If you are already an SS Member (whether thru Employment or Self Employment), you can still continue your SSS Membership as an Overseas Filipino Worker (OFW) if you happen to work abroad. Here is a comprehensive article on How to Continue Paying your SSS Contributions as an OFW. Do you know that there are several privileges that the SSS OFW member compared to other types of membership?

Privilege of an OFW SSS Members:

- Only OFW SSS Members are allowed for retroactive payments. Which means:

- Payment of contributions for the months of January to December of a given year may be paid within the same year. For example, you can pay your whole year’s contribution (January – December) until December of the current year. While Employed, Self Employed and Voluntary members are only allowed to pay quarterly (e,g pay January to March contributions until April observing the check digit deadline).

- October to December of a given year may also be paid on or before the 31st of January of the succeeding year.

- However, aside from the relaxed payment schedule allowed for OFW, past years and months can no longer be paid. So take advantage to atleast pay your whole year’s contribution even once a year.

- You are entitled to participate in SSS Flexi Fund. The SSS Flexi fund is a form of provident fund offered only for SSS OFW Member. The member should pay the maximum SSS Contribution Amount (e.g Php 1760/month ) and on top of that, contribute any amount not lower than Php200 to be credited on his/her Flexi Fund Account. Any contribution to the Flexi fund will be used for the member’s retirement, disability and death benefit. An early withdrawal is be allowed anytime for urgent cash needs (with pre termination fees if less than 1 year retention). Unlike the SSS Peso Fund, the Flexi Fund grants an annual incentive benefit (AIB) or dividend to qualified active members. The SSS Flexi Fund is a secured investment opportunity for the SSS OFW member since it is managed by the government.

You can learn more about the SSS OFW member here:- What is SSS Flexi Fund for OFW?

- Comparison between SSS PESO Fund and Pagibig Modified 2

How to become an OFW SSS member?

- If you have an existing SS Number, you can continue paying contributions thru getting the SSS Payment Reference Number and select the Overseas Worker as your SSS Membership Type. Make sure to indicate your correct SSS Number. Once your payment has been posted, your membership status will automatically be changed to OFW.

- If you are an OFW but do not yet have an SS Number, you can accomplish and submit the SSS-E1 with the original or certified true copy of your Birth Certificate together with any of your ID. Or you may also obtain your SS Number online by selecting the OFW in the Purpose then enter the country where you are/will be working. Here is a Step by Step Guide on how to apply for an SS Number Online.

The effectivity of your SSS Coverage as an OFW member starts on the first payment of your SSS Contributions.

How to Continue Contributing to SSS while you are abroad:

- You can assign a representative in the Philippines to remit your SSS contributions as an OFW member. Your spouse, your parents or siblings may pay your SSS Contributions even without a Letter of Authority, just make sure that they are using your correct SS Number and tick the OFW option in the SSS payment form.

- You can directly remit your SSS contributions at any accredited collection partners abroad near you:

To pay your SSS Contributions as an OFW, you need to obtain your SSS Payment Reference Number thru the SSS Website. Some Payment Partners abroad has a facility to obtain your Payment Reference Number thru their system. Just make sure to present your correct SS Number and observe your Contributions Payment Schedule.

You can also pay your SSS Loan on the SSS accredited partners abroad or ask your relative or any representative to pay your SSS Loan on the SSS Branch or accredited collection partners anywhere in the Philippines.

Can I change my MSC or the amount of my SSS Contributions?

