It is every Filipino dream to buy their own house, but it will require huge sum of money. But, there are ways to get a second house cheap and that is buying a Foreclosed Property. The Social Security System sells their acquired or foreclosed properties and is regularly uploaded in the SSS Website. Before jumping in and buying an SSS Foreclosed Property, here are few information on that is worth knowing.

What is an Acquired Asset?

Acquired assets, also called foreclosures, are properties that have been possessed by a lending institution such as a bank when the homeowner fails to keep up with the monthly mortgage payments. Since a foreclosed property is a non-performing asset, the lender will want to sell it as soon as possible, which is why these properties are often offered for a low price. Banks and various institution like PagIBIG and SSS has inventories of foreclosed properties which you can avail as a direct buyer or thru bidding.

Who Can Buy an SSS Foreclosed Property?

To be able to buy an SSS Foreclosed Property, one must be:

- A natural or juridical person who can legally own property in the Philippines

- Of legal age and able to enter into a contract

- Not more than 65 years old (if paying in installments)

(Note: SSS employees with rank of Section Head or higher, all those receiving representation and transportation allowance [RATA], and those involved in the administration and their relatives up to the second degree of consanguinity or affinity shall be disqualified from purchasing SSS Foreclose Properties)

What Are the Terms of Payment?

When purchasing an SSS Foreclosed Property, you need to prepare a down-payment equivalent to 5 percent of asking price for properties costing a maximum of Php500,000, or 10 percent of properties cost over Php500,000. For installment sales, interest rates are 6 percent per annum for one to five years, 7.5 percent per annum for five to 10 years, and 9 percent per annum for 11 to 15 years.

What Are the Requirements?

- Two valid IDs with picture

- For Employed buyers

- Certificate of Employment and Compensation

- Payslip

- Income tax return (ITR)

- For Self-Employed buyers or in Informal Sector

- Income/business tax return

- Tax clearance issued by the Bureau of Internal Revenue (BIR)

- Affidavit of Income

- For Overseas Filipino Workers (OFW)

- Certificate of Employment or Employment Contract

- Payslip or any supporting documents issued by the employer stating monthly income with all the deduction

Important Things to Remember

- Some Properties has Illegal Occupants – If the property has illegal occupants, the buyer shall be entitled to a discount equivalent to 10 percent of the appraised value. If the ejectment of illegal occupant(s) exceeds three years, the 10 percent discount shall be forfeited. Within three years from execution of the sale, the SSS will refund in full the payments made by the buyers of HAA without interest if ejectment is unsuccessful and the buyer is unable to take possession of the property.

- When Property is Defaulted and Buyer has made a Permanent Improvement, Expense for Improvement shall not be refunded by SSS. If the Deed of Conditional Sale (DCS) of the HAA is cancelled or defaulted and the buyer had already made permanent improvements to the property, these improvements will be transferred to the SSS, who will not be obligated to reimburse the buyer for said improvements.

- The buyer will be responsible for the transfer of the Transfer Certificate of Title (TCT) to his or her name. All taxes and fees involved in transferring the title to the buyer will be paid for by the buyer, except for the Capital Gains Tax (CGT), to which the SSS is exempted as stated in Section 16 of RA 1161.

- Foreclosed Properties are sold “as-is”. Acquired assets are sold below market value, and are sold “as-is.” This means any and all repair and maintenance work required to bring the property up to grade will be shouldered by the buyer.

- You can buy the foreclosed property directly or bid for it. Buying a property as soon as a lender acquires it is the easiest route to take. It is also the safest, since you get to inspect the property before making an offer. If you decide to try your luck at an auction, however, you cannot view the property beforehand, so you will have no idea of the extent of damages, if any. The benefit of going to a bidding, though, is that prices start really low, so you have a shot at saving money if you end up winning.

- You need to take care of left over bills. If you’re unlucky, you might be looking at a property where water, electricity, and cable bills, and even homeowners’ association fees have been neglected for months. You will have to add those to the possible costs of repairing the home.

- You have limited time to buy it. Since lender’s intention is to dispose the property quickly, those who has the buying power can get it immediately.

How to view SSS Foreclosed Properties?

