Are you planning for your retirement, and thinking how much will be your SSS Pension when you reach your 60 or 65? Or are you planning to be an SSS Member and still have questions in your mind if contributing to SSS is worth it? Good news, there is this facility in the SSS Website where you can Compute for the possible amount of your SSS Pension when you reach your retirement age – the SSS Retirement Benefit Estimator.

Disclaimer:

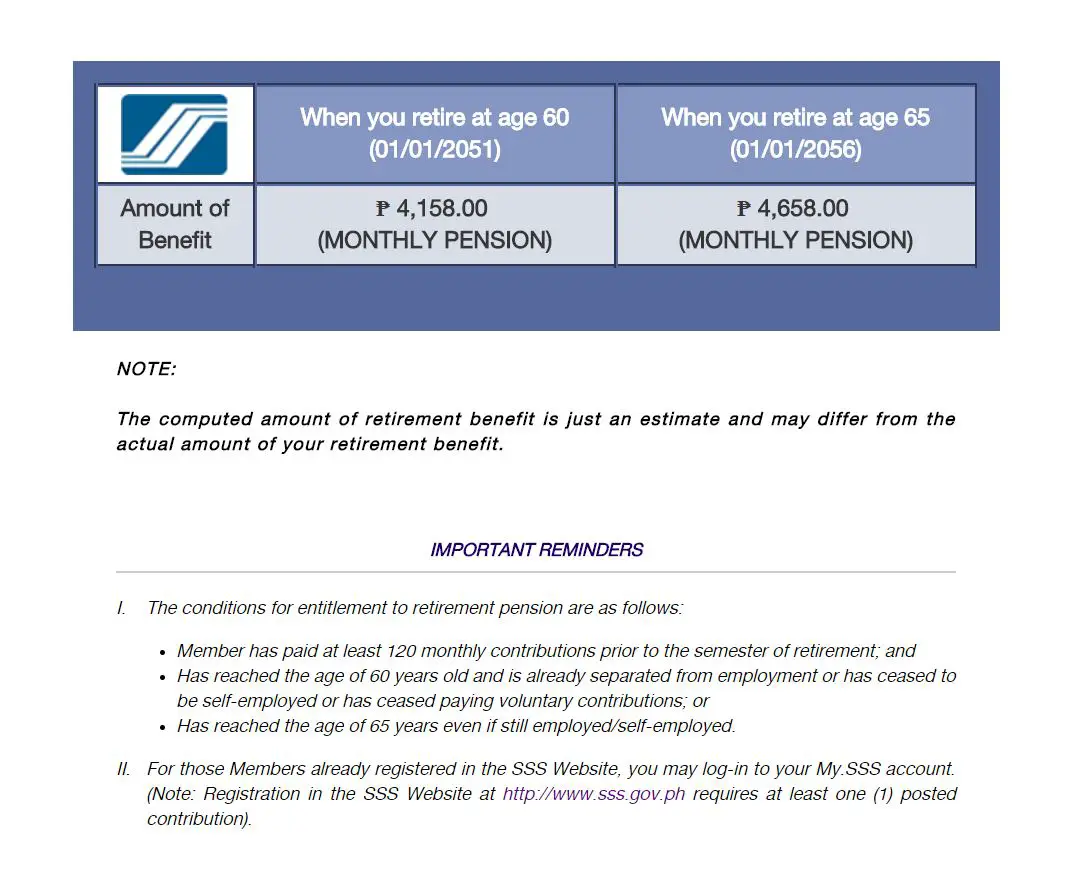

- The amount displayed is just an estimate based on your inputted year of working and your monthly salary. The actual computation will still be based on the total number of months of your contribution and the amount of your contribution. You first need to have at least 120 months of contribution or 10 years for you to be qualified of SSS retirement pension. If you are employed, your SSS Contribution is based on your monthly salary. If you are a voluntary paying SSS member, it is really up to you how much will be your monthly contribution. The higher the amount of your contribution, the higher will be your possible pension.

- The formula of computation may still change. SSS is a government-owned and controlled corporation. The President of the Philippines and law making bodies may decide to increase or decrease SSS Pension based on their set guidelines. Last 2017, PH President Rodrigo Duterte decided the pension increase of 1,000Php across the board. Other administration may also implement of that law in the future, if permitting to the SSS funding.

How to Use the SSS Retirement Benefit Estimator?

- Type www.sss.gov.ph on your Browser’s Address Bar or on Google

- The SSS website will load. Click the sss.gov.ph link (highlighted in green) next to the SSS Login menu.