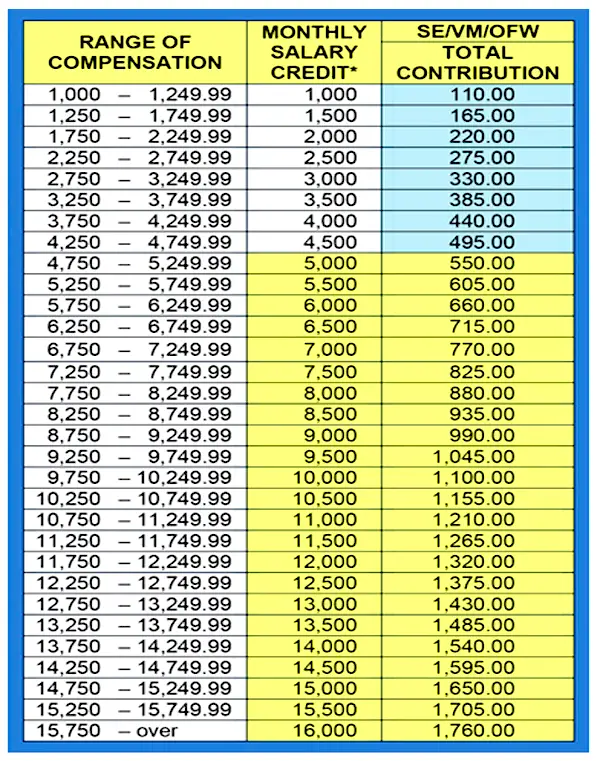

Minimum Monthly Salary Credit for OFW is 5,000 which means your minimum SSS Contribution should be Php550.00 (as of April 2018)

If you wish to increase your MSC or Monthly Salary Credit, it may be by one or two salary brackets without requiring the submission of documents to prove your earnings.

Monthly salary credit (MSC) is the compensation base for contributions and benefits related to the total earnings for the month. As of 2018, the maximum MSC is P16,000. Check the MSC column below.

However, in case the change will result to an MSC of lower than P5,000.00, or where the change will result in more than two salary brackets higher or lower than the present MSC, a Declaration of Earnings must be submitted to support the new earnings.

Members who are 55 years or older, if the present MSC is more than P10,000.00, the allowed increase is only one salary bracket regardless of whether the supporting documents are submitted or not.

How to Update your Personal Information in SSS Records?

To update or correct your personal records with the SSS, you must submit a duly filled-up Member’s Data Change (SS Form E-4) with supporting documents (e.g Birth Certificate of your child for adding a beneficiary, Marriage Contract if changing your Martital Status). You can submit your documents at the SSS Branch abroad near you, or any SSS Branch. If you wish to change your Contact Information in the SSS, you may do it thru the SSS Website. You may follow this link for the Step by Step Guide on how to Update your Contact Infomation online.

How to Pay SSS Contributions via Auto-Debit Arrangement System?

Auto-Debit Arrangement (ADA) System allows the one-time enrollment of the Self-Employed and Voluntary Member’s bank account for the automatic payment of their monthly SSS contributions and loan repayments. ADA is convenient because you don’t have to go to the SSS payment center or any accredited collection partner to pay your SSS contributions.

ADA is available at the following banks:

- United Coconut Planters Bank

- BDO (Banco de Oro Unibank)

- BPI (Bank of the Philippine Islands)

- Metrobank (Metropolitan Bank and Trust Co.)

- PNB (Philippine National Bank)

- Philippine Savings Bank

- Development Bank of the Philippines

- First Consolidated Bank

Here is a Comprehensive Guide on How to enroll on SSS Auto Debit Arrangement.

Is there a Contact Center for SSS OFW Members?

If you happen to still find a difficulty in continue paying your SSS Contributions as an OFW, you may reach the available SSS Contact services:

- You may reach the OFW CONTACT SERVICE UNIT (CSU)

- ofw.relations@sss.gov.ph

- Philippines landline numbers

- (632) 364-7796

- (532) 354-7795

- PHL mobile numbers

- Globe (63) 977 804-8668

- Sman (63) 998 847-4092

- Pwede rin any instant messaging gamit ang Line, Viber at Wechat

- International toll-free call services

MIDDLE EAST

- Qatar – 00800-100-260

- UAE – 800-0639-0038

- Saudi Arabia – 800-863-0022

- Bahrain – 8000-6094

ASIA

- Hongkong – 001-800-0225-5777

- Singapore – 001-800-0225-5777

- Malaysia – 00-800-0225-5777

- Taiwan – 00-800-0225-5777

- Brunei – 801-4275

EUROPE

- Italy – 00-800-0225-5777

- UK 00-800-0225-5777

3. International direct landline number

USA (San Francisco) – 760-797-218

How do I know if there is an SSS Branch near my place abroad?