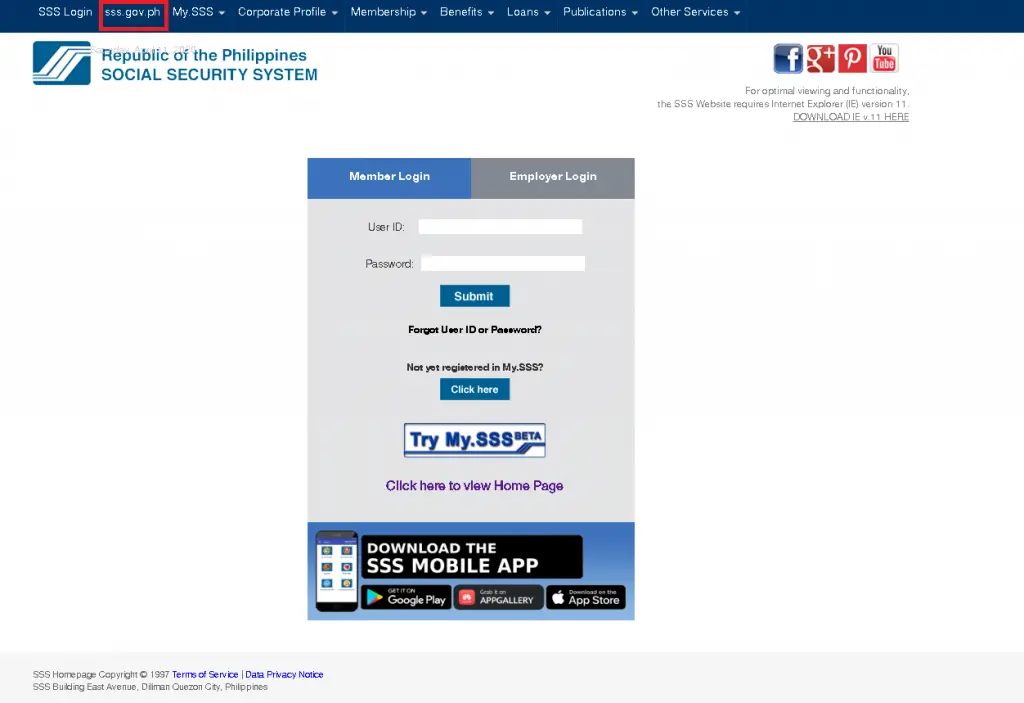

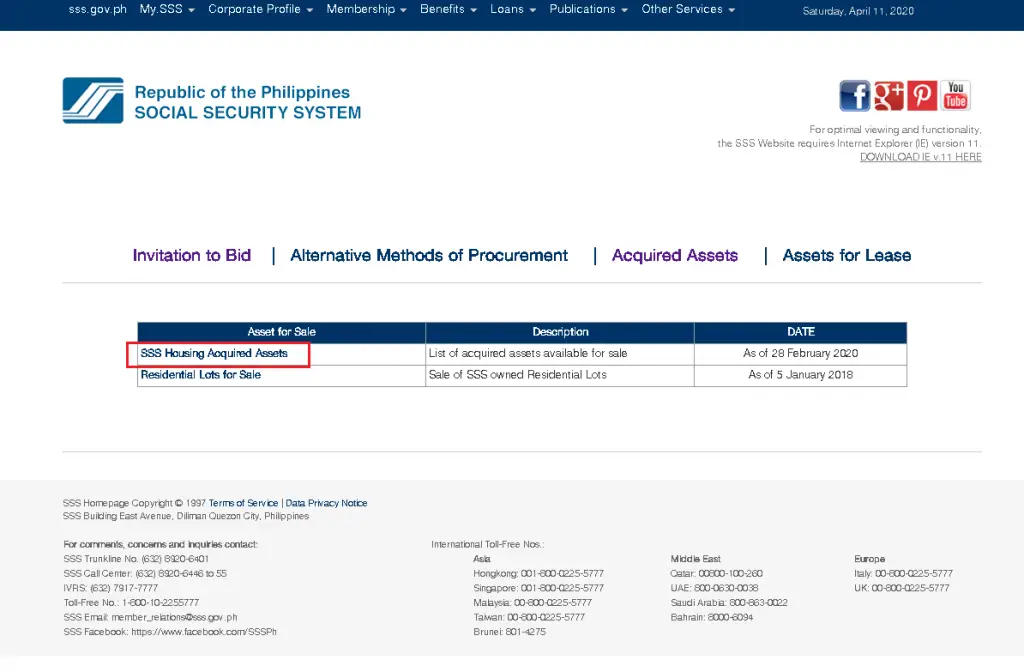

1. Open your Browser and type www.sss.gov.ph. Click the sss.gov.ph Tab.

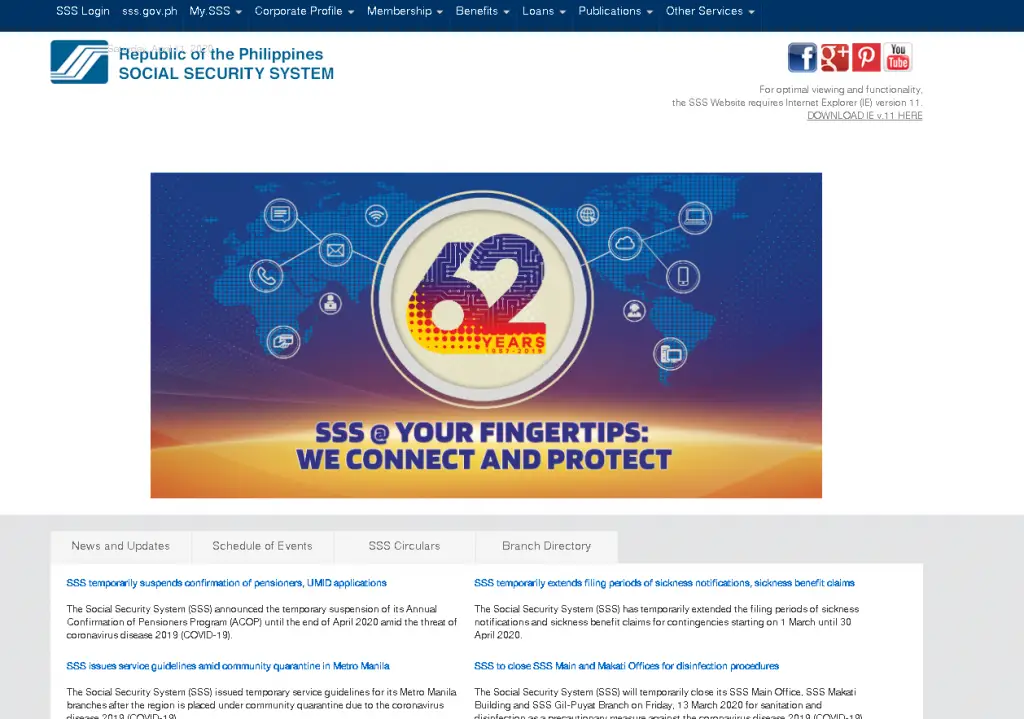

