior Citizen Card

- Government Office ID

- Company ID (must be listed by the same employer provided in the application form)

- PhilHealth Insurance Card

- OWWA ID

- OFW ID

- Seaman’s Book

- ACR/ICR

- Voter’s ID

- TIN

23. What should I do if my current address does not match the address reflected on my ID?

It is important that the details you input in the app are the same as those reflected in your ID. If not, please proceed to any UnionBank branch to open an account. Bring any of the following supporting documents for verification:

- Credit Card Statement of Account

- Electricity, Water or Telecommunications Bill

24. The app does not want to automatically take the photo of my ID, what should I do?

Please ensure that you use a dark background, all data on your ID are visible, the ID is glare-free and not blurred.

25. I am currently residing/working outside of the Philippines. Will I be allowed to open an account online?

Digital Account Opening is open to Filipino citizens residing in the Philippines. It is mandatory that you have an active Philippine mobile number to avail of the service.

26. What should I do if I forget the Username and/or Password I nominated during account application?

You may recover your Username and/or Password through the Forgot Password option in the UB Onine app. We suggest for you to enable Fingerprint/Touch ID in the app for a more convenient log in experience.

27. I am a US Citizen residing in the Philippines, will I be able to apply for an account online?

Please proceed to the branch to apply for an account, present additional documentation (US Passport) and fill-up mandatory forms.

28. I’ve already submitted my application. What happens next?

After successfully submitting your application, you will receive an email from UnionBank notifying you of the status of your application. If your application is approved, the email that you will receive contains a link to activate your UB Online profile. The link will expire after 24 hours. If your application encountered some issues, you will receive an email asking you to proceed to the branch to continue your application.

29. I was not able to activate my account and the link has already expired. What should I do?

Log-in to your UB Online app to request for a new email with a fresh activation link. Upon opening, the app, a pop-up will appear and you can tap on it to request for a new activation link.

30. What are the possible issues that my application will be routed to the branch?

Possible issues include:

- US Citizenship

- Failed ID verification (expired, mismatch of details, etc)

- Selfie does not match photo in ID

31. It’s been days but I have not received any email from UnionBank. I checked the app and status is Processing. How can I follow-up on my application?

You may email customer.service@unionbankph.com to follow-up on your application.

32. Does my account automatically generate an ATM card for me?

For UB Online app versions 2.13.4 and up, cards should be requested after account has been opened. For lower versions, these are already part of the account opening process.

33. Where can I find the Card Request option?

In the UB Online app, go to Account Details and tap on Order a Physical Card. Provide necessary details and complete the order process.

34. How long will the card delivery take?

It will take 5-10 working days to deliver your card.

35. Transaction Limits for Digitally Opened Accounts

Effective June 30, 2021 we will also be applying Daily Limits to outward fund transfers done through UnionBank Online

| Transaction | Transaction Type | Transaction Limit | Daily Limit |

| Outward | To Own | Php 500,000 | No Limit |

| Same Bank | Php 500,000 | Php 1,000,000 | |

| via Pesonet | Php 500,000 | ||

| via Instapay | Php 50,000 | Php 500,000 | |

| to e-wallets | Php 100,000 | ||

| (Gcash, PayMaya, Coins.ph, GrabPay) | |||

| Inward | OTC / Cash Acceptance | Php 5,000,000 | |

| Deposit via 7/11 | Php 10,000 | Php 50,000 | |

| Deposit via ECPay | Php 40,000 | ||

| Deposit via PeraHub | Php 25,000 | Php 50,000 | |

| Other Transactions | Cash-Out | Subject to limits of the partner remittance center | |

| Cebuana Lhuillier | Php 20,000 | ||

| Palawan Express | Php 50,000 | ||

| LBC | Php 20,000 | ||

| PeraHub | Php 10,000 | Php 20,000 | |

| ATM Withdrawal via UB ATMs | Php 10,000 | Php 20,000 | |

| ATM Withdrawal | Subject to Acquirer Bank’s Limits | Php 100,000 | |

| Debit Card Transactions | Php 100,000 | ||

| Cardless Withdrawal | Php 10,000 | Php 20,000 | |

Source: Unionbank Website