You may check the list of SSS Foreign Branches in this link.

Sir,madam,

I stop my sss payment in 2yrs ago.i worked in hongkong.pls! can you me how to updated ny account payment and want to know i much money i pay on my sss account.thank you

Sir/mam

I am OFW Can i pay january to june? Then after july to dec?

Please advise.

Thank you

Panu po pagdalawa ang sss no.

I stop paying my contribution many years ago and i want continue my contribution but the problem is i ready forgot my SSS NUMBER,CAN YOU HELP ME PLEASEL

Sir,yung husband ko po almost 5yrs. Ng OFW but i continue his SSS CONTRIBUTION as a volunteer not as OFW. I payed 550, a month pano po yan sir/maam how will i convert his remittance to OFW CONTRIBUTION? Anung dapat gawin ko po?

How can I change my monthly contribution from minimum to maximum..last year I paid a minimum amount but ds year I plan to pay as a maximum contributions.

Inquiries.

Good afternoon!

My brother is 57yrs old,worked in the Phil’s.with paid 90monthly contributions 25yrs ago before working abroad.

He is an ofw and wanted to good home for good for retirement.Can he continue sss contribution payments today and still be qualified for pension benefits at 60yrs old and still enjoy same benefits like any active member.

Maraming salamat.

Hello po maam/sir ilng taon q n din pong d nahulugan ang sss q gsto q rin pong ipgptuloy ang pghuhulog bilang isang ofw kng asawa q po ang mghuhulog ano2 po ang dapat nyang gawin

paano po mag register.

Sir maaari po kayong magregister through their online portal.

https://sss.gov.ph/sss/registrationPages/memberE1.jsp

ask qlang po qng pwd qpa magamit sss q kht 2 yrs qna xa hnd nahuhulugan?

sir/mam ask ko lng po paano ko ma avail yoong loan restructing d2 po ako sa abroad ibig kong mabayaran ang naging loan in full payment ano po ang dapat kung gawin hindi rin po ako maka register on line dahil wala pa akong umid ,thanks po

paano ko malalaman ang sss number ko nawala po kc ang ard ko

paano ko malalaman ang sss number ko nawala po kc ang ard ko,wala kasi sumasagot e

Pumunta na lang po kayo sa Branch mismo ng SSS.

pasagot na lang po

Magandang araw po matagal ko na pong Hindi na babayarn ang SSS ko poh . Gusto ko po sanang magbayad pwede po pang liv in partner ko po ang pupunta sa office kc abroad po ako.. salamat po .. sana makareply po Kau

Hello ma’am /sir matagal ko na pong na stop ang pag bayad ng sss ko gusto ko po sanang ituloy ang contribution ko.thanks

pwde ba ako magbayad sa bayad center ng sss .first time ko lang magbayad .

Nagregister ako as OFW SSS member, tpos may nag email na i-activate daw yung user ID..Bakit hindi naman sya maactivate??Legit ba to?

Meron po talagang used id na ginagamit once nagregister ka online sa sss.

I haven’t paid my sss contribution po for almost 2 years since I am currently teaching here in Thailand. How can i check the amount that i should pay po and how to send payment po?

Kung nakaregister ka po online makikita mo po. Or else you can register online sa portal ng SSS, mahalaga po na alam niyo ang SSS number niyo.