2. Page will redirect to the SSS Home Page.

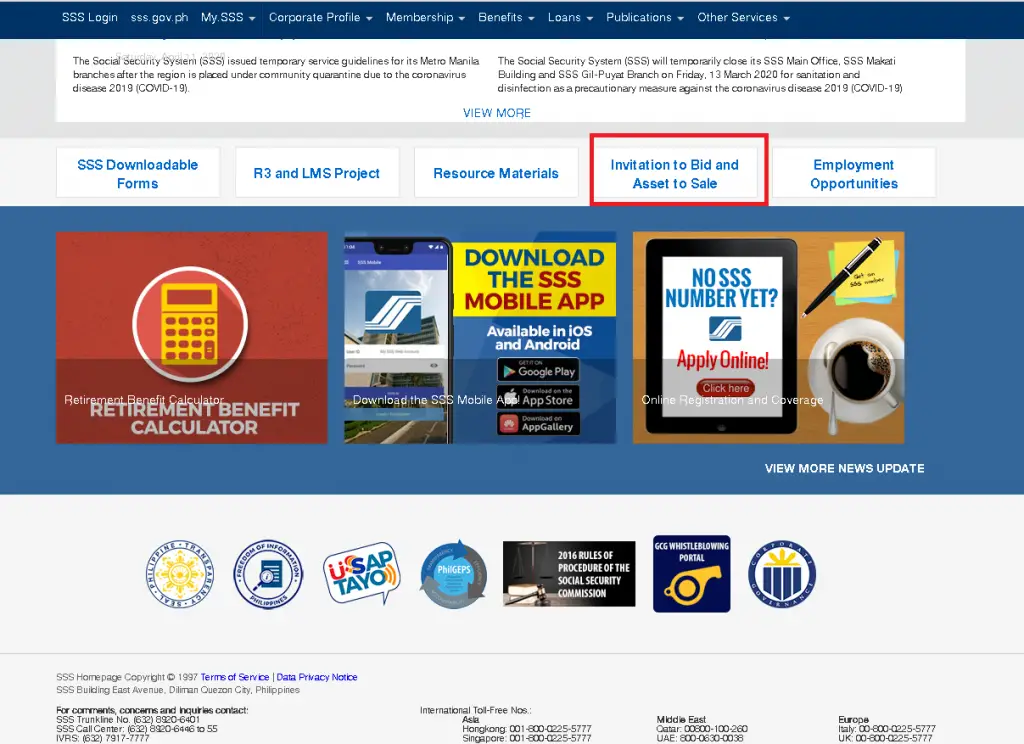

3. Scroll down and find the Invitation to Bid and Asset to Sale

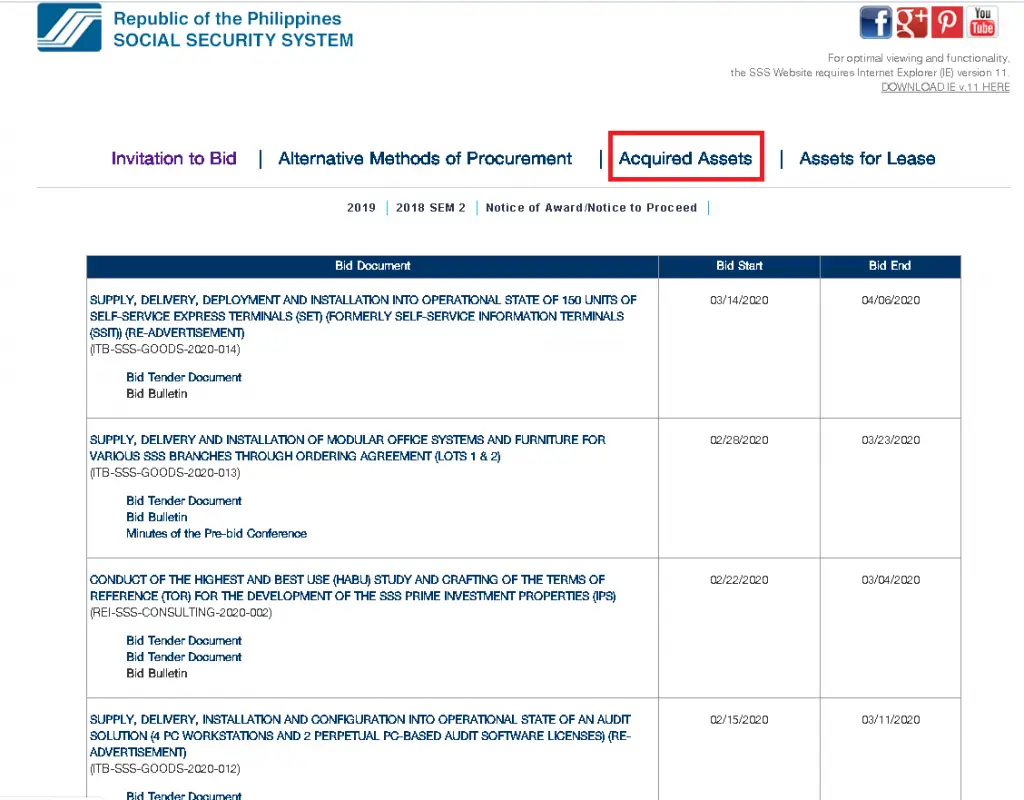

4. Click the Acquired Asset tab.

5. The Acquired Asset Tab will display. Click the SSS Housing Asset Acquired link. Page will open a PDF document of the list of acquired asset.