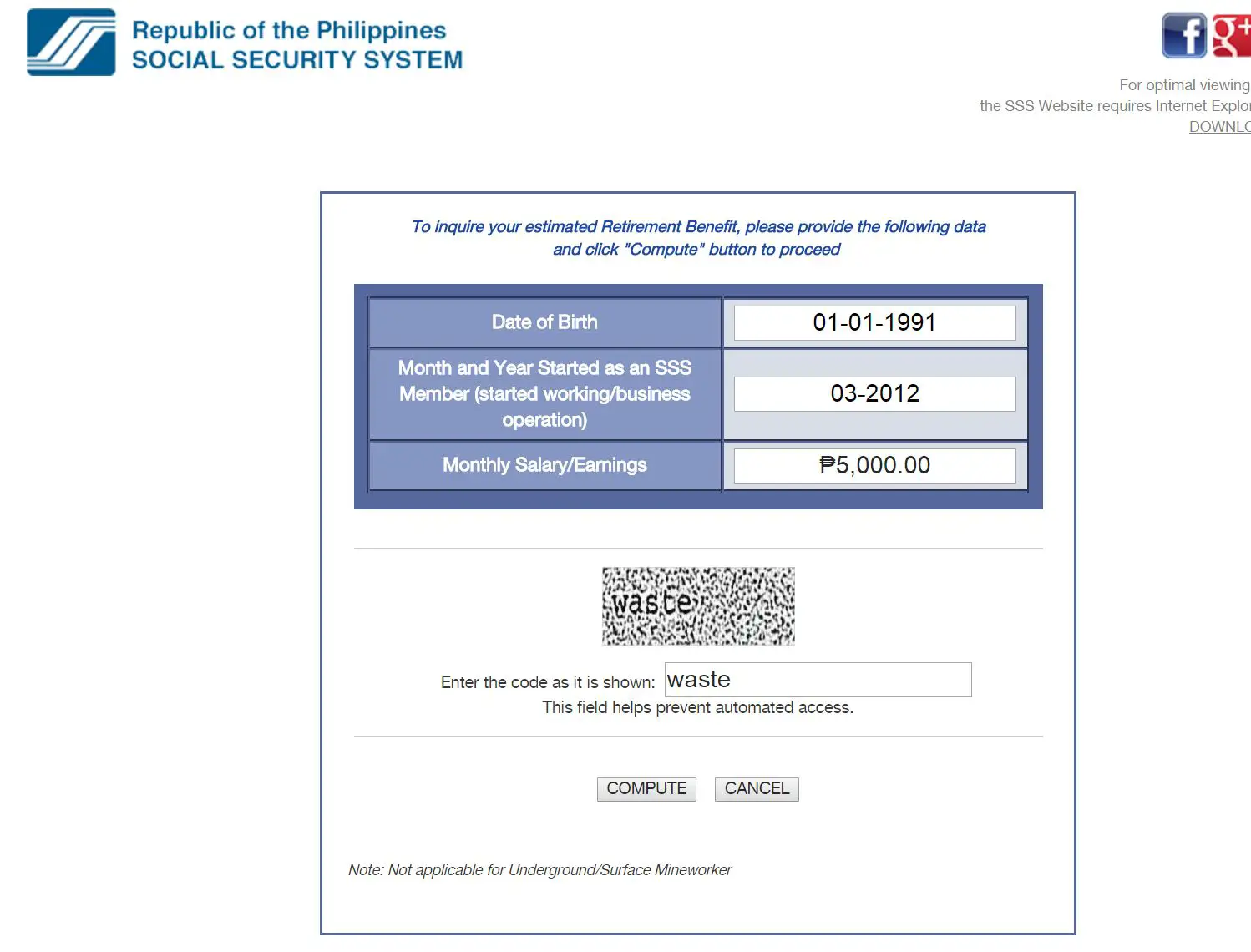

- After the Page has loaded, scroll down to the bottom part of the page and look for the orange Calculator Icon which is the Retirement Calculator (highlighted in green box). Click the icon and the page will be redirected to the Retirement Benefit Estimator.

- Type your Date of Birth, the Month and Year you started as an SSS Member and your Monthly Salary Earning. The three input will be the basis of your retirement benefit estimate.

- The page will redirect to the Estimate of Benefit when you reach 60 and 65 years old. The page will also indicate if you will receive a monthly pension or a lumpsum.

Outstanding loans you have with SSS will be deducted to your SSS Retirement Benefit, so better make sure that you have already settled of your Loan. You may also apply for SSS Loan Condonation to apply for a payment restructuring and deduct penalties on your total obligation.

Related Articles:

Mam, sir, tanung ko lang po panu po pag naka lagay sa binificiary ang ang parents tapos po single o ung status nya dun. Piru po kasal na sya hindi nga lang po napa change status kasi namatay na po yung my ari ng ss. Hindi po kasi namin ma kuhu ung lansam nya kasi mali po yung pangalan ng napangasawa nya.panu po namin yan ma kukuha. Kasi po 3 taon yung namatay nag hulog sa sss

Paano po kung stop n po AQ s work pero more than10 years n po aqng nghulog s sss. Makakakuha p RN b qng pension?

Hi, how do I change my birth year? My registered year is 1959 but actually 1958. Please advise

To Whom It may concerned:

Hi Itanong kolang po regarding sa contribution ko ma matagal na nahinto dahil dito ako sa overseas. Is there any possible im allowed to have pension later on? Thanks

Sir,madam, I stop my sss payment in 2yrs ago.i worked in hongkong.pls! can you me how to updated ny account payment and want to know i much money i pay on my sss account.thank you

gud afternoon po ask ko lng single po aq at 50 years old nko,, ang beneficiary kopo ay parents ko,, my mother passed away,, pwede kopo ba ilagay na beneficiary ang isang pmangkin ko? salamat po

good afternoon po sir mam puwede pong malaman kung mag kano po ang magiging montly pension ko if mag file na po ako ng montly pensionim already 63 years old i have already 179 montly contribution

good afternoon po sir mam puwede pong malaman kung mag kano po ang magiging montly pension ko if mag file na po ako ng montly pensionim already 63 years old i have already 179 montly contribution paanu ko po malalaman saiyung good office

maraming salamat po sa good service nyu

Hi gudeve po tanong q lng po if pued po b mag lump sum ang 40 yrs old n may contribution ng 121 months.??.pra mapakinabangan n ang money and ipon ulit ng 120 months pra mka avail ng pension on 60 yrs old.

gud pm, ask ko lang po regarding sa lump sum, kasi ng dumating ang tseke isakto naka burol sya, kaya binalik ang tseke sa sss virac, catanduanes branch, pwede pa po bang makuka o maibalik ang kaunting halaga para sa pamilya ng naiwan ng namatay?

I’m using SSS Beta, I can’t find my flexi-fund record. Please help. Thanks in advance.