As an ofw, the lowest MSC bracket is set to 5000.00 PHP with a monthly contribution of 550.00 PHP

Good day mam/sir nag start po aq nag bayad ng sss ko nung january 1mo lang po un.tas sunod po nagnyad aq 3mo ung feb,march ar april pro ng i follow up ko d dw pumasok eh my recibo po nman aq.at thus month po magbbayad aq uli ng pang 3mo.wla po bang maging problema kaya uli?pano ko po malamn kong pumasok na ang contribution ko?tnx po sa sasagot

sir/madaam may sss # na poh aq at di q nhulugan simula ng mag apply aq…gusto q po sana byran as an ofw..ano poh ggwin q at gusto q po sana n ang employer q poh mismo ang mgbbyad isa poh akong HSW…salamat poh

paanu ko ma check yung sss account ko at paanu ko malaman kung naka lagay doon ang name ng anak ko bilang beneficiary m

Hisir/mam ofw po ako d2 uae 3years n po ako d nauwe,mother ko nghuhulog ng SSS ko n dati po volountary tas inilipat n po niya SA ofw, counted n po b Yun Hindi n po b need n mgfill up p ako Ng form para SA ofw? Tnx po pkisgot po

magandang hapon po..i’m currently an ofw here in hongkong,gusto konlng sana mlaman how at kung pwede p bng hulugan sss number ko,kahit matagal n ung number ko perobla p naihuhulog?sana po masagot nio.. salamat ng marami

Dear Sir / Madame:

I am an OFW SINCE 2005 — FROM THAT TIME TILL 2018..I DID NOT CONTRIBUTE IN MY SSS ACCOUNT… I WOULD LIKE TO PAY RETROACTIVELY FROM 2005-2018 AS A VOLUNTARY MEMBER.

ID LIKE TO KNOW HOW MUCH IS THE MINIMUM PAYMENT FOR AN OFW VOLUNTARY MEMBER?

pwede niyo pa po hulugan yun pero hindi na po tayo pwede mag’bayad ng mga namiss nating taon.

MSC bracket for OFW is set to 5000 po with a contribution of 550 PHP. Mas mataas mas better po. tandaan po na ang qualified lang makakakuha lang ng pension pagdating ng 60 ay mga member na nakapagbayad ng 120 months.

HINDI NIYO NA PO PWEDENG BALIKAN YUN. IPAGPATULOY PO PWEDE, ANYTIME OF THE YEAR PWEDE NIYO PO BAYARAN ANG BUONG TAON

MSC BRACKET FOR OFW IS SET TO 5000PHP WITH 550 MONTHLY CONTRIBUTION.

dear sir / madame:

Matagal na po akong ofw since 2005 till 2018; gusto ko pong mag bayad retroactively from 2005 till 2018 as a voluntary sss member… paano po… Maraming salamat.

Ofw ang husband ko less than 1000 ang monthly hulog nya sAZ SSS now gusto nya lakihan 1320 per month may kelangan p b akong fill upan n form o derecho n ako sa cashier

matagal ko na pong hindi nahuhulugan sss ko po..now po ofw po ako..mgkno po babayaran ko monthly?

Hi po almost two years ko na po na stop bayaran ang sss contribution ko pero nkahulog n po Ako ng ten years.. If I continue kopo ang payment ko sa contribution Wala po ba mgiging problema non?

Magandang araw po! Tanong ko lang po kung magkano ang maximum monthly contribution for a voluntary member and magkano din po ang maximum monthly contribution for ofws? Salamat po.

Hello po good day ofw po aq ng 4yrs sa hk continues po ang contribution ko natapos na po contract q last july at umuwi na po tanong ko lang ok lang po ba gamitin q parin OFW contribution status ko kahit nasa pinas na ako?

i have a sss before piro na stop napo nong andito na ako sa ksa anong gagawin ko para ma continue ko po

i have a sss before piro na stop napo nong andito na ako sa ksa anong gagawin ko para ma continue ko po. please kindly advice

nakalimutan ko SSS nr ko, puede po ba makuha SSS nr ko gusto ko kasi hulugan kasi no remittance po ako?