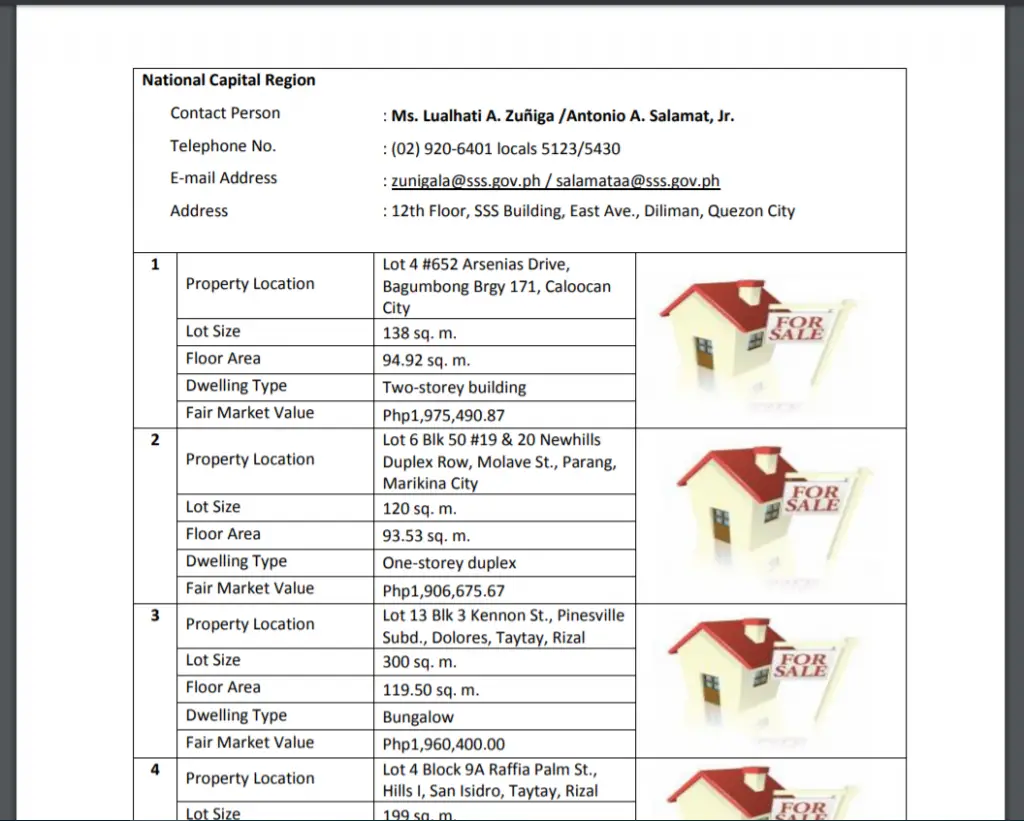

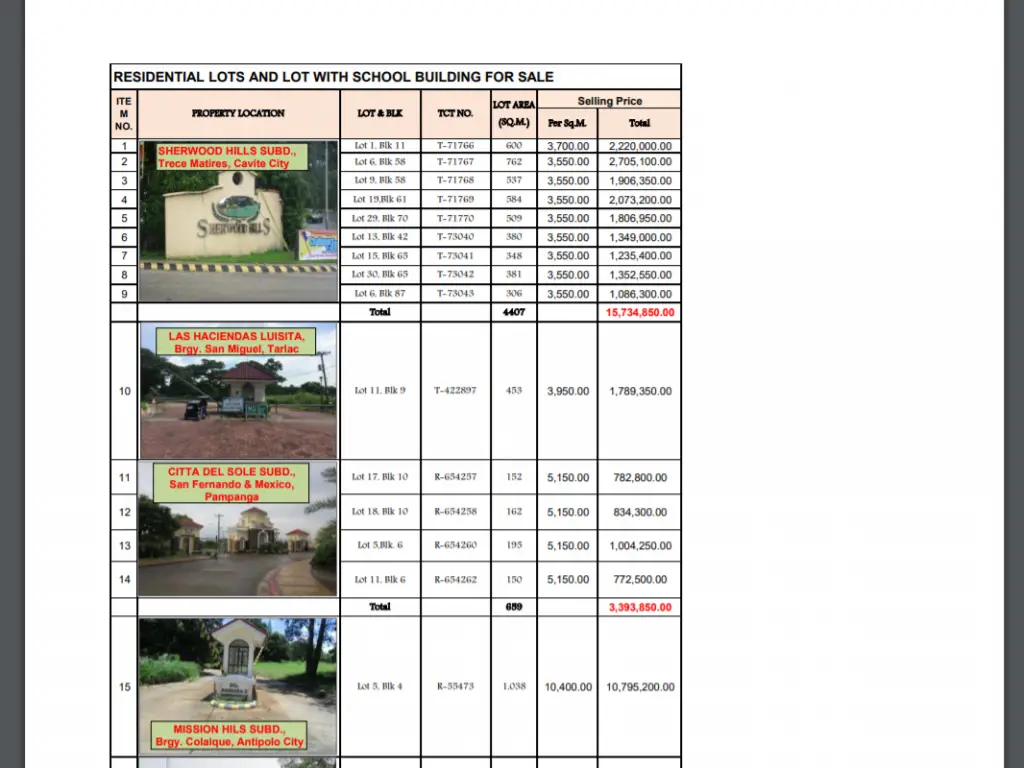

There are SSS Contact Person and their respective contact information indicated in the PDF if you wish to inquire or avail of the property listed.

References: Lamudi, SSS Webiste

Be the first to comment on "How to Invest on SSS Foreclosed Properties"